WCG IPO Presentation Deck

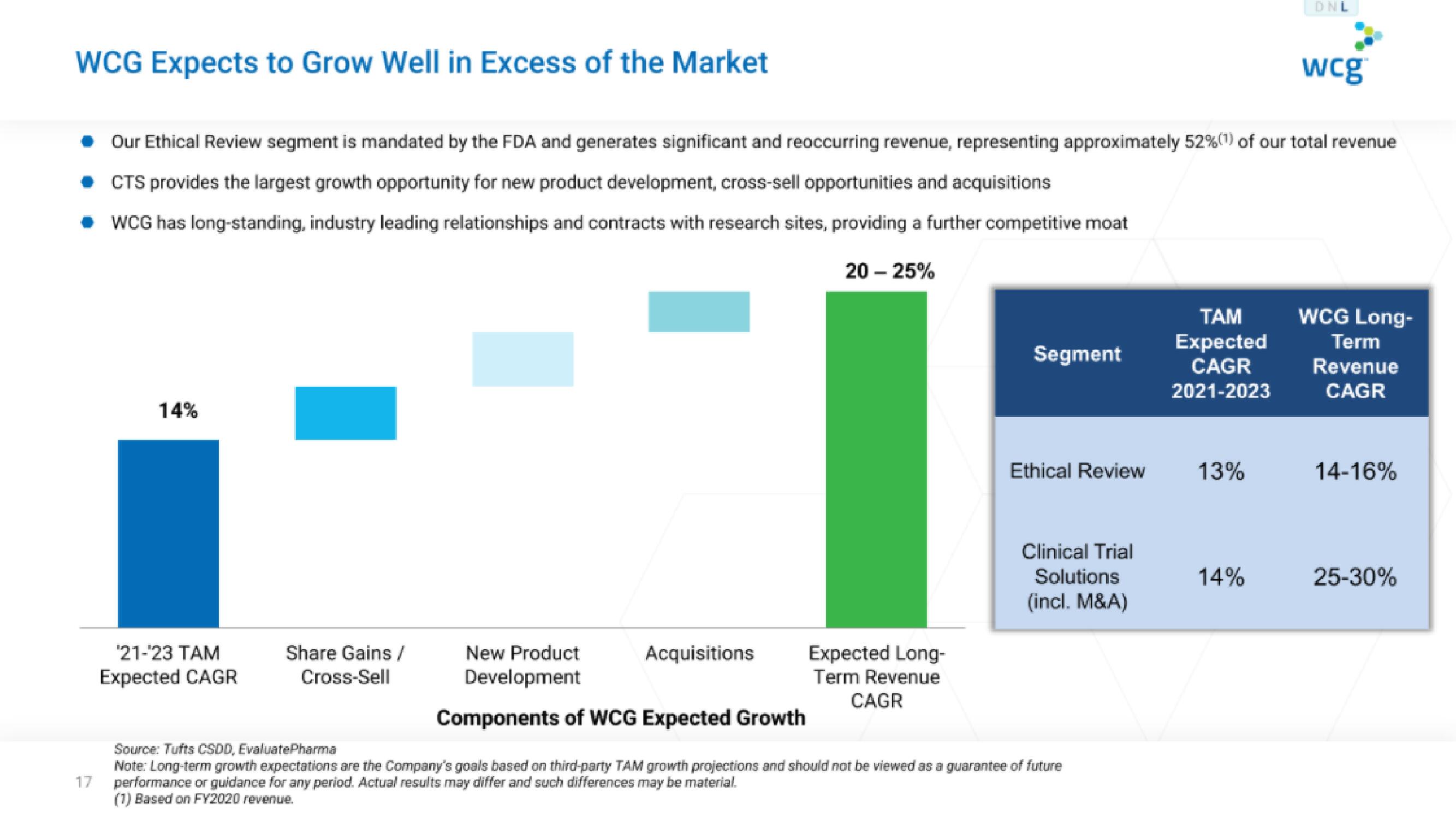

WCG Expects to Grow Well in Excess of the Market

17

◆ Our Ethical Review segment is mandated by the FDA and generates significant and reoccurring revenue, representing approximately 52% (1) of our total revenue

◆ CTS provides the largest growth opportunity for new product development, cross-sell opportunities and acquisitions

◆ WCG has long-standing, industry leading relationships and contracts with research sites, providing a further competitive moat

14%

'21-23 TAM

Expected CAGR

Share Gains/

Cross-Sell

New Product

Development

Components of WCG Expected Growth

Acquisitions

20 - 25%

Expected Long-

Term Revenue

CAGR

Segment

Ethical Review

Clinical Trial

Solutions

(incl. M&A)

Source: Tufts CSDD, EvaluatePharma

Note: Long-term growth expectations are the Company's goals based on third-party TAM growth projections and should not be viewed as a guarantee of future

performance or guidance for any period. Actual results may differ and such differences may be material.

(1) Based on FY2020 revenue.

TAM

Expected

CAGR

2021-2023

13%

DNL

14%

wcg

WCG Long-

Term

Revenue

CAGR

14-16%

25-30%View entire presentation