Q2 2018 Fixed Income Investor Conference Call

Current Ratings

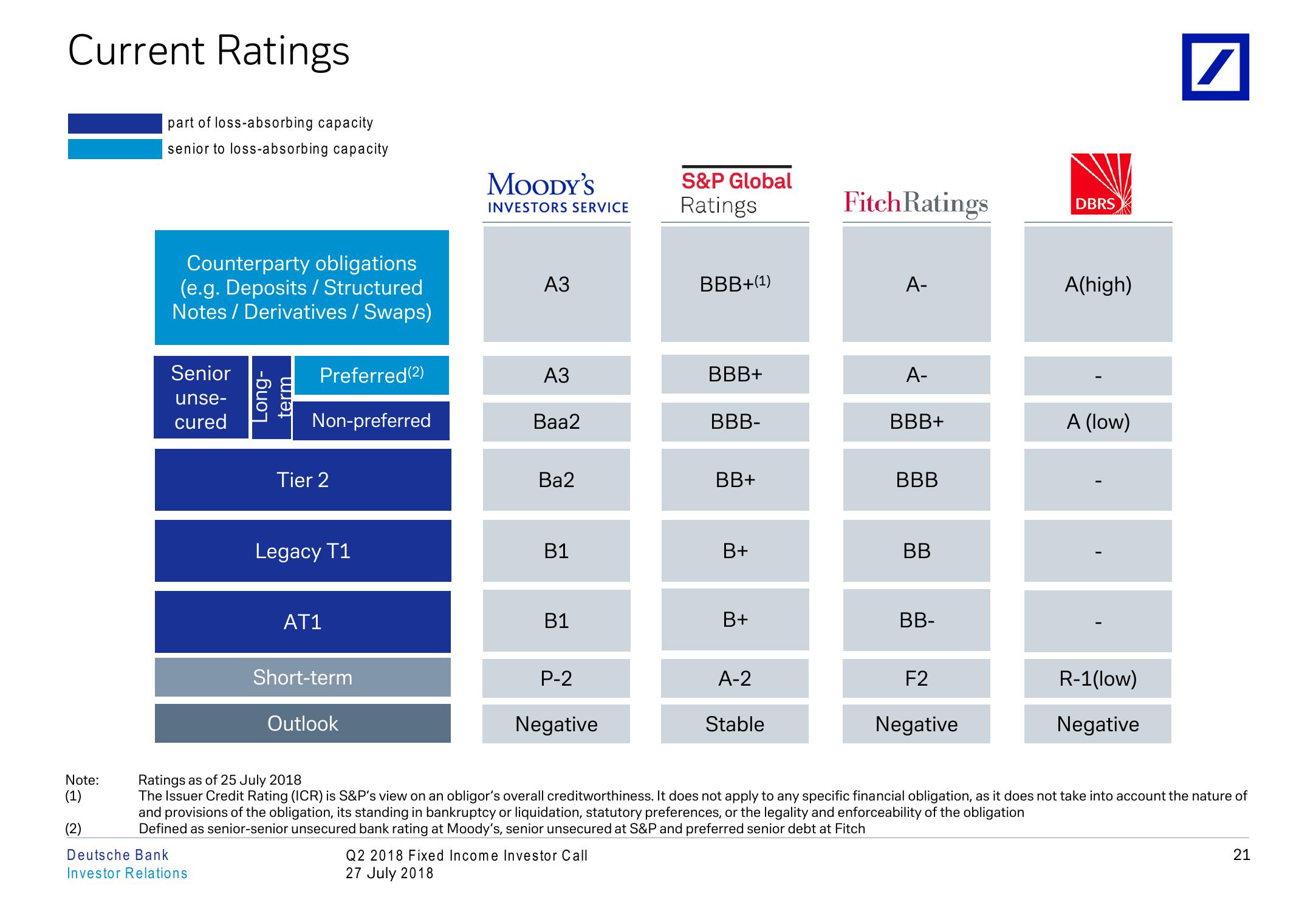

part of loss-absorbing capacity

senior to loss-absorbing capacity

Counterparty obligations

(e.g. Deposits / Structured

Notes / Derivatives/Swaps)

Senior

unse-

cured

Long-

term

MOODY'S

INVESTORS SERVICE

S&P Global

Ratings

A3

Fitch Ratings

DBRS

BBB+(1)

A-

A(high)

Preferred (2)

A3

BBB+

A-

Non-preferred

Baa2

BBB-

BBB+

A (low)

Tier 2

Ba2

BB+

BBB

Legacy T1

B1

B+

BB

AT1

B1

B+

BB-

Short-term

P-2

A-2

F2

R-1(low)

Outlook

Negative

Stable

Negative

Negative

Note:

(1)

(2)

Ratings as of 25 July 2018

The Issuer Credit Rating (ICR) is S&P's view on an obligor's overall creditworthiness. It does not apply to any specific financial obligation, as it does not take into account the nature of

and provisions of the obligation, its standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation

Defined as senior-senior unsecured bank rating at Moody's, senior unsecured at S&P and preferred senior debt at Fitch

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

21View entire presentation