First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

Actively Managing Asset-Sensitive Balance Sheet

■

■

First Busey Corporation | Ticker: BUSE

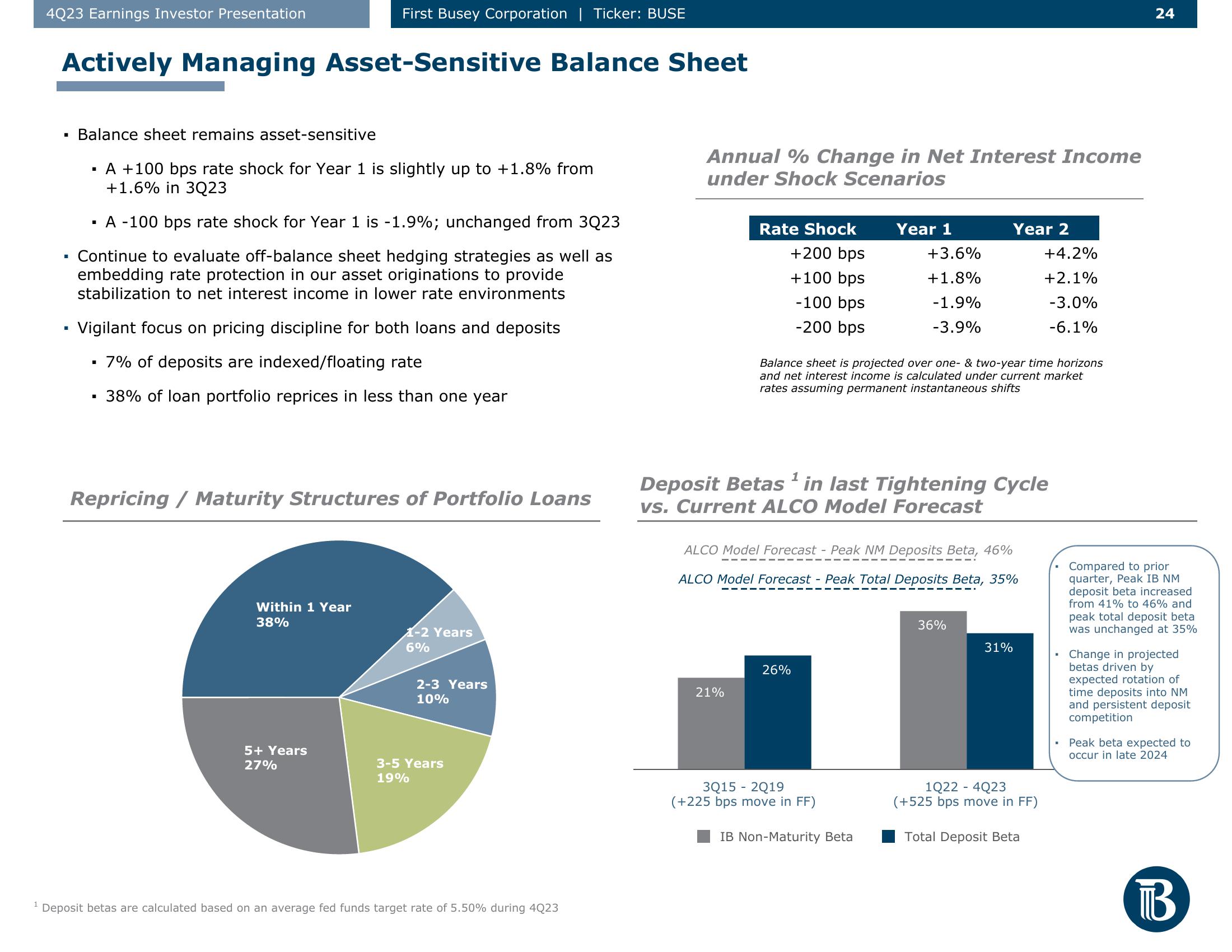

Balance sheet remains asset-sensitive

A +100 bps rate shock for Year 1 is slightly up to +1.8% from

+1.6% in 3Q23

▪ A -100 bps rate shock for Year 1 is -1.9%; unchanged from 3Q23

Continue to evaluate off-balance sheet hedging strategies as well as

embedding rate protection in our asset originations to provide

stabilization to net interest income in lower rate environments

Vigilant focus on pricing discipline for both loans and deposits

7% of deposits are indexed/floating rate

▪ 38% of loan portfolio reprices in less than one year

Repricing / Maturity Structures of Portfolio Loans

Within 1 Year

38%

5+ Years

27%

1-2 Years

6%

2-3 Years

10%

3-5 Years

19%

1 Deposit betas are calculated based on an average fed funds target rate of 5.50% during 4Q23

Annual % Change in Net Interest Income

under Shock Scenarios

Rate Shock

+200 bps

+100 bps

-100 bps

-200 bps

21%

Year 1

26%

+3.6%

+1.8%

-1.9%

-3.9%

Balance sheet is projected over one- & two-year time horizons

and net interest income is calculated under current market

rates assuming permanent instantaneous shifts

Deposit Betasin last Tightening Cycle

vs. Current ALCO Model Forecast

ALCO Model Forecast - Peak NM Deposits Beta, 46%

ALCO Model Forecast - Peak Total Deposits Beta, 35%

3Q15 - 2019

(+225 bps move in FF)

IB Non-Maturity Beta

Year 2

36%

31%

+4.2%

+2.1%

-3.0%

-6.1%

1Q22 - 4Q23

(+525 bps move in FF)

Total Deposit Beta

24

Compared to prior

quarter, Peak IB NM

deposit beta increased

from 41% to 46% and

peak total deposit beta

was unchanged at 35%

Change in projected

betas driven by

expected rotation of

time deposits into NM

and persistent deposit

competition

Peak beta expected to

occur in late 2024

BView entire presentation