Bed Bath & Beyond Results Presentation Deck

APPENDIX

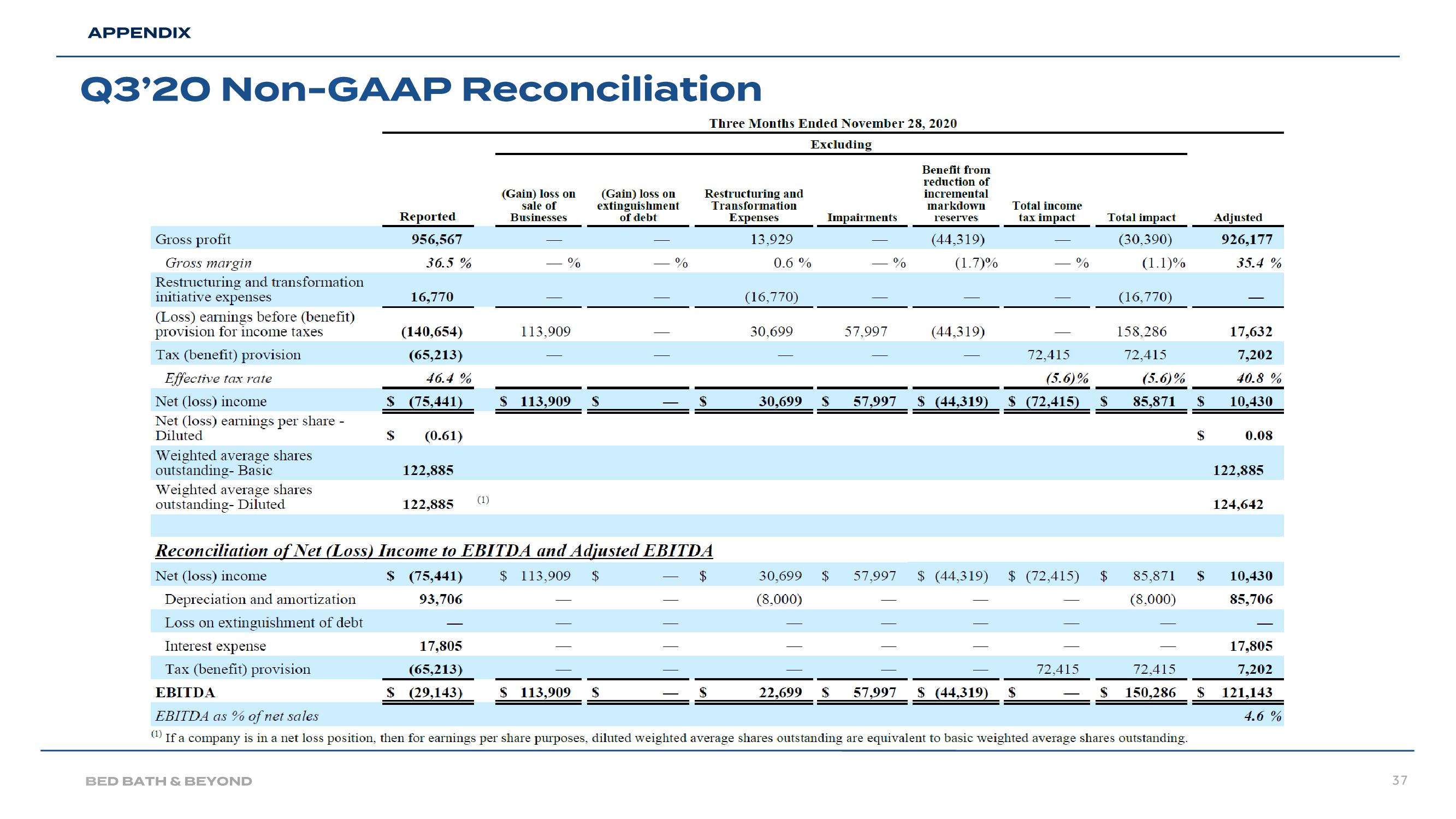

Q3'20 Non-GAAP Reconciliation

Gross profit

Gross margin

Restructuring and transformation

initiative expenses

(Loss) earnings before (benefit)

provision for income taxes

Tax (benefit) provision

Effective tax rate

Net (loss) income

Net (loss) earnings per share -

Diluted

Weighted average shares

outstanding- Basic

Weighted average shares

outstanding- Diluted

Reported

956,567

36.5 %

BED BATH & BEYOND

16,770

(140,654)

(65,213)

46.4%

$ (75,441)

$ (0.61)

122,885

122,885

$ (75,441)

93,706

(1)

(Gain) loss on

sale of

Businesses

17,805

(65,213)

$ (29,143)

113,909

(Gain) loss on

extinguishment

of debt

$ 113,909 S

%

Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA

$ 113,909 $

$

$ 113,909 S

Three Months Ended November 28, 2020

Restructuring and

Transformation

Expenses

13,929

S

0.6 %

(16,770)

30.699

Excluding

Impairments

30,699 S

30.699 $

(8,000)

57,997

%

57,997

Benefit from

reduction of

incremental

markdown

reserves

(44,319)

(1.7)%

(44,319)

22,699 S 57,997

Total income

tax impact

$ (44,319)

(5.6)%

57,997 $ (44,319) $ (72,415) S

72,415

%

Net (loss) income

Depreciation and amortization

Loss on extinguishment of debt

Interest expense

Tax (benefit) provision

EBITDA

EBITDA as % of net sales

If a company is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average shares outstanding.

(1)

$ (72,415)

$ (44,319) S

Total impact

72,415

$

(30,390)

(1.1)%

(16,770)

158,286

72,415

(5.6)%

85,871 $

85,871

(8,000)

72,415

S 150,286

$

$

S

Adjusted

926,177

35.4 %

17,632

7,202

40.8 %

10,430

0.08

122,885

124,642

10,430

85,706

17,805

7,202

121,143

4.6 %

37View entire presentation