Alternus Energy SPAC Presentation Deck

1.

2.

3.

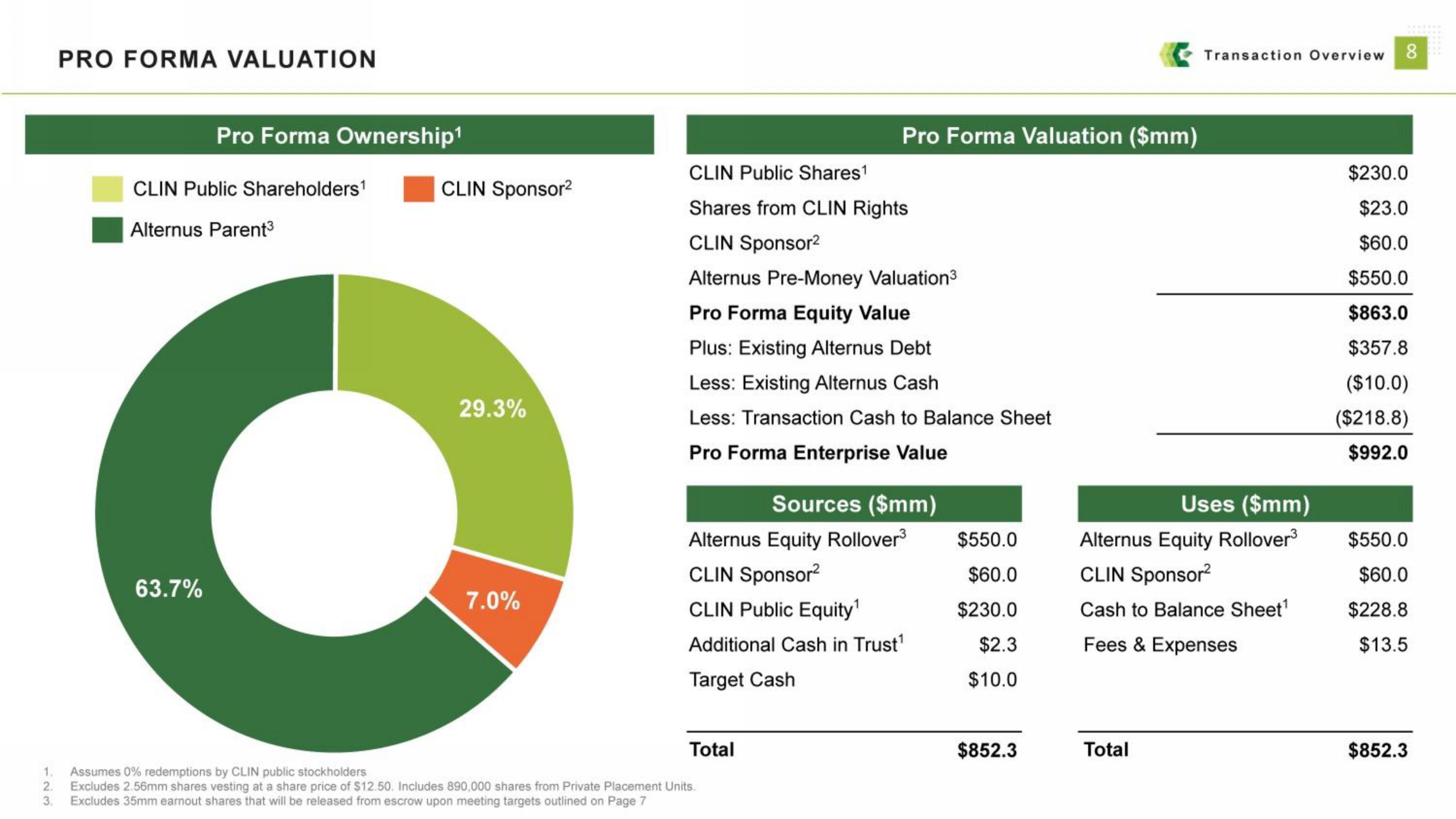

PRO FORMA VALUATION

Pro Forma Ownership¹

CLIN Public Shareholders¹

Alternus Parent³

63.7%

CLIN Sponsor²

29.3%

7.0%

CLIN Public Shares¹

Shares from CLIN Rights

CLIN Sponsor²

Pro Forma Valuation ($mm)

Alternus Pre-Money Valuation³

Pro Forma Equity Value

Plus: Existing Alternus Debt

Less: Existing Alternus Cash

Less: Transaction Cash to Balance Sheet

Pro Forma Enterprise Value

Total

Alternus Equity Rollover³

CLIN Sponsor²

CLIN Public Equity¹

Additional Cash in Trust¹

Target Cash

Assumes 0% redemptions by CLIN public stockholders

Excludes 2.56mm shares vesting at a share price of $12.50. Includes 890,000 shares from Private Placement Units.

Excludes 35mm earnout shares that will be released from escrow upon meeting targets outlined on Page 7

Sources ($mm)

$550.0

$60.0

$230.0

$2.3

$10.0

$852.3

Transaction Overview 8

Uses ($mm)

Alternus Equity Rollover³

CLIN Sponsor²

Cash to Balance Sheet¹

Fees & Expenses

Total

$230.0

$23.0

$60.0

$550.0

$863.0

$357.8

($10.0)

($218.8)

$992.0

$550.0

$60.0

$228.8

$13.5

$852.3View entire presentation