Rentokil Initial Investor Day Presentation Deck

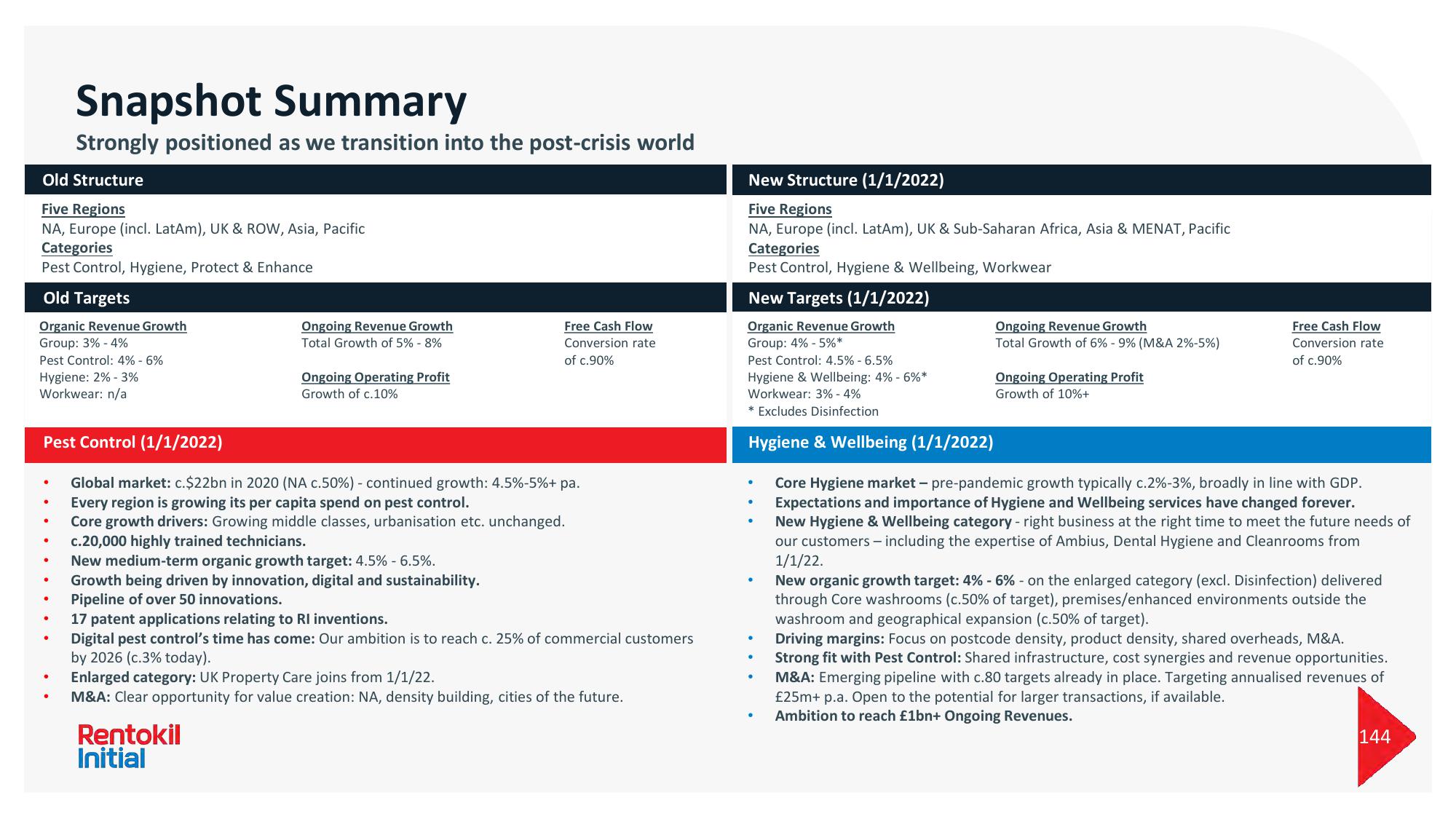

Old Structure

Five Regions

NA, Europe (incl. LatAm), UK & ROW, Asia, Pacific

Categories

Pest Control, Hygiene, Protect & Enhance

Old Targets

Organic Revenue Growth

Group: 3% -4%

Pest Control: 4% -6%

Hygiene: 2% -3%

Workwear: n/a

Pest Control (1/1/2022)

●

Snapshot Summary

Strongly positioned as we transition into the post-crisis world

●

●

•

Ongoing Revenue Growth

Total Growth of 5% - 8%

Ongoing Operating Profit

Growth of c.10%

Global market: c.$22bn in 2020 (NA c.50%) - continued growth: 4.5%-5%+ pa.

Every region is growing its per capita spend on pest control.

Core growth drivers: Growing middle classes, urbanisation etc. unchanged.

c.20,000 highly trained technicians.

New medium-term organic growth target: 4.5% -6.5%.

Growth being driven by innovation, digital and sustainability.

Pipeline of over 50 innovations.

Free Cash Flow

Conversion rate

of c.90%

Rentokil

Initial

17 patent applications relating to RI inventions.

Digital pest control's time has come: Our ambition is to reach c. 25% of commercial customers

by 2026 (c.3% today).

Enlarged category: UK Property Care joins from 1/1/22.

M&A: Clear opportunity for value creation: NA, density building, cities of the future.

New Structure (1/1/2022)

Five Regions

NA, Europe (incl. LatAm), UK & Sub-Saharan Africa, Asia & MENAT, Pacific

Categories

Pest Control, Hygiene & Wellbeing, Workwear

New Targets (1/1/2022)

Organic Revenue Growth

Group: 4% - 5%*

Pest Control: 4.5% -6.5%

Hygiene & Wellbeing: 4% -6%*

Workwear: 3% -4%

* Excludes Disinfection

Hygiene & Wellbeing (1/1/2022)

·

●

●

•

Ongoing Revenue Growth

Total Growth of 6% -9% (M&A 2%-5%)

Ongoing Operating Profit

Growth of 10%+

Free Cash Flow

Conversion rate

of c.90%

Core Hygiene market - pre-pandemic growth typically c.2%-3%, broadly in line with GDP.

Expectations and importance of Hygiene and Wellbeing services have changed forever.

New Hygiene & Wellbeing category - right business at the right time to meet the future needs of

our customers - including the expertise of Ambius, Dental Hygiene and Cleanrooms from

1/1/22.

New organic growth target: 4% -6% - on the enlarged category (excl. Disinfection) delivered

through Core washrooms (c.50% of target), premises/enhanced environments outside the

washroom and geographical expansion (c.50% of target).

Driving margins: Focus on postcode density, product density, shared overheads, M&A.

Strong fit with Pest Control: Shared infrastructure, cost synergies and revenue opportunities.

M&A: Emerging pipeline with c.80 targets already in place. Targeting annualised revenues of

£25m+ p.a. Open to the potential for larger transactions, if available.

Ambition to reach £1bn+ Ongoing Revenues.

144View entire presentation