Coppersmith Presentation to Alere Inc Stockholders

PAGE 64 |

Endnotes

COPPERSMITH

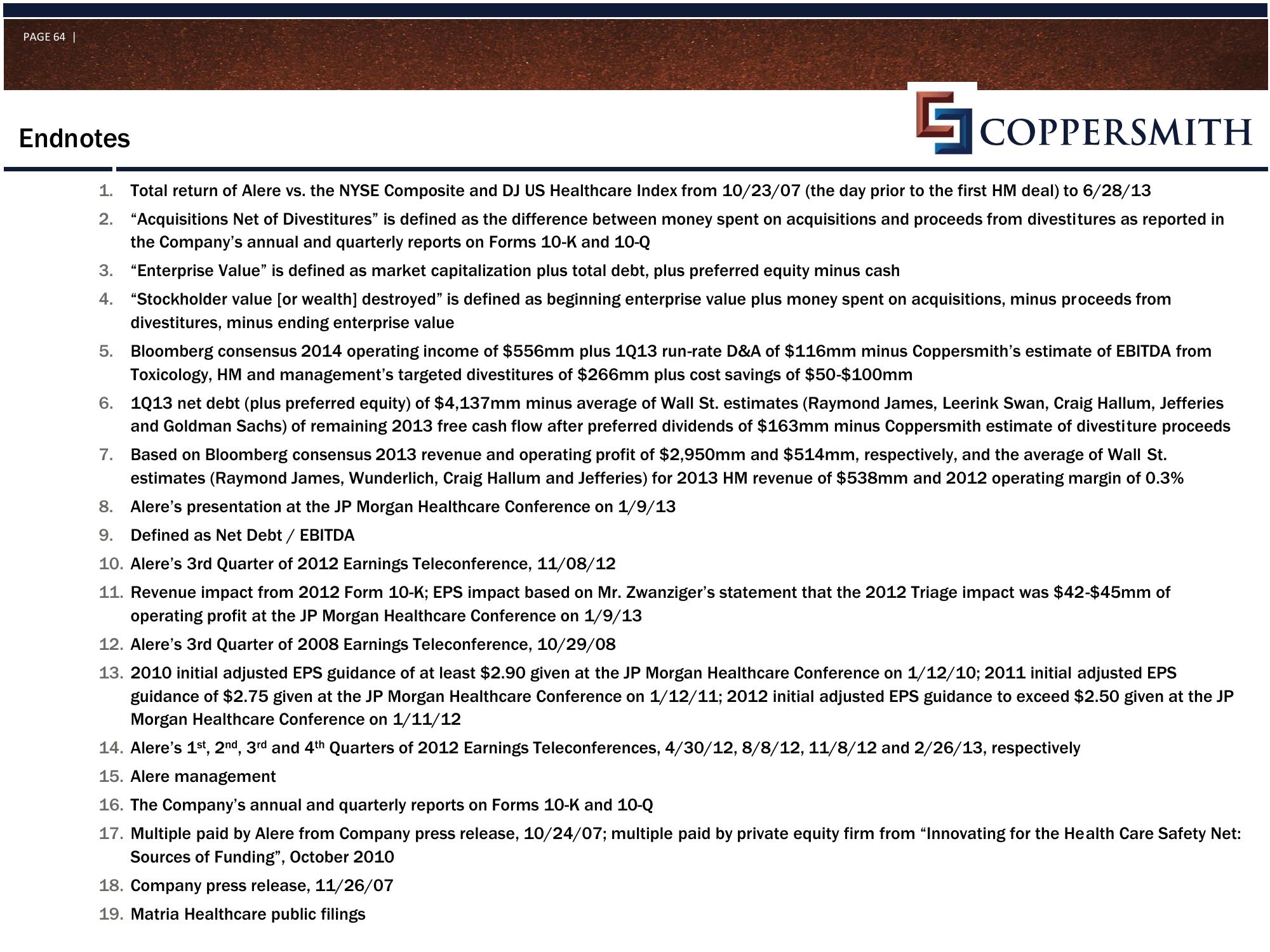

1. Total return of Alere vs. the NYSE Composite and DJ US Healthcare Index from 10/23/07 (the day prior to the first HM deal) to 6/28/13

2.

"Acquisitions Net of Divestitures" is defined as the difference between money spent on acquisitions and proceeds from divestitures as reported in

the Company's annual and quarterly reports on Forms 10-K and 10-Q

3.

"Enterprise Value” is defined as market capitalization plus total debt, plus preferred equity minus cash

4. "Stockholder value [or wealth] destroyed" is defined as beginning enterprise value plus money spent on acquisitions, minus proceeds from

divestitures, minus ending enterprise value

5. Bloomberg consensus 2014 operating income of $556mm plus 1013 run-rate D&A of $116mm minus Coppersmith's estimate of EBITDA from

Toxicology, HM and management's targeted divestitures of $266mm plus cost savings of $50-$100mm

6. 1013 net debt (plus preferred equity) of $4,137mm minus average of Wall St. estimates (Raymond James, Leerink Swan, Craig Hallum, Jefferies

and Goldman Sachs) of remaining 2013 free cash flow after preferred dividends of $163mm minus Coppersmith estimate of divestiture proceeds

7. Based on Bloomberg consensus 2013 revenue and operating profit of $2,950mm and $514mm, respectively, and the average of Wall St.

estimates (Raymond James, Wunderlich, Craig Hallum and Jefferies) for 2013 HM revenue of $538mm and 2012 operating margin of 0.3%

8. Alere's presentation at the JP Morgan Healthcare Conference on 1/9/13

9. Defined as Net Debt / EBITDA

10. Alere's 3rd Quarter of 2012 Earnings Teleconference, 11/08/12

11. Revenue impact from 2012 Form 10-K; EPS impact based on Mr. Zwanziger's statement that the 2012 Triage impact was $42-$45mm of

operating profit at the JP Morgan Healthcare Conference on 1/9/13

12. Alere's 3rd Quarter of 2008 Earnings Teleconference, 10/29/08

13. 2010 initial adjusted EPS guidance of at least $2.90 given at the JP Morgan Healthcare Conference on 1/12/10; 2011 initial adjusted EPS

guidance of $2.75 given at the JP Morgan Healthcare Conference on 1/12/11; 2012 initial adjusted EPS guidance to exceed $2.50 given at the JP

Morgan Healthcare Conference on 1/11/12

14. Alere's 1st, 2nd, 3rd and 4th Quarters of 2012 Earnings Teleconferences, 4/30/12, 8/8/12, 11/8/12 and 2/26/13, respectively

15. Alere management

16. The Company's annual and quarterly reports on Forms 10-K and 10-Q

17. Multiple paid by Alere from Company press release, 10/24/07; multiple paid by private equity firm from "Innovating for the Health Care Safety Net:

Sources of Funding", October 2010

18. Company press release, 11/26/07

19. Matria Healthcare public filingsView entire presentation