Pershing Square Activist Presentation Deck

Appendix

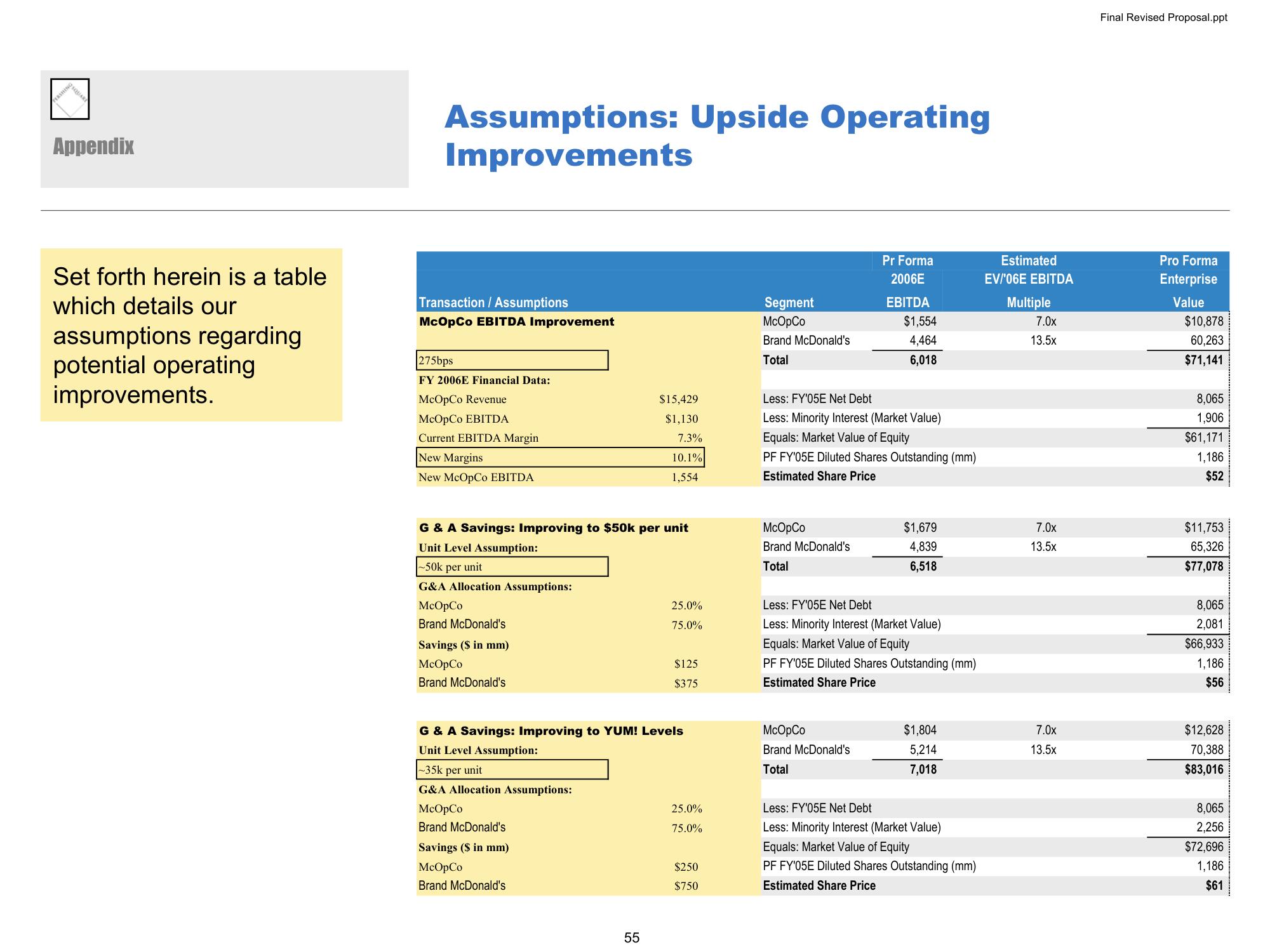

Set forth herein is a table

which details our

assumptions regarding

potential operating

improvements.

Assumptions: Upside Operating

Improvements

Transaction / Assumptions

McOpCo EBITDA Improvement

275bps

FY 2006E Financial Data:

McOpCo Revenue

McOpCo EBITDA

Current EBITDA Margin

New Margins

New McOpCo EBITDA

G & A Savings: Improving to $50k per unit

Unit Level Assumption:

-50k per unit

G&A Allocation Assumptions:

McOpCo

Brand McDonald's

Savings ($ in mm)

McOpCo

Brand McDonald's

-35k per unit

G&A Allocation Assumptions:

McOpCo

Brand McDonald's

$15,429

$1,130

7.3%

10.1%

1,554

G & A Savings: Improving to YUM! Levels

Unit Level Assumption:

Savings ($ in mm)

McOpCo

Brand McDonald's

55

25.0%

75.0%

$125

$375

25.0%

75.0%

$250

$750

Segment

McOpCo

Brand McDonald's

Total

McOpCo

Brand McDonald's

Total

Pr Forma

2006E

EBITDA

Less: FY'05E Net Debt

Less: Minority Interest (Market Value)

Equals: Market Value of Equity

PF FY'05E Diluted Shares Outstanding (mm)

Estimated Share Price

$1,554

4.464

6,018

McOpCo

Brand McDonald's

Total

$1,679

4,839

6,518

Less: FY'05E Net Debt

Less: Minority Interest (Market Value)

Equals: Market Value of Equity

PF FY'05E Diluted Shares Outstanding (mm)

Estimated Share Price

$1,804

5,214

7,018

Less: FY'05E Net Debt

Less: Minority Interest (Market Value)

Equals: Market Value of Equity

PF FY'05E Diluted Shares Outstanding (mm)

Estimated Share Price

Estimated

EV/'06E EBITDA

Multiple

7.0x

13.5x

7.0x

13.5x

7.0x

13.5x

Final Revised Proposal.ppt

Pro Forma

Enterprise

Value

$10,878

60,263

$71,141

8,065

1,906

$61,171

1,186

$52

$11,753

65,326

$77,078

8,065

2,081

$66,933

1,186

$56

$12,628

70,388

$83,016

8,065

2,256

$72,696

1,186

$61View entire presentation