Telia Company Results Presentation Deck

Finland

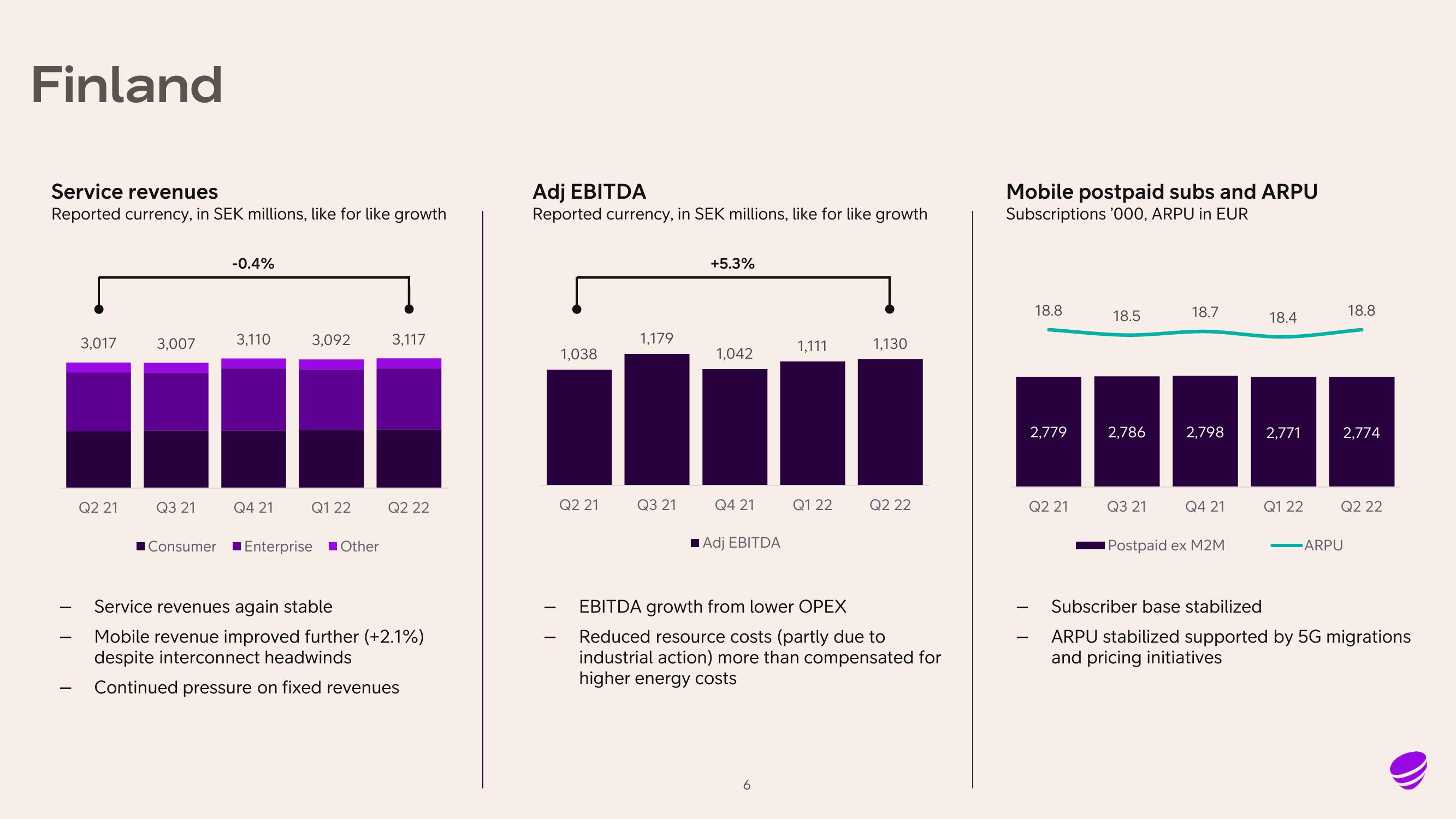

Service revenues

Reported currency, in SEK millions, like for like growth

3,017

Q2 21

3,007

Q3 21

-0.4%

3,110

Q4 21

3,092

Q1 22

Consumer Enterprise Other

3,117

Q2 22

Service revenues again stable

Mobile revenue improved further (+2.1%)

despite interconnect headwinds

Continued pressure on fixed revenues

Adj EBITDA

Reported currency, in SEK millions, like for like growth

1,038

Q2 21

1,179

Q3 21

+5.3%

1,042

Q4 21

■Adj EBITDA

1,111

Q1 22

1,130

Q2 22

EBITDA growth from lower OPEX

Reduced resource costs (partly due to

industrial action) more than compensated for

higher energy costs

Mobile postpaid subs and ARPU

Subscriptions '000, ARPU in EUR

-

18.8

2,779

Q2 21

18.5

2,786

Q3 21

18.7

2,798

Q4 21

Postpaid ex M2M

18.4

2,771

Q1 22

18.8

ARPU

2,774

Q2 22

Subscriber base stabilized

ARPU stabilized supported by 5G migrations

and pricing initiativesView entire presentation