BlackRock Global Long/Short Credit Absolute Return Credit

Case Study: Idiosyncratic Short Position

Background

Within the technology sector, cloud

infrastructure, software and services has

become an area many companies are

focusing on given forward growth

projections

However, there are sizable differences

between some of the various players, both

in terms of product capabilities as well as

balance sheet capacity to invest

Bond Price

109

107

105

103

101

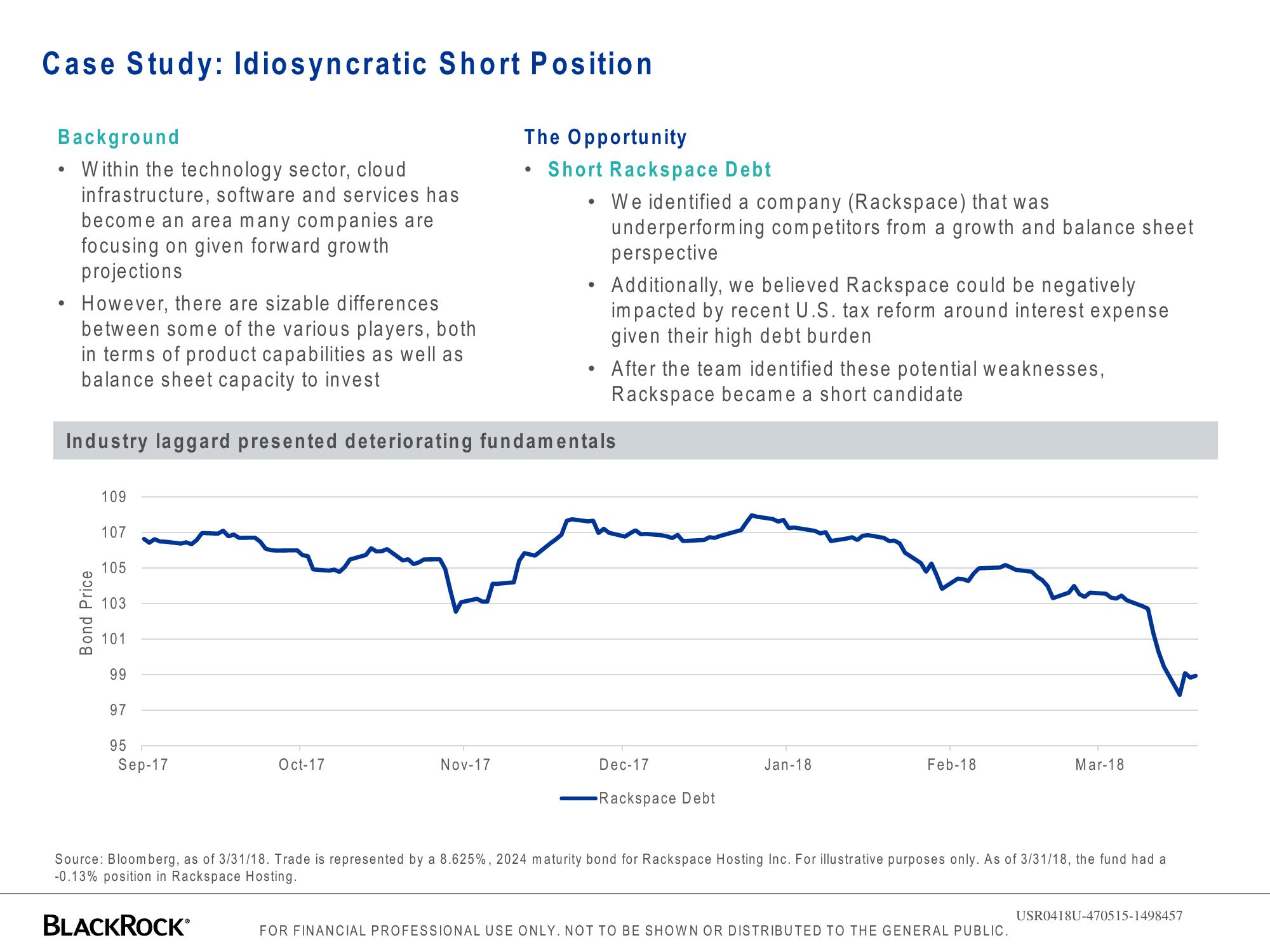

Industry laggard presented deteriorating fundamentals

99

97

95

Sep-17

Oct-17

The Opportunity

Nov-17

●

Short Rackspace Debt

●

●

We identified a company (Rackspace) that was

underperforming competitors from a growth and balance sheet

perspective

Additionally, we believed Rackspace could be negatively

impacted by recent U.S. tax reform around interest expense

given their high debt burden

After the team identified these potential weaknesses,

Rackspace became a short candidate

Dec-17

Rackspace Debt

Jan-18

Feb-18

Mar-18

Source: Bloomberg, as of 3/31/18. Trade is represented by a 8.625%, 2024 maturity bond for Rackspace Hosting Inc. For illustrative purposes only. As of 3/31/18, the fund had a

-0.13% position in Rackspace Hosting.

BLACKROCK®

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

USR0418U-470515-1498457View entire presentation