Masterworks Investor Update

Art Outperforms During High Inflation

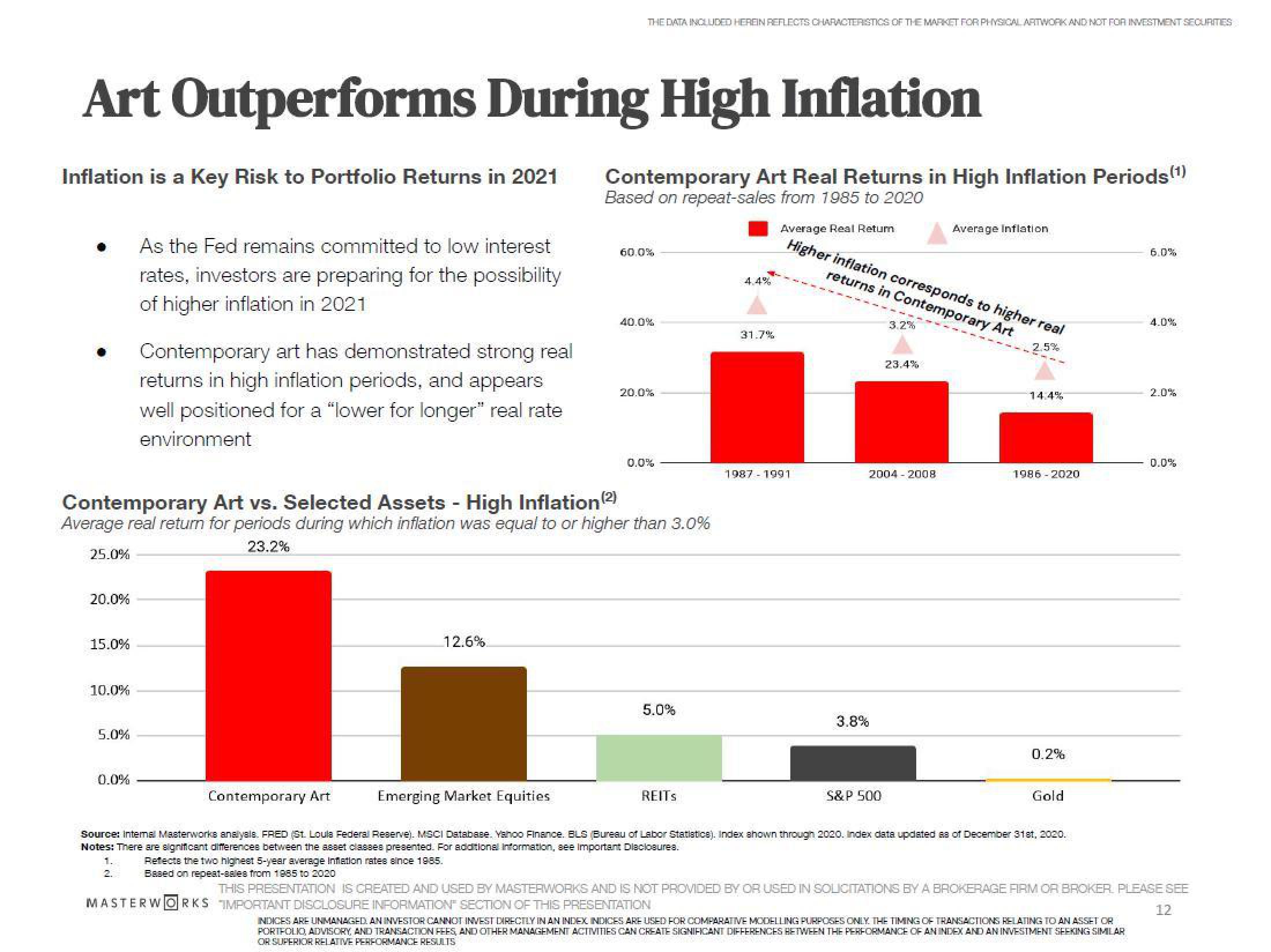

Inflation is a Key Risk to Portfolio Returns in 2021

0

.

25.0%

20.0%

15.0%

10.0%

5.0%

As the Fed remains committed to low interest

rates, investors are preparing for the possibility

of higher inflation in 2021

0.0%

Contemporary art has demonstrated strong real

returns in high inflation periods, and appears.

well positioned for a "lower for longer" real rate

environment

Contemporary Art vs. Selected Assets - High Inflation (2)

Average real return for periods during which inflation was equal to or higher than 3.0%

23.2%

THE DATA INCLUDED HEREIN REFLECTS CHARACTERISTICS OF THE MARKET FOR PHYSICAL ARTWORK AND NOT FOR INVESTMENT SECURITIES

Contemporary Art

12.6%

Contemporary Art Real Returns in High Inflation Periods (¹)

Based on repeat-sales from 1985 to 2020

60.0%

40.0%

20.0%

0.0%

5.0%

REITS

4.4%

31.7%

Average Real Retur

Higher inflation corresponds to higher real

returns in Contemporary Art

2.5%

1987-1991

3.8%

3.2%

S&P 500

23.4%

2004-2008

Average Inflation

1986-2020

0.2%

Emerging Market Equities

Source: Internal Masterworks analyale. FRED (St. Loula Federal Reserve). MSCI Database. Yahoo Finance. BLS (Bureau of Labor Statistics). Index shown through 2020. Index data updated as of December 31st, 2020.

Notes: There are significant differences between the asset classes presented. For additional Information, see Important Diaclosures.

1.

Gold

6.0%

4.0%

2.0%

0.0%

Reflects the two highest 5-year average Inflation rates since 1885.

Based on repeat-sales from 1985 to 2020

THIS PRESENTATION IS CREATED AND USED BY MASTERWORKS AND IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A BROKERAGE FIRM OR BROKER. PLEASE SEE

MASTERWORKS IMPORTANT DISCLOSURE INFORMATION SECTION OF THIS PRESENTATION

12

INDICES ARE UNMANAGED AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTSView entire presentation