Antero Midstream Partners Mergers and Acquisitions Presentation Deck

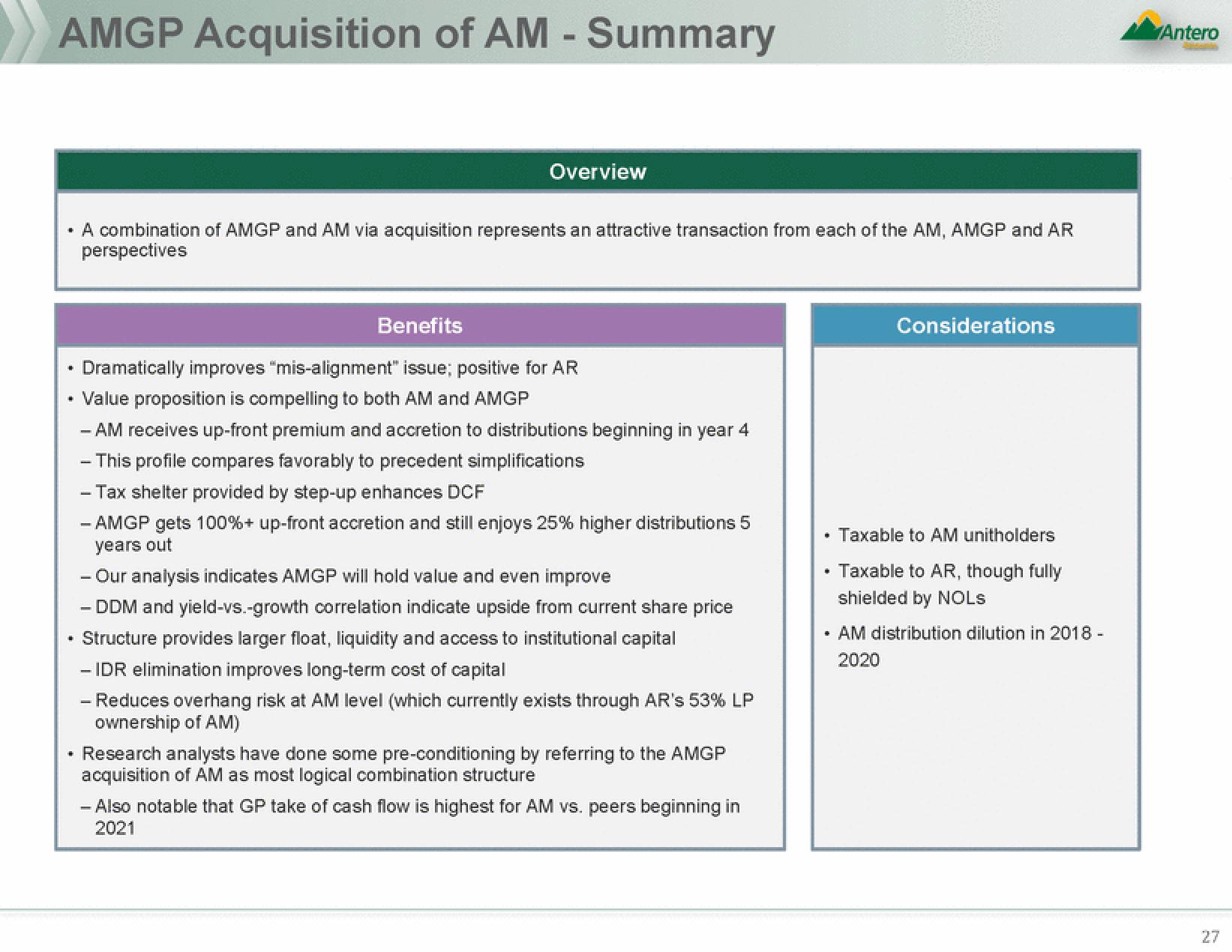

AMGP Acquisition of AM - Summary

+

A combination of AMGP and AM via acquisition represents an attractive transaction from each of the AM, AMGP and AR

perspectives

·

Overview

·

Benefits

Dramatically improves "mis-alignment" issue; positive for AR

Value proposition is compelling to both AM and AMGP

- AM receives up-front premium and accretion to distributions beginning in year 4

- This profile compares favorably to precedent simplifications

- Tax shelter provided by step-up enhances DCF

- AMGP gets 100%+ up-front accretion and still enjoys 25% higher distributions 5

years out

- Our analysis indicates AMGP will hold value and even improve

- DDM and yield-vs.-growth correlation indicate upside from current share price

Structure provides larger float, liquidity and access to institutional capital

- IDR elimination improves long-term cost of capital

- Reduces overhang risk at AM level (which currently exists through AR's 53% LP

ownership of AM)

Research analysts have done some pre-conditioning by referring to the AMGP

acquisition of AM as most logical combination structure

- Also notable that GP take of cash flow is highest for AM vs. peers beginning in

2021

■

#

Considerations

Taxable to AM unitholders

Taxable to AR, though fully

shielded by NOLS

AM distribution dilution in 2018 -

2020

Antero

27View entire presentation