SoftBank Results Presentation Deck

Segment Income:

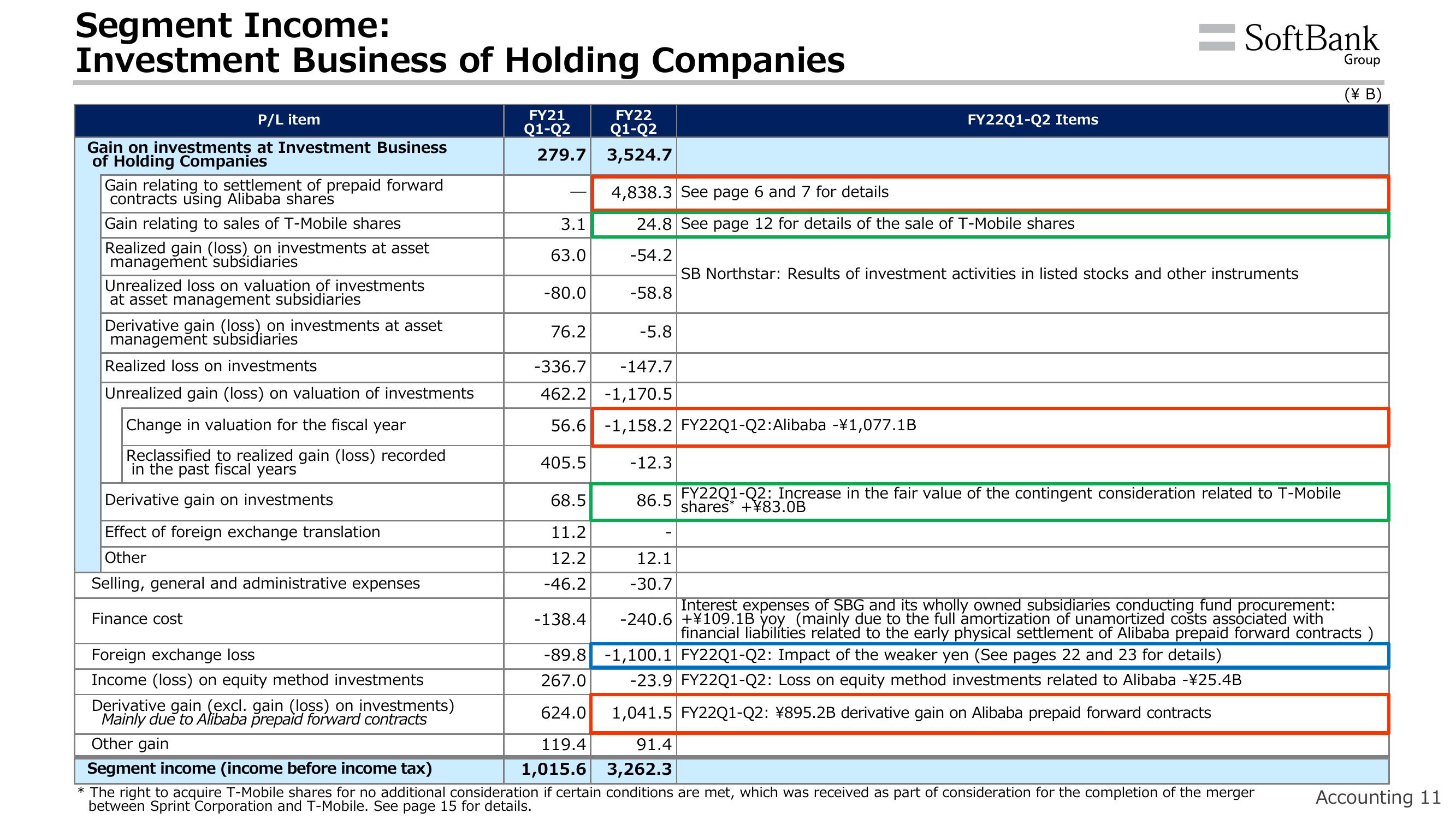

Investment Business of Holding Companies

P/L item

Gain on investments at Investment Business

of Holding Companies

Gain relating to settlement of prepaid forward

contracts using Alibaba shares

Gain relating to sales of T-Mobile shares

Realized gain (loss) on investments at asset

management subsidiaries

Unrealized loss on valuation of investments

at asset management subsidiaries

Derivative gain (loss) on investments at asset

management subsidiaries

Realized loss on investments

Unrealized gain (loss) on valuation of investments

Change in valuation for the fiscal year

Reclassified to realized gain (loss) recorded

in the past fiscal years

Derivative gain on investments

FY21

Q1-Q2

279.7

3.1

63.0

-80.0

405.5

FY22

Q1-Q2

3,524.7

68.5

11.2

12.2

-46.2

4,838.3 See page 6 and 7 for details

24.8 See page 12 for details of the sale of T-Mobile shares

-54.2

-58.8

76.2

-5.8

-336.7 -147.7

462.2 -1,170.5

56.6 -1,158.2 FY22Q1-Q2:Alibaba -¥1,077.1B

-12.3

FY22Q1-Q2 Items

=SoftBank

SB Northstar: Results of investment activities in listed stocks and other instruments

12.1

-30.7

FY22Q1-Q2: Increase in the fair value of the contingent consideration related to T-Mobile

86.5 shares +¥83.0B

Group

(¥ B)

Effect of foreign exchange translation

Other

Selling, general and administrative expenses

Finance cost

Interest expenses of SBG and its wholly owned subsidiaries conducting fund procurement:

-138.4 -240.6 +¥109.1B yoy (mainly due to the full amortization of unamortized costs associated with

financial liabilities related to the early physical settlement of Alibaba prepaid forward contracts)

-89.8 -1,100.1 FY22Q1-Q2: Impact of the weaker yen (See pages 22 and 23 for details)

267.0

Foreign exchange loss

Income (loss) on equity method investments

Derivative gain (excl. gain (loss) on investments)

Mainly due to Alibaba prepaid forward contracts

-23.9 FY22Q1-Q2: Loss on equity method investments related to Alibaba -¥25.4B

1,041.5 FY22Q1-Q2: ¥895.2B derivative gain on Alibaba prepaid forward contracts

624.0

Other gain

119.4

91.4

Segment income (income before income tax)

1,015.6

3,262.3

* The right to acquire T-Mobile shares for no additional consideration if certain conditions are met, which was received as part of consideration for the completion of the merger

between Sprint Corporation and T-Mobile. See page 15 for details.

Accounting 11View entire presentation