Amplitude Results Presentation Deck

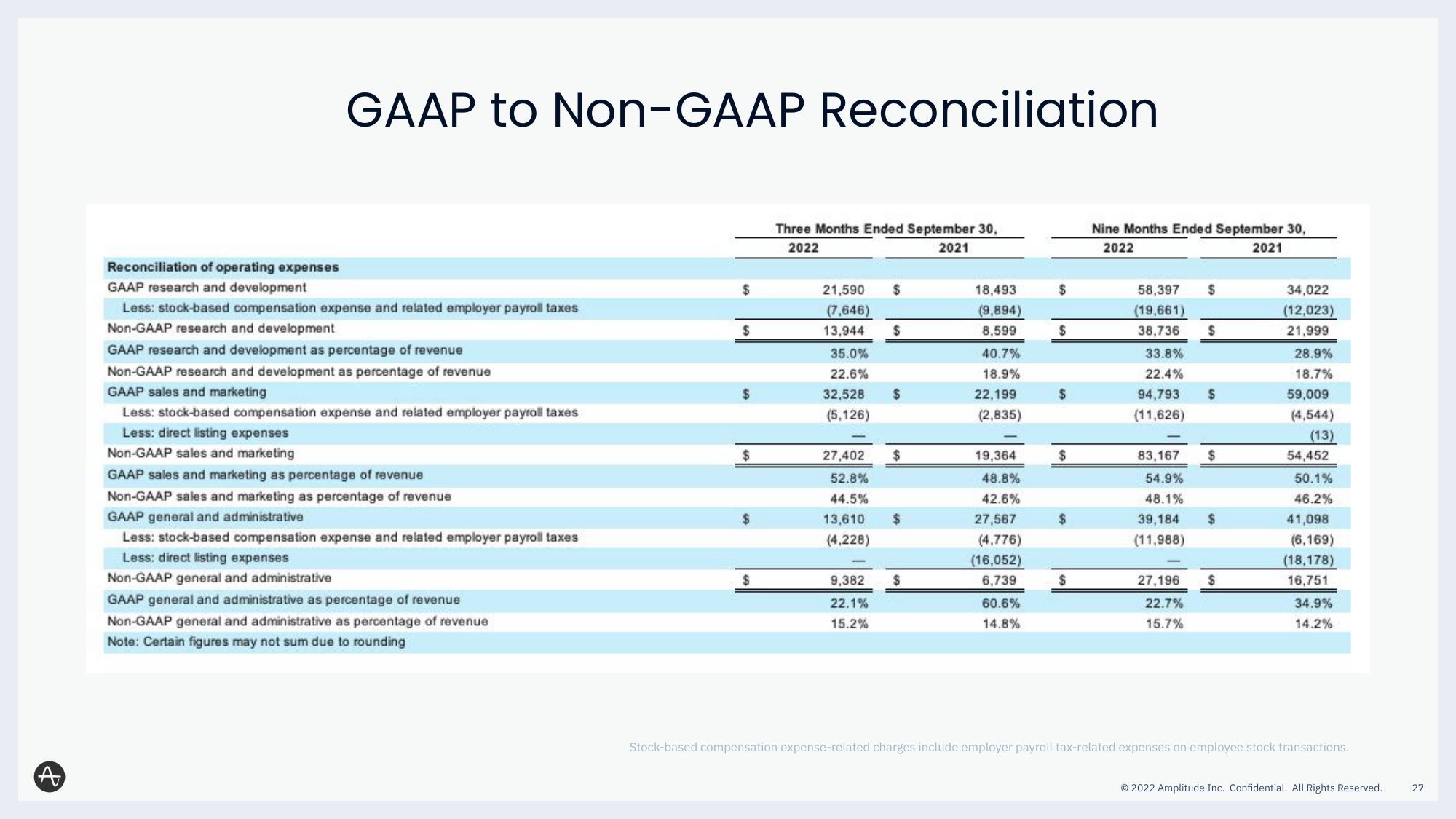

GAAP to Non-GAAP Reconciliation

Reconciliation of operating expenses

GAAP research and development

Less: stock-based compensation expense and related employer payroll taxes

Non-GAAP research and development

GAAP research and development as percentage of revenue

Non-GAAP research and development as percentage of revenue

GAAP sales and marketing

Less: stock-based compensation expense and related employer payroll taxes

Less: direct listing expenses

Non-GAAP sales and marketing

GAAP sales and marketing as percentage of revenue

Non-GAAP sales and marketing as percentage of revenue

GAAP general and administrative

Less: stock-based compensation expense and related employer payroll taxes

Less: direct listing expenses

Non-GAAP general and administrative

GAAP general and administrative as percentage of revenue

Non-GAAP general and administrative as percentage of revenue

Note: Certain figures may not sum due to rounding

$

$

$

$

Three Months Ended September 30,

2022

2021

21,590 $

(7,646)

13,944

35.0%

22.6%

32,528 $

(5,126)

$

27,402

52.8%

44.5%

13,610 $

(4,228)

9,382

22.1%

15.2%

$

$

18,493

(9,894)

8,599

40.7%

18.9%

22,199

(2,835)

19,364

48.8%

42.6%

27,567

(4,776)

(16,052)

6,739

60.6%

14.8%

$

$

$

$

$

$

Nine Months Ended September 30,

2022

2021

58,397 $

(19,661)

38,736

33.8%

22.4%

94,793

(11,626)

83,167

54.9%

48.1%

39,184

(11,988)

27.196

22.7%

15.7%

$

$

$

$

$

34,022

(12,023)

21,999

28.9%

18.7%

59,009

(4,544)

(13)

54,452

50.1%

46.2%

41,098

(6,169)

(18,178)

16,751

34.9%

14.2%

Stock-based compensation expense-related charges include employer payroll tax-related expenses on employee stock transactions.

Ⓒ2022 Amplitude Inc. Confidential. All Rights Reserved.

27View entire presentation