Tuya Results Presentation Deck

Strong Cash Position

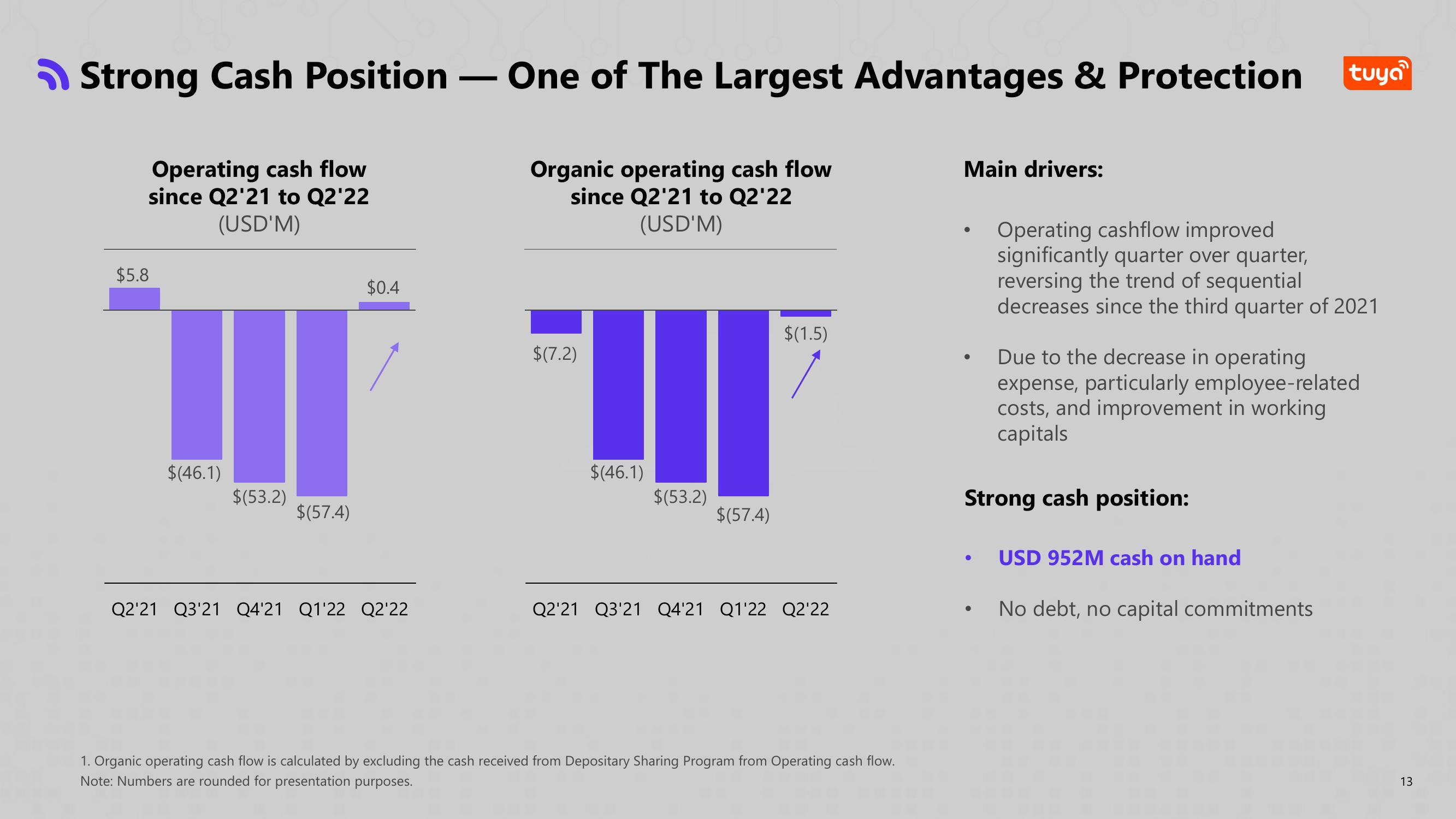

Operating cash flow

since Q2'21 to Q2'22

(USD'M)

$5.8

$(46.1)

$(53.2)

$(57.4)

$0.4

Q2'21 Q3'21 Q4'21 Q1'22 Q2'22

One of The Largest Advantages & Protection

Organic operating cash flow

since Q2'21 to Q2'22

(USD'M)

$(7.2)

$(46.1)

$(53.2)

$(57.4)

$(1.5)

Q2'21 Q3'21 Q4'21 Q1'22 Q2'22

1. Organic operating cash flow is calculated by excluding the cash received from Depositary Sharing Program from Operating cash flow.

Note: Numbers are rounded for presentation purposes.

Main drivers:

●

●

Strong cash position:

●

Operating cashflow improved

significantly quarter over quarter,

reversing the trend of sequential

decreases since the third quarter of 2021

Due to the decrease in operating

expense, particularly employee-related

costs, and improvement in working

capitals

tuya

USD 952M cash on hand

No debt, no capital commitments

13View entire presentation