Vivid Seats Results Presentation Deck

Non-GAAP Reconciliations

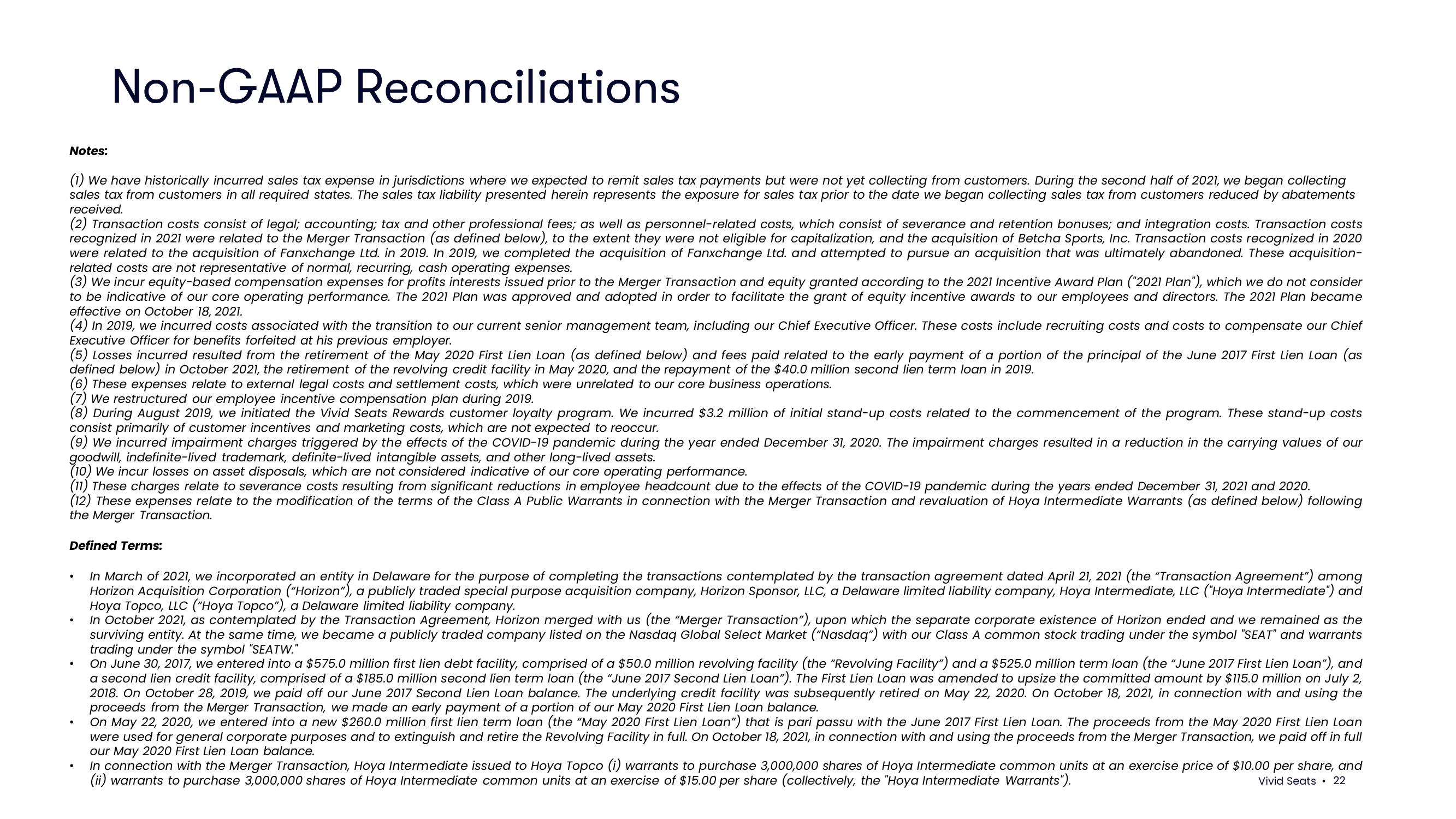

(1) We have historically incurred sales tax expense in jurisdictions where we expected to remit sales tax payments but were not yet collecting from customers. During the second half of 2021, we began collecting

sales tax from customers in all required states. The sales tax liability presented herein represents the exposure for sales tax prior to the date we began collecting sales tax from customers reduced by abatements

received.

Notes:

(2) Transaction costs consist of legal; accounting; tax and other professional fees; as well as personnel-related costs, which consist of severance and retention bonuses; and integration costs. Transaction costs

recognized in 2021 were related to the Merger Transaction (as defined below), to the extent they were not eligible for capitalization, and the acquisition of Betcha Sports, Inc. Transaction costs recognized in 2020

were related to the acquisition of Fanxchange Ltd. in 2019. In 2019, we completed the acquisition of Fanxchange Ltd. and attempted to pursue an acquisition that was ultimately abandoned. These acquisition-

related costs are not representative of normal, recurring, cash operating expenses.

