Credit Suisse Investment Banking Pitch Book

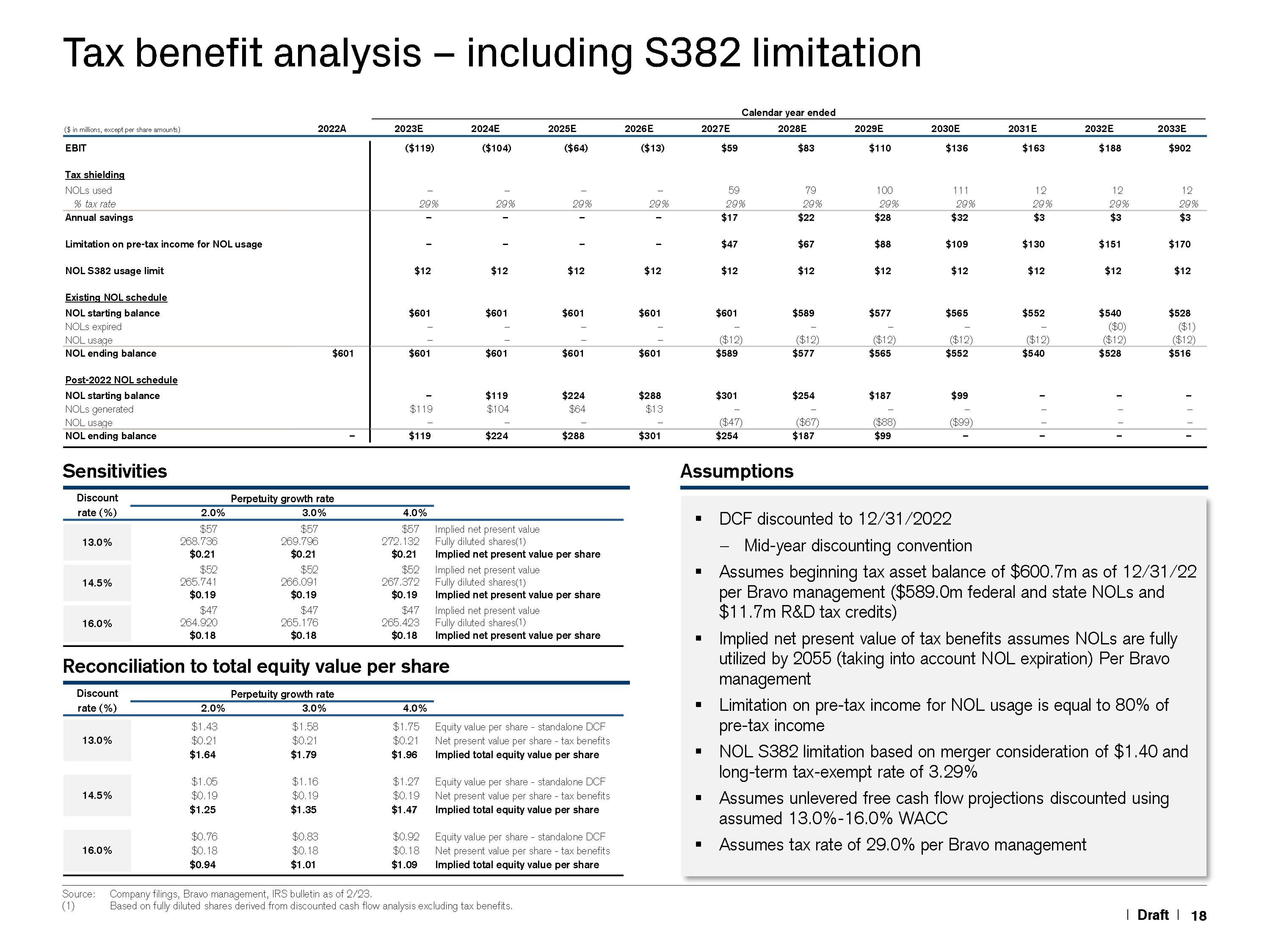

Tax benefit analysis - including S382 limitation

($ in millions, except per share amounts)

