HPS Specialty Loan Fund VI

SLF Portfolio Snapshots

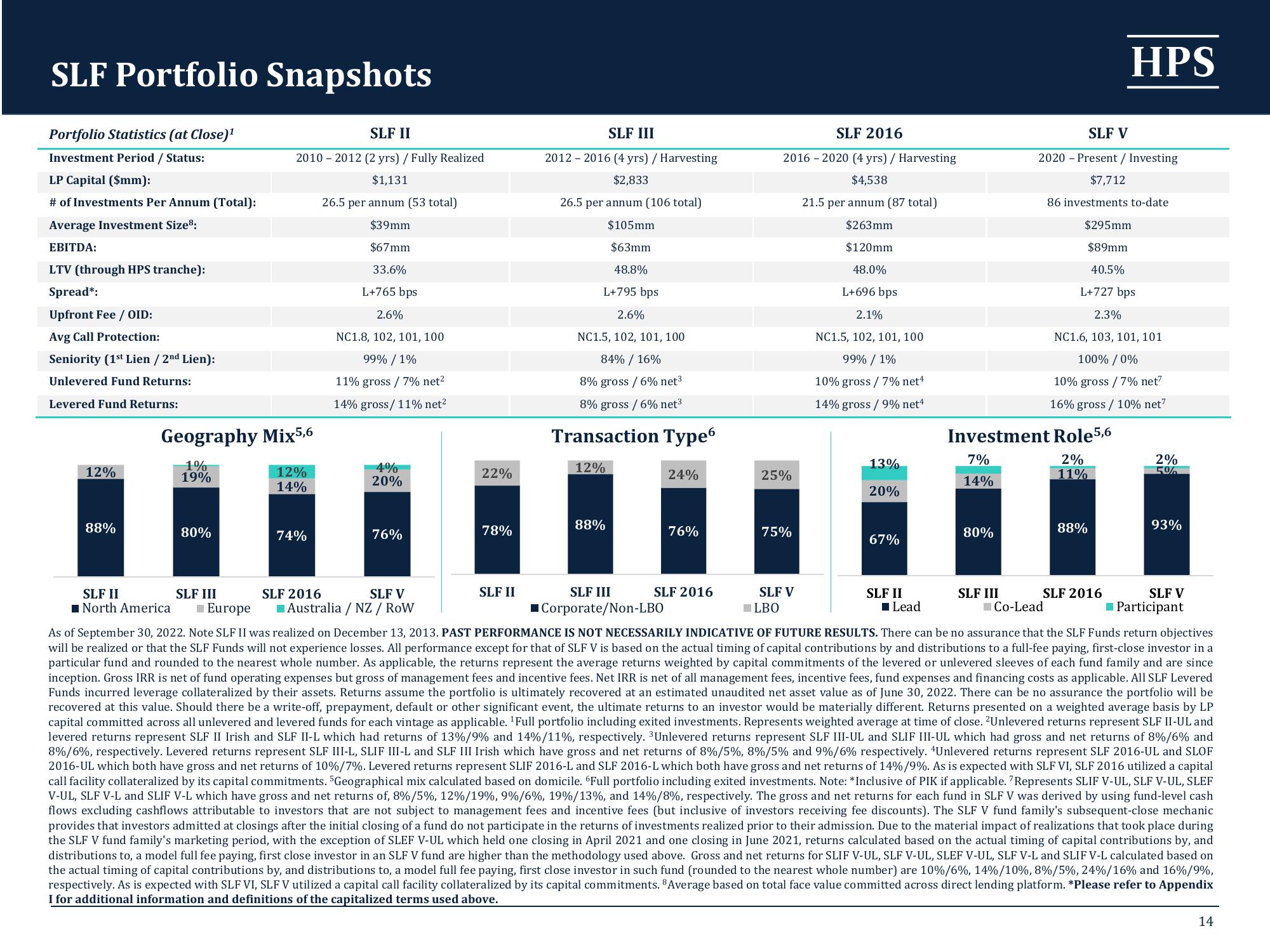

Portfolio Statistics (at Close)¹

Investment Period / Status:

LP Capital ($mm):

# of Investments Per Annum (Total):

Average Investment Size:

EBITDA:

LTV (through HPS tranche):

