Alternus Energy SPAC Presentation Deck

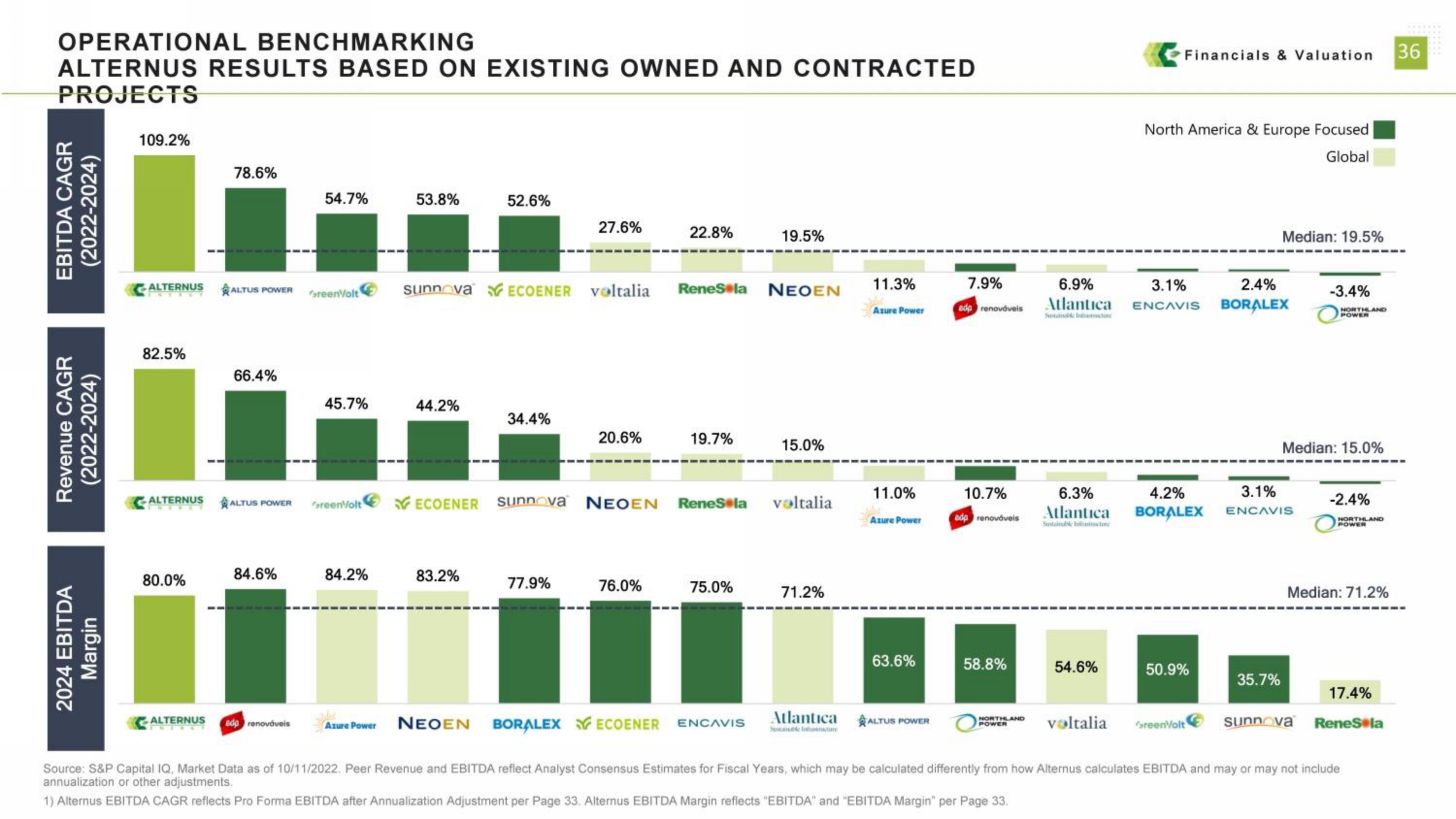

OPERATIONAL BENCHMARKING

ALTERNUS RESULTS BASED ON EXISTING OWNED AND CONTRACTED

PROJECTS

EBITDA CAGR

(2022-2024)

Revenue CAGR

(2022-2024)

2024 EBITDA

Margin

109.2%

82.5%

ALTERNUS ALTUS POWER reenvolt

78.6%

80.0%

ALTERNUS

66.4%

54.7%

84.6%

edp renováveis

45.7%

53.8%

84.2%

44.2%

sunnova ECOENER voltalia

52.6%

83.2%

NEOEN

Azure Power

34.4%

27.6%

ALTERNUS ALTUS POWER GreenVolt ECOENER Sunnova NEOEN Renes la voltalia

77.9%

20.6%

22.8%

76.0%

ReneSola NEOEN

19.7%

19.5%

75.0%

BORALEX ECOENER ENCAVIS

15.0%

71.2%

Atlantica

11.3%

Azure Power

11.0%

Azure Power

63.6%

ALTUS POWER

7.9%

edp renováveis

10.7%

ada renováveis

58.8%

NORTHLAND

POWER

Financials & Valuation 36

54.6%

North America & Europe Focused

Global

6.9%

3.1%

2.4%

Atlantica ENCAVIS BORALEX

6.3%

4.2%

Atlantica BORALEX

voltalia

50.9%

GreenVolt

Median: 19.5%

35.7%

3.1%

ENCAVIS

-3.4%

NORTHLAND

POWER

Median: 15.0%

-2.4%

NORTHLAND

POWER

Median: 71.2%

17.4%

sunnova Renes la

Source: S&P Capital IQ, Market Data as of 10/11/2022. Peer Revenue and EBITDA reflect Analyst Consensus Estimates for Fiscal Years, which may be calculated differently from how Alternus calculates EBITDA and may or may not include

annualization or other adjustments.

1) Alternus EBITDA CAGR reflects Pro Forma EBITDA after Annualization Adjustment per Page 33. Alternus EBITDA Margin reflects "EBITDA" and "EBITDA Margin" per Page 33.View entire presentation