Faraday Future SPAC Presentation Deck

Transaction Overview

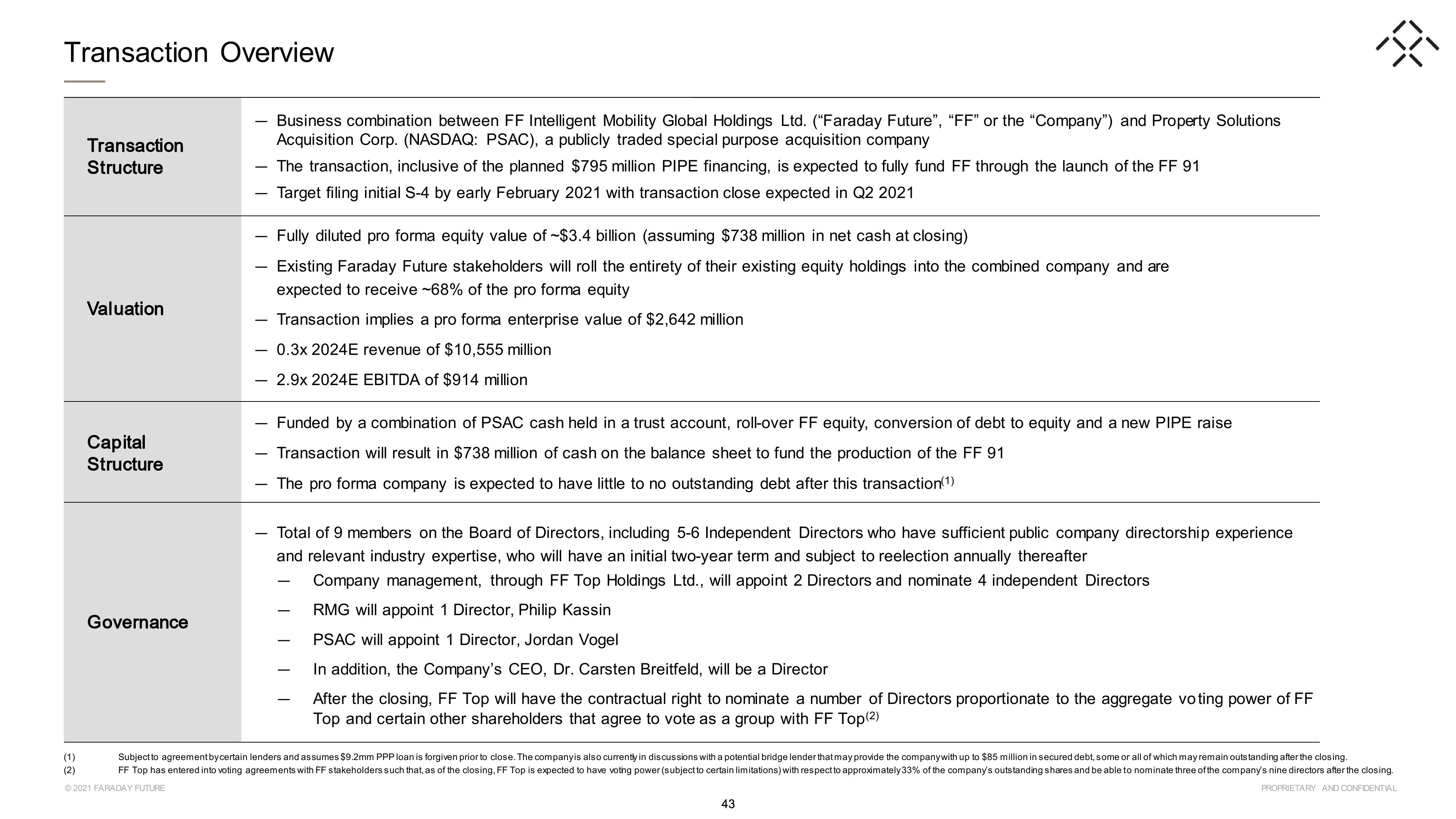

Transaction

Structure

(1)

(2)

Valuation

Capital

Structure

Governance

Business combination between FF Intelligent Mobility Global Holdings Ltd. ("Faraday Future", "FF" or the "Company") and Property Solutions

Acquisition Corp. (NASDAQ: PSAC), a publicly traded special purpose acquisition company

- The transaction, inclusive of the planned $795 million PIPE financing, is expected to fully fund FF through the launch of the FF 91

Target filing initial S-4 by early February 2021 with transaction close expected in Q2 2021

Fully diluted pro forma equity value of -$3.4 billion (assuming $738 million in net cash at closing)

Existing Faraday Future stakeholders will roll the entirety of their existing equity holdings into the combined company and are

expected to receive -68% of the pro forma equity

Transaction implies a pro forma enterprise value of $2,642 million

0.3x 2024E revenue of $10,555 million

2.9x 2024E EBITDA of $914 million

- Funded by a combination of PSAC cash held in a trust account, roll-over FF equity, conversion of debt to equity and a new PIPE raise

- Transaction will result in $738 million of cash on the balance sheet to fund the production of the FF 91

The pro forma company is expected to have little to no outstanding debt after this transaction(1)

Total of 9 members on the Board of Directors, including 5-6 Independent Directors who have sufficient public company directorship experience

and relevant industry expertise, who will have an initial two-year term and subject to reelection annually thereafter

Company management, through FF Top Holdings Ltd., will appoint 2 Directors and nominate 4 independent Directors

RMG will appoint 1 Director, Philip Kassin

PSAC will appoint 1 Director, Jordan Vogel

In addition, the Company's CEO, Dr. Carsten Breitfeld, will be a Director

After the closing, FF Top will have the contractual right to nominate a number of Directors proportionate to the aggregate voting power of FF

Top and certain other shareholders that agree to vote as a group with FF Top(2)

Subject to agreement by certain lenders and assumes $9.2mm PPP loan is forgiven prior to close. The companyis also currently in discussions with a potential bridge lender that may provide the company with up to $85 million in secured debt, some or all of which may remain outstanding after the closing.

FF Top has entered into voting agreements with FF stakeholders such that, as of the closing, FF Top is expected to have voting power (subject to certain limitations) with respect to approximately 33% of the company's outstanding shares and be able to nominate three of the company's nine directors after the closing.

Ⓒ2021 FARADAY FUTURE

PROPRIETARY AND CONFIDENTIAL

38

43View entire presentation