(3) We incur equity-based compensation expenses for profits interests issued prior to the Merger Transaction and equity granted according to the 2021 Incentive Award Plan ("2021 Plan"), which we do not consider

to be indicative of our core operating performance. The 2021 Plan was approved and adopted in order to facilitate the grant of equity incentive awards to our employees and directors. The 2021 Plan became

effective on October 18, 2021.

(4) In 2019, we incurred costs associated with the transition to our current senior management team, including our Chief Executive Officer. These costs include recruiting costs and costs to compensate our Chief

Executive Officer for benefits forfeited at his previous employer.

(5) Losses incurred resulted from the retirement of the May 2020 First Lien Loan (as defined below) and fees paid related to the early payment of a portion of the principal of the June 2017 First Lien Loan (as

defined below) in October 2021, the retirement of the revolving credit facility in May 2020, and the repayment of the $40.0 million second lien term loan in 2019.

(6) These expenses relate to external legal costs and settlement costs, which were unrelated to our core business operations.

(7) We restructured our employee incentive compensation plan during 2019.

(8) During August 2019, we initiated the Vivid Seats Rewards customer loyalty program. We incurred $3.2 million of initial stand-up costs related to the commencement of the program. These stand-up costs

consist primarily of customer incentives and marketing costs, which are not expected to reoccur.

(9) We incurred impairment charges triggered by the effects of the COVID-19 pandemic during the year ended December 31, 2020. The impairment charges resulted in a reduction in the carrying values of our

goodwill, indefinite-lived trademark, definite-lived intangible assets, and other long-lived assets.

(10) We incur losses on asset disposals, which are not considered indicative of our core operating performance.

(11) These charges relate to severance costs resulting from significant reductions in employee headcount due to the effects of the COVID-19 pandemic during the years ended December 31, 2021 and 2020.

(12) These expenses relate to the modification of the terms of the Class A Public Warrants in connection with the Merger Transaction and revaluation of Hoya Intermediate Warrants (as defined below) following

the Merger Transaction.

Defined Terms:

.

.

.

●

●

In March of 2021, we incorporated an entity in Delaware for the purpose of completing the transactions contemplated by the transaction agreement dated April 21, 2021 (the "Transaction Agreement") among

Horizon Acquisition Corporation ("Horizon"), a publicly traded special purpose acquisition company, Horizon Sponsor, LLC, a Delaware limited liability company, Hoya Intermediate, LLC ("Hoya Intermediate") and

Hoya Topco, LLC ("Hoya Topco"), a Delaware limited liability company.

In October 2021, as contemplated by the Transaction Agreement, Horizon merged with us (the "Merger Transaction"), upon which the separate corporate existence of Horizon ended and we remained as the

surviving entity. At the same time, we became a publicly traded company listed on the Nasdaq Global Select Market ("Nasdaq") with our Class A common stock trading under the symbol "SEAT" and warrants

trading under the symbol "SEATW."

On June 30, 2017, we entered into a $575.0 million first lien debt facility, comprised of a $50.0 million revolving facility (the "Revolving Facility") and a $525.0 million term loan (the "June 2017 First Lien Loan"), and

a second lien credit facility, comprised of a $185.0 million second lien term loan (the "June 2017 Second Lien Loan"). The First Lien Loan was amended to upsize the committed amount by $115.0 million on July 2,

2018. On October 28, 2019, we paid off our June 2017 Second Lien Loan balance. The underlying credit facility was subsequently retired on May 22, 2020. On October 18, 2021, in connection with and using the

proceeds from the Merger Transaction, we made an early payment of a portion of our May 2020 First Lien Loan balance.

On May 22, 2020, we entered into a new $260.0 million first lien term loan (the "May 2020 First Lien Loan") that is pari passu with the June 2017 First Lien Loan. The proceeds from the May 2020 First Lien Loan

were used for general corporate purposes and to extinguish and retire the Revolving Facility in full. On October 18, 2021, in connection with and using the proceeds from the Merger Transaction, we paid off in full

our May 2020 First Lien Loan balance.

In connection with the Merger Transaction, Hoya Intermediate issued to Hoya Topco (i) warrants to purchase 3,000,000 shares of Hoya Intermediate common units at an exercise price of $10.00 per share, and

(ii) warrants to purchase 3,000,000 shares of Hoya Intermediate common units at an exercise of $15.00 per share (collectively, the "Hoya Intermediate Warrants").

Vivid Seats 22View entire presentation