Hilltop Holdings Results Presentation Deck

Hilltop Holdings - Allowance for Credit Losses

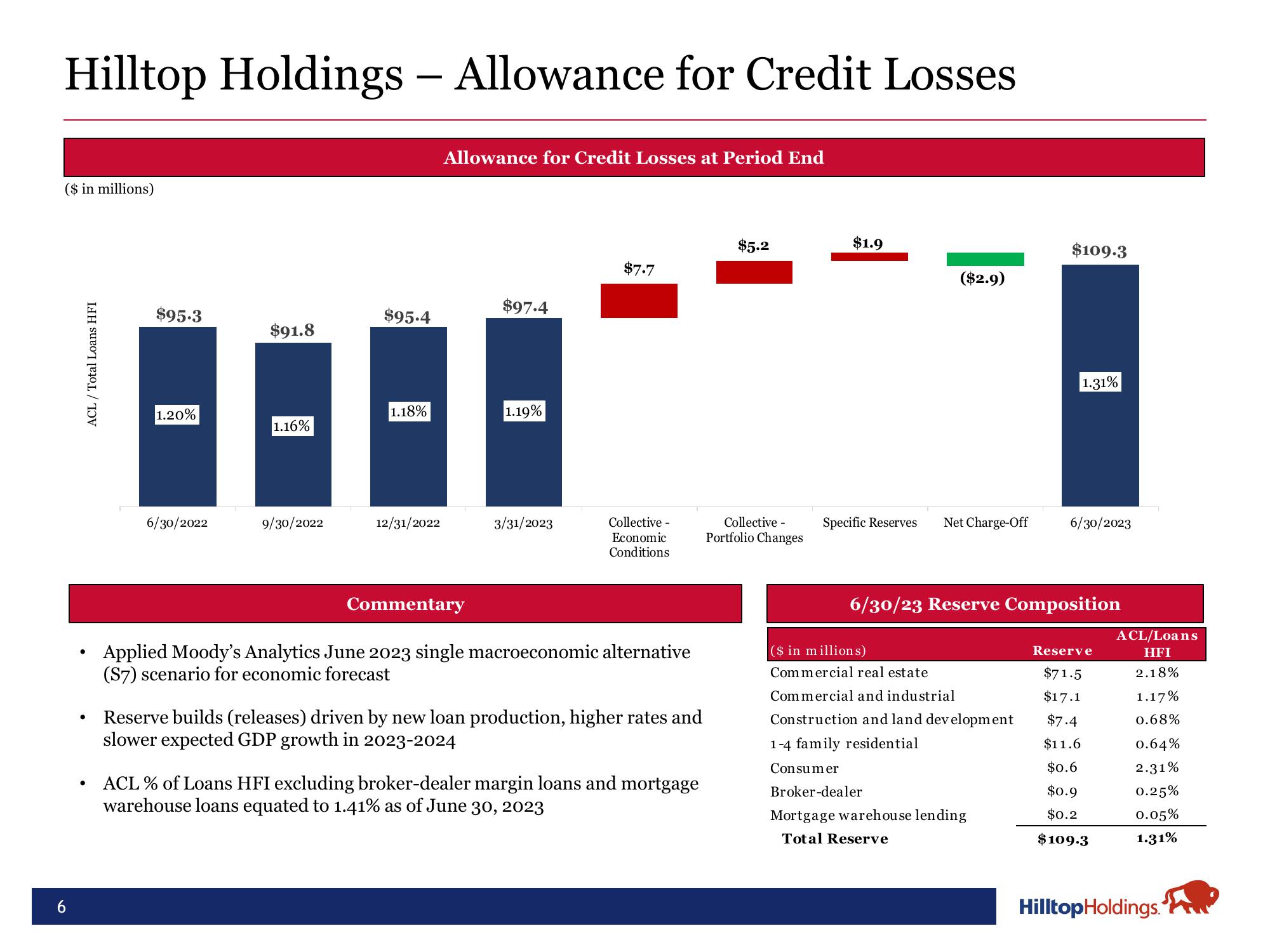

($ in millions)

ACL/Total Loans HFI

●

●

●

$95.3

1.20%

6/30/2022

$91.8

1.16%

9/30/2022

$95.4

1.18%

12/31/2022

Allowance for Credit Losses at Period End

Commentary

$97.4

1.19%

3/31/2023

$7.7

Collective -

Economic

Conditions

Applied Moody's Analytics June 2023 single macroeconomic alternative

(S7) scenario for economic forecast

Reserve builds (releases) driven by new loan production, higher rates and

slower expected GDP growth in 2023-2024

ACL % of Loans HFI excluding broker-dealer margin loans and mortgage

warehouse loans equated to 1.41% as of June 30, 2023

$5.2

Collective -

Portfolio Changes

$1.9

Specific Reserves

($2.9)

Net Charge-Off

$109.3

($ in millions)

Commercial real estate

Commercial and industrial

Construction and land development

1-4 family residential

Consumer

Broker-dealer

Mortgage warehouse lending

Total Reserve

1.31%

6/30/2023

6/30/23 Reserve Composition

Reserve

$71.5

$17.1

$7.4

$11.6

$0.6

$0.9

$0.2

$109.3

ACL/Loans

HFI

2.18%

1.17%

0.68%

0.64%

2.31%

0.25%

0.05%

1.31%

Hilltop Holdings.View entire presentation