Foxo SPAC Presentation Deck

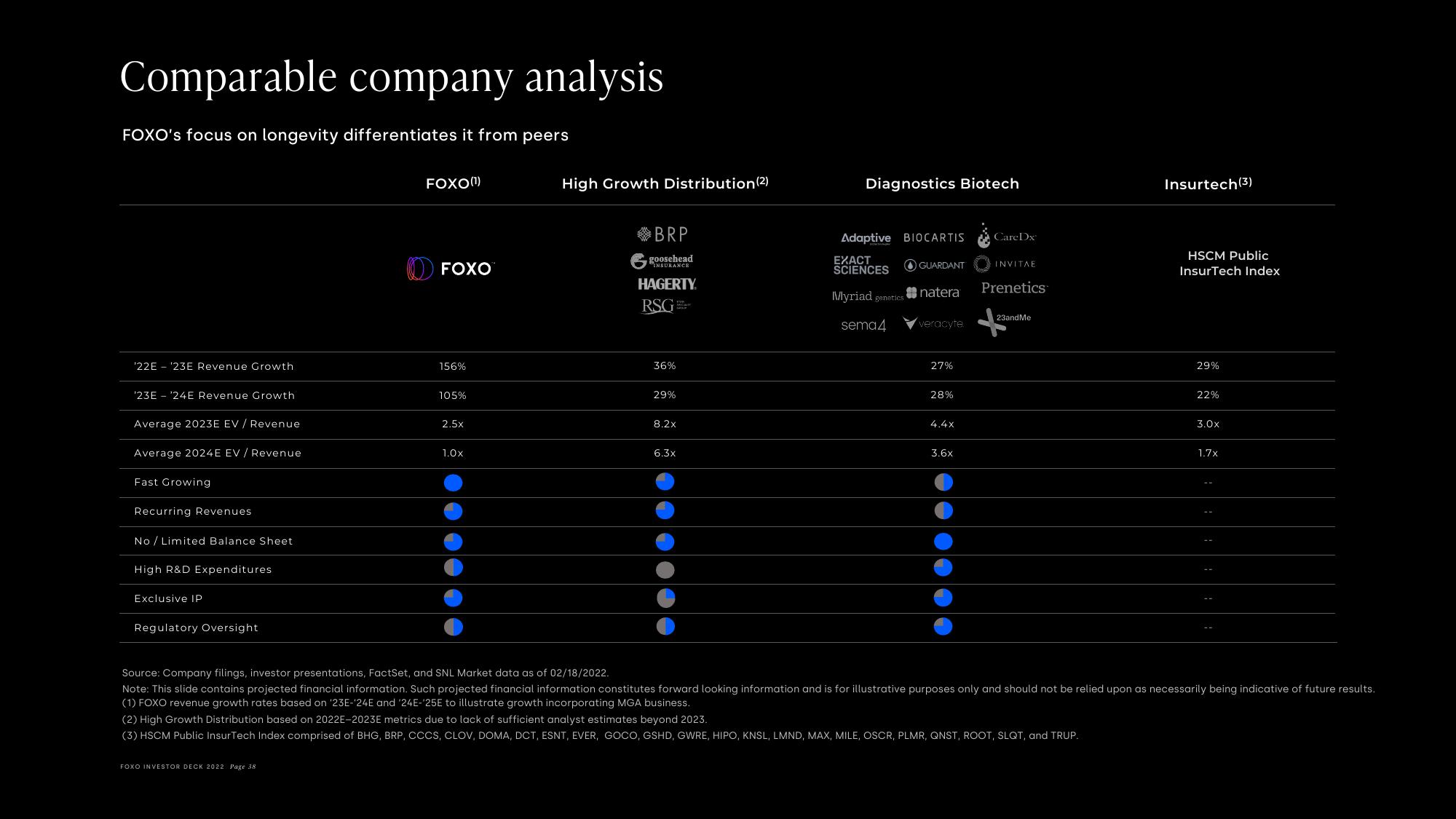

Comparable company analysis

FOXO's focus on longevity differentiates it from peers

'22E - ¹23E Revenue Growth

'23E '24E Revenue Growth

Average 2023E EV / Revenue

Average 2024E EV / Revenue

Fast Growing

Recurring Revenues

No / Limited Balance Sheet

High R&D Expenditures

Exclusive IP

Regulatory Oversight

FOXO(¹)

FOXO

FOXO INVESTOR DECK 2022 Page 38

156%

105%

2.5x

1.0x

High Growth Distribution (2)

BRP

goosehead

INSURANCE

HAGERTY.

RSG

36%

29%

8.2x

6.3x

Diagnostics Biotech

Adaptive BIOCARTIS

EXACT

SCIENCES

Myriad genetics

sema4

GUARDANT

veracyte

natera Prenetics

27%

28%

4.4X

CareDx

3.6x

INVITAE

23andMe

(2) High Growth Distribution based on 2022E-2023E metrics due to lack of sufficient analyst estimates beyond 2023.

(3) HSCM Public InsurTech Index comprised of BHG, BRP, CCCS, CLOV, DOMA, DCT, ESNT, EVER, GOCO, GSHD, GWRE, HIPO, KNSL, LMND, MAX, MILE, OSCR, PLMR, QNST, ROOT, SLQT, and TRUP.

Insurtech (3³)

HSCM Public

InsurTech Index

29%

22%

3.0x

Source: Company filings, investor presentations, FactSet, and SNL Market data as of 02/18/2022.

Note: This slide contains projected financial information. Such projected financial information constitutes forward looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results.

(1) FOXO revenue growth rates based on '23E-'24E and '24E-25E to illustrate growth incorporating MGA business.

1.7xView entire presentation