Bank of America Investment Banking Pitch Book

Weighted Average Cost of Capital

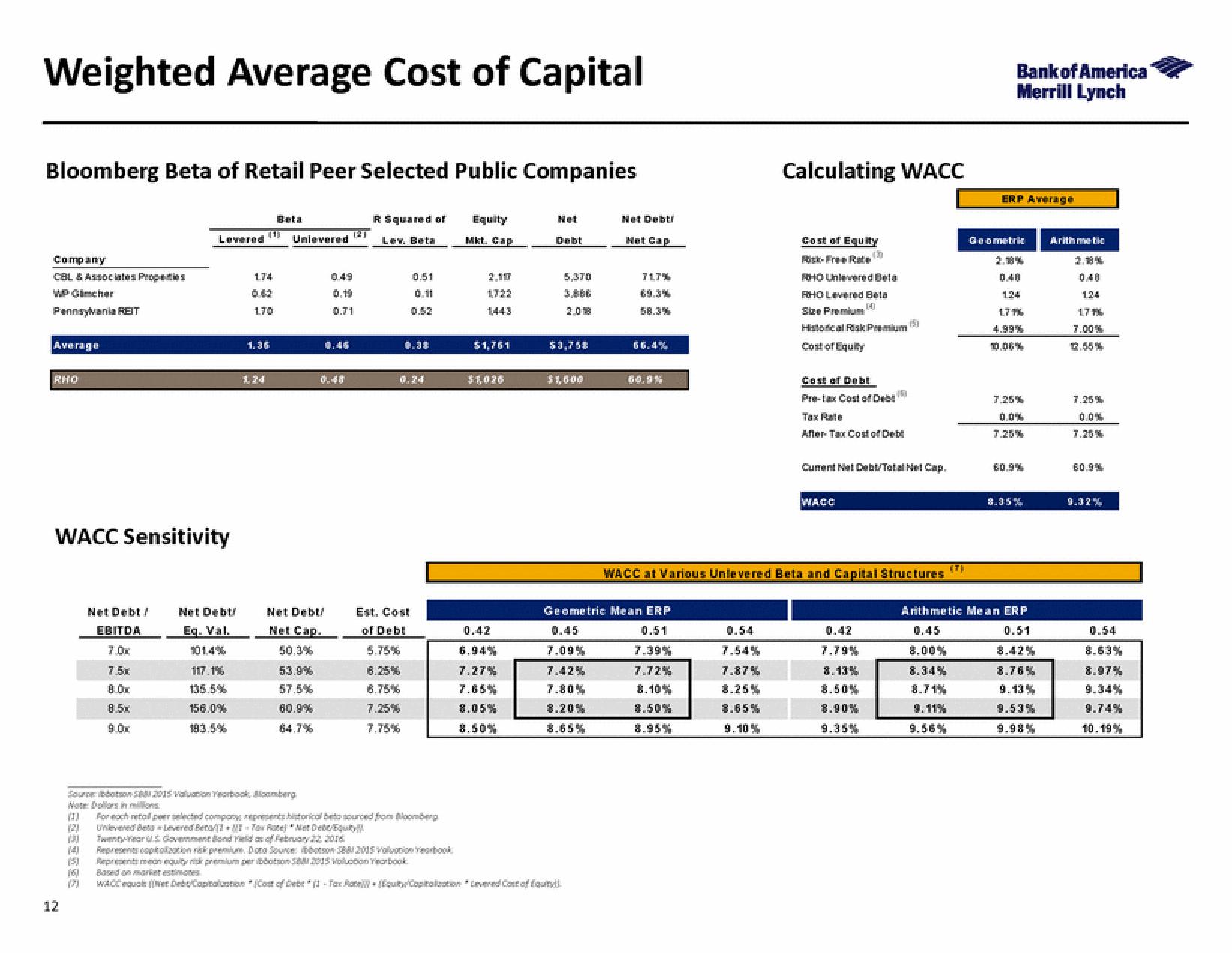

Bloomberg Beta of Retail Peer Selected Public Companies

Equity

Mkt. Cap

Company

CBL & Associates Properties

WP Gimcher

Pennsylvania REIT

Average

RHO

WACC Sensitivity

12

Levered

Net Debt/

EBITDA

7.0x

7.5x

8.0x

8.5x

9.0x

1:30

(4)

(5)

16)

(7)

Net Debt/

Eq. Val.

101.4%

117.1%

135.5%

156.0%

183.5%

174

170

124

Beta

Unlevered

Sourbon 2015 Valuation Yearbook, Bloomberg

Note Dolors in milions

Net Debt/

Net Cap.

50.3%

53.9%

57.5%

60.9%

64.7%

0.48

121

0.19

0.71

R Squared of

Lev. Beta

6.75%

7.25%

7.75%

0.51

0.11

0.52

0.30

Est. Cost

of Debt

5.75%

0.24

(1) For each retailer selected company represents historical beta sourced from Bloomberg

Unlevered BetLevered Beta/Tow Rotel NetDecqu

Twentyr Government Bond Field as of February 22, 2016

Represents copolization rak premiue. Dora Source bbotson 881 2015 Volvonion Yearbook

Representen equity rik premium per boton 588 2015 Voluotobook

2.117

$1,761

$1,026

0.42

6.94%

7.27%

7.65%

8.05%

8.50%

Net

5,370

2.08

$3,758

$1,600

Based on market estimates

WACC equals(Net DebCapitation (Cost of Debt (1-Tax Rate Equity Capitaluation Levered Cost of foundl

0.45

7.09%

7.42%

7.80%

8.20%

8.65%

Net Debt

Net Cap

717%

69.3%

58.3%

Geometric Mean ERP

0.51

7.39%

7.72%

8.10%

8.50%

Calculating WACC

0.54

7.54%

7.87%

8.25%

8.85%

9.10%

Cost of Equity

ROHO Unlevered Beta

RHO Levered Beta

Size Premium

Historical Risk Premium (5)

Cost of Equity

Cost of Debt

Pre-tax Cost of Debt

Tax Rate

After Tax Cost of Debt

10

Cument Net Debt/Total Ne! Cap.

WACC

WACC at Various Unlevered Beta and Capital Structures (™)

0.42

7.79%

8.13%

8.50%

8.90%

9.35%

Bank of America

Merrill Lynch

ERP Average

Geometric

2.18%

0.48

124

1.77%

4.99%

10.06%

7.25%

0.0%

7.25%

8.35%

Arithmetic Mean ERP

0.45

0.51

8.00%

8.34%

8.71%

9.11%

9.56%

8.42%

8.76%

9.13%

9.53%

Arithmetic

2.18%

0.48

124

1.77%

7.00%

12.55%

7.25%

0.0%

7.25%

60.9%

9.32%

0.54

8.63%

8.97%

9.34%

9.74%

10.19%View entire presentation