Maersk Investor Presentation Deck

Ocean highlights Q3 2020

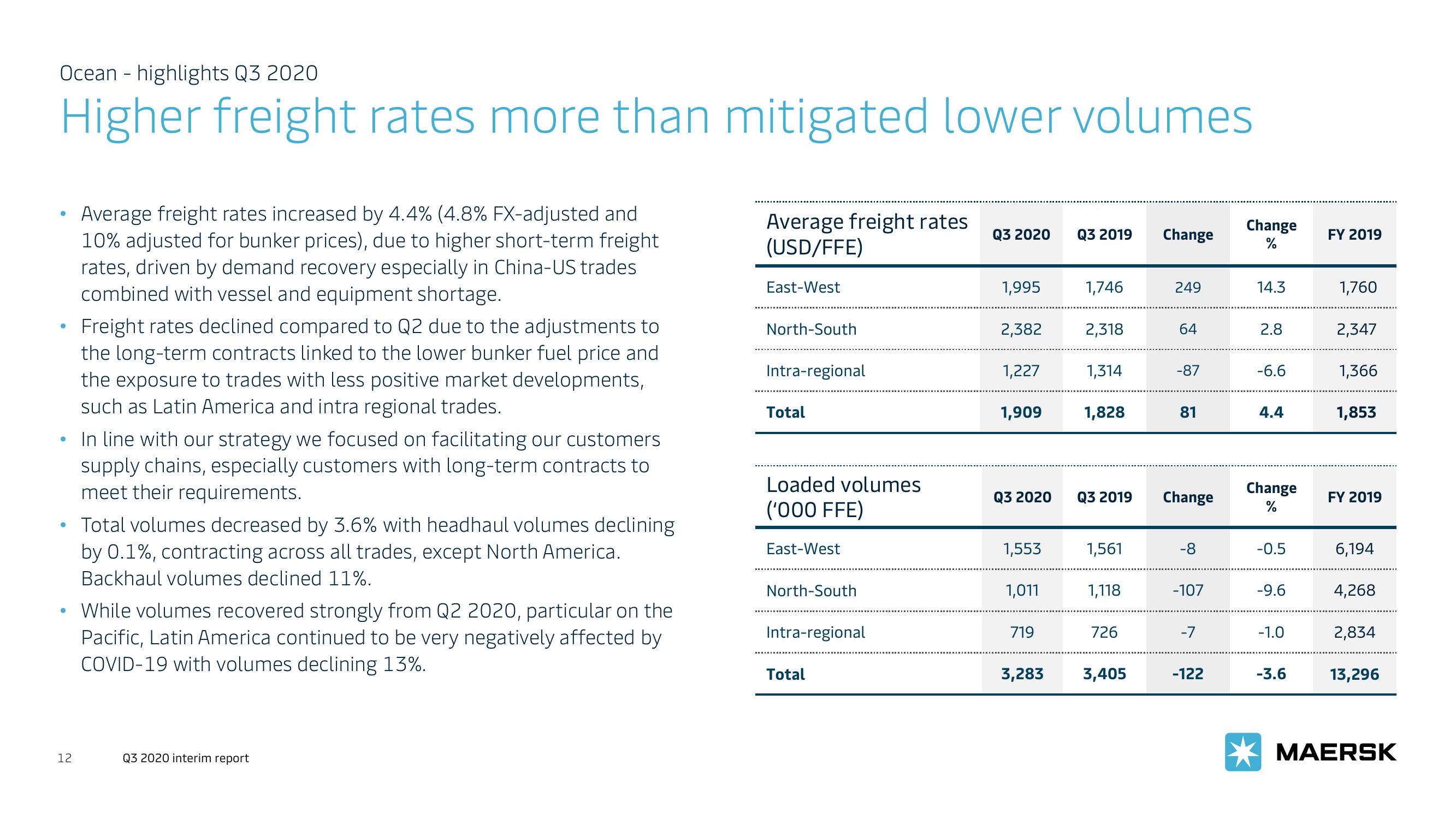

Higher freight rates more than mitigated lower volumes

●

• Freight rates declined compared to Q2 due to the adjustments to

the long-term contracts linked to the lower bunker fuel price and

the exposure to trades with less positive market developments,

such as Latin America and intra regional trades.

●

Average freight rates increased by 4.4% (4.8% FX-adjusted and

10% adjusted for bunker prices), due to higher short-term freight

rates, driven by demand recovery especially in China-US trades

combined with vessel and equipment shortage.

12

In line with our strategy we focused on facilitating our customers

supply chains, especially customers with long-term contracts to

meet their requirements.

Total volumes decreased by 3.6% with headhaul volumes declining

by 0.1%, contracting across all trades, except North America.

Backhaul volumes declined 11%.

• While volumes recovered strongly from Q2 2020, particular on the

Pacific, Latin America continued to be very negatively affected by

COVID-19 with volumes declining 13%.

Q3 2020 interim report

Average freight rates

(USD/FFE)

East-West

North-South

Intra-regional

Total

Loaded volumes

('000 FFE)

East-West

North-South

Intra-regional

Total

Q3 2020

1,995

2,382

1,227

1,909

Q3 2020

1,553

1,011

719

Q3 2019

1,746

2,318

1,314

1,828

Q3 2019

1,561

1,118

726

3,283 3,405

Change

249

64

-87

81

Change

-8

-107

-7

-122

Change

%

14.3

2.8

-6.6

4.4

Change

%

-0.5

-9.6

-1.0

-3.6

FY 2019

1,760

2,347

1,366

1,853

FY 2019

6,194

4,268

2,834

13,296

MAERSKView entire presentation