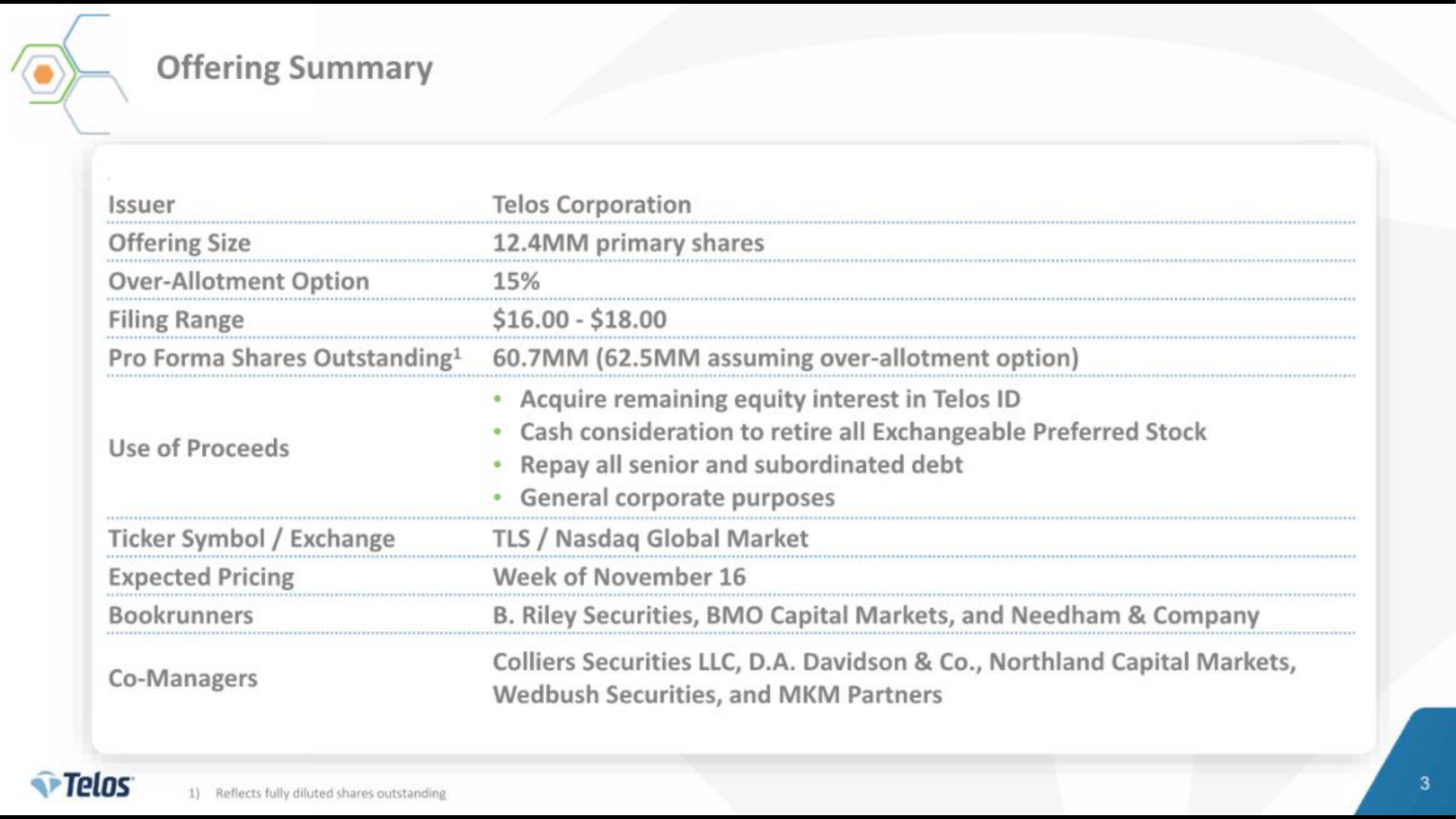

Telos IPO Presentation Deck

Offering Summary

Issuer

Offering Size

Over-Allotment Option

Filing Range

$16.00-$18.00

Pro Forma Shares Outstanding¹ 60.7MM (62.5MM assuming over-allotment option)

Use of Proceeds

Ticker Symbol/ Exchange

Expected Pricing

Bookrunners

Co-Managers

Telos

Telos Corporation

12.4MM primary shares

15%

1) Reflects fully diluted shares outstanding

Acquire remaining equity interest in Telos ID

Cash consideration to retire all Exchangeable Preferred Stock

Repay all senior and subordinated debt

General corporate purposes

TLS / Nasdaq Global Market

Week of November 16

B. Riley Securities, BMO Capital Markets, and Needham & Company

Colliers Securities LLC, D.A. Davidson & Co., Northland Capital Markets,

Wedbush Securities, and MKM Partners

3View entire presentation