EBIT

Tax shielding

NOLS used

% tax rate

Annual savings

Limitation on pre-tax income for NOL usage

NOL S382 usage limit

Existing NOL schedule

NOL starting balance

NOLS expired

NOL usage

NOL ending balance

Post-2022 NOL schedule

NOL starting balance

NOLS generated

NOL usage

NOL ending balance

Sensitivities

Discount

rate (%)

13.0%

14.5%

16.0%

Discount

rate (%)

13.0%

14.5%

2.0%

16.0%

$57

268.736

$0.21

$52

265.741

$0.19

$47

264.920

$0.18

2.0%

$1.43

$0.21

$1.64

$1.05

$0.19

$1.25

2022A

$0.76

$0.18

$0.94

Perpetuity growth rate

3.0%

$57

269.796

$0.21

$52

266.091

$0.19

$47

265.176

$0.18

$1.58

$0.21

$1.79

$601

$1.16

$0.19

$1.35

Reconciliation to total equity value per share

Perpetuity growth rate

3.0%

$0.83

$0.18

$1.01

2023E

Source: Company filings, Bravo management, IRS bulletin as of 2/23.

(1)

($119)

29%

$12

$601

$601

$119

$119

4.0%

$57

272.132

$0.21

2024E

4.0%

($104)

29%

$12

$601

$601

$119

$104

$224

2025E

($64)

29%

$12

Based on fully diluted shares derived from discounted cash flow analysis excluding tax benefits.

$601

$601

Implied net present value

Fully diluted shares(1)

Implied net present value per share

$52 Implied net present value

267.372 Fully diluted shares(1)

$0.19 Implied net present value per share

$47 Implied net present value

265.423 Fully diluted shares(1)

$0.18

Implied net present value per share

$224

$64

$288

$1.75

Equity value per share - standalone DCF

Net present value per share - tax benefits

$0.21

$1.96 Implied total equity value per share

$1.27 Equity value per share - standalone DCF

$0.19 Net present value per share - tax benefits

$1.47 Implied total equity value per share

$0.92 Equity value per share standalone DCF

$0.18 Net present value per share - tax benefits

Implied total equity value per share

$1.09

2026E

($13)

29%

$12

$601

$601

$288

$13

$301

2027E

■

$59

I

■

59

29%

$17

$47

$12

$601

($12)

$589

Calendar year ended

2028E

$301

($47)

$254

$83

Assumptions

79

29%

$22

$67

$12

$589

($12)

$577

$254

($67)

$187

2029E

$110

100

29%

$28

$88

$12

$577

($12)

$565

$187

($88)

$99

2030E

$136

111

29%

$32

$109

$12

$565

($12)

$552

■ DCF discounted to 12/31/2022

Mid-year discounting convention

$99

($99)

2031 E

$163

12

29%

$3

$130

$12

$552

($12)

$540

2032E

$188

12

29%

$3

$151

$12

$540

($0)

($12)

$528

2033E

$902

$170

12

29%

$3

$528

$12

$516

Limitation on pre-tax income for NOL usage is equal to 80% of

pre-tax income

($1)

($12)

Assumes beginning tax asset balance of $600.7m as of 12/31/22

per Bravo management ($589.0m federal and state NOLs and

$11.7m R&D tax credits)

Implied net present value of tax benefits assumes NOLs are fully

utilized by 2055 (taking into account NOL expiration) Per Bravo

management

Assumes unlevered free cash flow projections discounted using

assumed 13.0%-16.0% WACC

Assumes tax rate of 29.0% per Bravo management

NOL S382 limitation based on merger consideration of $1.40 and

long-term tax-exempt rate of 3.29%

| Draft 18View entire presentation