SoftBank Results Presentation Deck

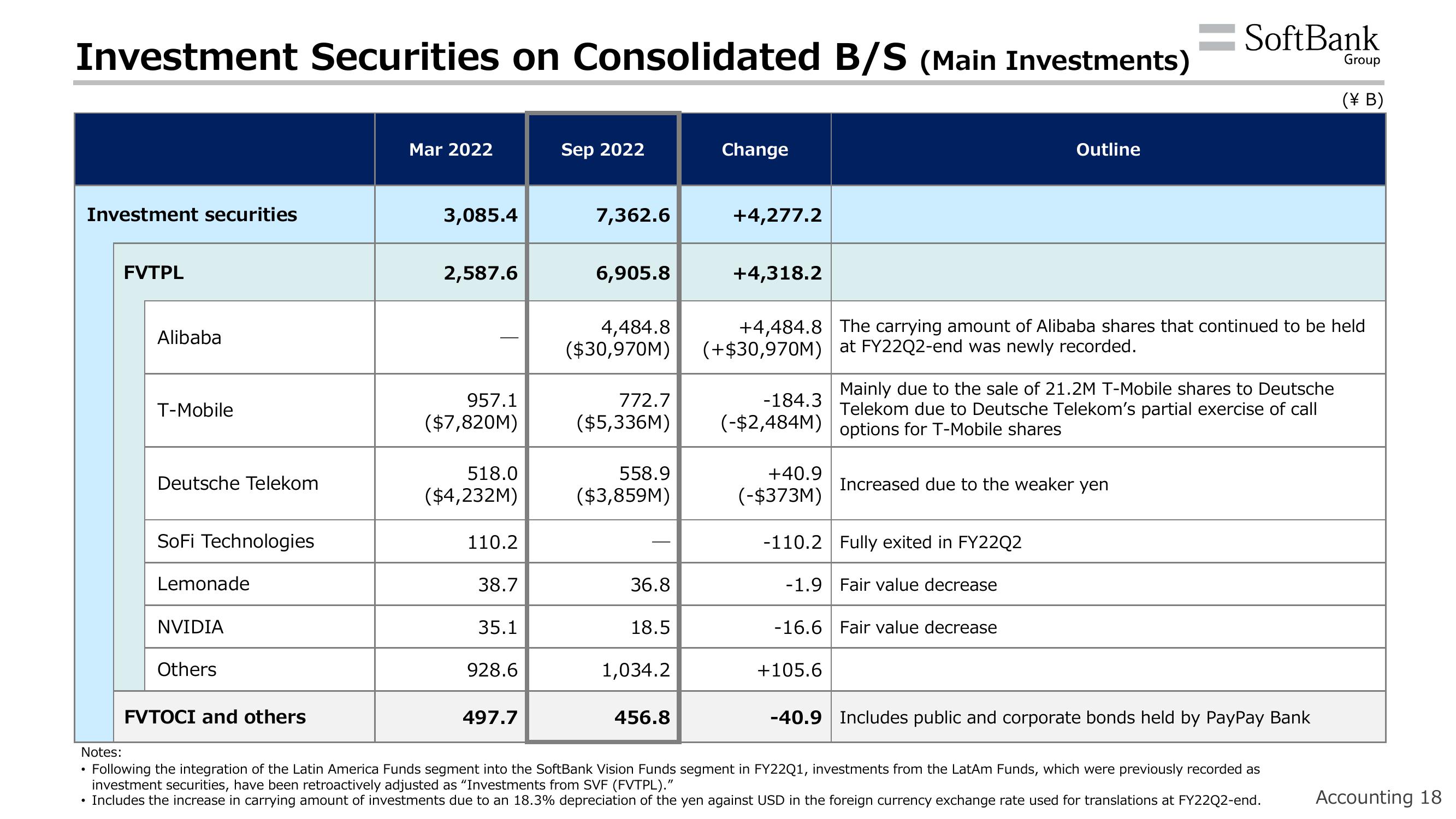

Investment Securities on Consolidated B/S (Main Investments)

Investment securities

FVTPL

Alibaba

T-Mobile

Deutsche Telekom

SoFi Technologies

Lemonade

NVIDIA

Others

FVTOCI and others

Mar 2022

3,085.4

2,587.6

957.1

($7,820M)

518.0

($4,232M)

110.2

38.7

35.1

928.6

497.7

Sep 2022

7,362.6

6,905.8

4,484.8

($30,970M)

772.7

($5,336M)

558.9

($3,859M)

36.8

18.5

1,034.2

456.8

Change

+4,277.2

+4,318.2

-184.3

(-$2,484M)

+40.9

(-$373M)

+4,484.8 The carrying amount of Alibaba shares that continued to be held

(+$30,970M) at FY22Q2-end was newly recorded.

-110.2 Fully exited in FY22Q2

Outline

Mainly due to the sale of 21.2M T-Mobile shares to Deutsche

Telekom due to Deutsche Telekom's partial exercise of call

options for T-Mobile shares

Increased due to the weaker yen

-1.9 Fair value decrease

+105.6

-16.6 Fair value decrease

SoftBank

-40.9 Includes public and corporate bonds held by PayPay Bank

Group

Notes:

Following the integration of the Latin America Funds segment into the SoftBank Vision Funds segment in FY22Q1, investments from the LatAm Funds, which were previously recorded as

investment securities, have been retroactively adjusted as "Investments from SVF (FVTPL)."

• Includes the increase in carrying amount of investments due to an 18.3% depreciation of the yen against USD in the foreign currency exchange rate used for translations at FY22Q2-end.

(\B)

Accounting 18View entire presentation