Spread*:

Upfront Fee / OID:

Avg Call Protection:

Seniority (1st Lien / 2nd Lien):

Unlevered Fund Returns:

Levered Fund Returns:

12%

88%

Geography Mix5,6

1%

19%

SLF II

2010-2012 (2 yrs) / Fully Realized

$1,131

26.5 per annum (53 total)

$39mm

$67mm

33.6%

L+765 bps

2.6%

NC1.8, 102, 101, 100

99% / 1%

11% gross / 7% net²

14% gross/11% net²

80%

12%

14%

74%

4%

20%

76%

22%

SLF 2016

SLF V

■Australia / NZ / RoW

78%

SLF II

SLF III

2012-2016 (4 yrs) / Harvesting

$2,833

26.5 per annum (106 total)

$105mm

$63mm

48.8%

L+795 bps

2.6%

NC1.5, 102, 101, 100

84% / 16%

8% gross / 6% net³

8% gross / 6% net³

Transaction Type6

12%

88%

SLF III

Corporate/Non-LBO

24%

76%

SLF 2016

SLF 2016

2016-2020 (4 yrs) / Harvesting

$4,538

21.5 per annum (87 total)

$263mm

$120mm

48.0%

L+696 bps

25%

75%

SLF V

LBO

2.1%

NC1.5, 102, 101, 100

99% / 1%

10% gross / 7% net¹

14% gross/9% net4

13%

20%

67%

SLF II

■Lead

7%

14%

Investment Role5,6

2%

11%

80%

SLF V

2020 Present / Investing

$7,712

86 investments to-date

$295mm

$89mm

40.5%

L+727 bps

SLF III

Co-Lead

SLF II

SLF III

North America ■ Europe

As of September 30, 2022. Note SLF II was realized on December 13, 2013. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. There can be no assurance that the SLF Funds return objectives

will be realized or that the SLF Funds will not experience losses. All performance except for that of SLF V is based on the actual timing of capital contributions by and distributions to a full-fee paying, first-close investor in a

particular fund and rounded to the nearest whole number. As applicable, the returns represent the average returns weighted by capital commitments of the levered or unlevered sleeves of each fund family and are since

inception. Gross IRR is net of fund operating expenses but gross of management fees and incentive fees. Net IRR is net of all management fees, incentive fees, fund expenses and financing costs as applicable. All SLF Levered

Funds incurred leverage collateralized by their assets. Returns assume the portfolio is ultimately recovered at an estimated unaudited net asset value as of June 30, 2022. There can be no assurance the portfolio will be

recovered at this value. Should there be a write-off, prepayment, default or other significant event, the ultimate returns to an investor would be materially different. Returns presented on a weighted average basis by LP

capital committed across all unlevered and levered funds for each vintage as applicable. ¹Full portfolio including exited investments. Represents weighted average at time of close. 2Unlevered returns represent SLF II-UL and

levered returns represent SLF II Irish and SLF II-L which had returns of 13%/9% and 14% / 11%, respectively. Unlevered returns represent SLF III-UL and SLIF III-UL which had gross and net returns of 8%/6% and

8%/6%, respectively. Levered returns represent SLF III-L, SLIF III-L and SLF III Irish which have gross and net returns of 8% / 5%, 8%/5% and 9% / 6% respectively. Unlevered returns represent SLF 2016-UL and SLOF

2016-UL which both have gross and net returns of 10%/7%. Levered returns represent SLIF 2016-L and SLF 2016-L which both have gross and net returns of 14%/9%. As is expected with SLF VI, SLF 2016 utilized a capital

call facility collateralized by its capital commitments. 5Geographical mix calculated based on domicile. 6Full portfolio including exited investments. Note: *Inclusive of PIK if applicable. Represents SLIF V-UL, SLF V-UL, SLEF

V-UL, SLF V-L and SLIF V-L which have gross and net returns of, 8%/5%, 12% / 19%, 9%/6%, 19% / 13%, and 14% / 8%, respectively. The gross and net returns for each fund in SLF V was derived by using fund-level cash

flows excluding cashflows attributable to investors that are not subject to management fees and incentive fees (but inclusive of investors receiving fee discounts). The SLF V fund family's subsequent-close mechanic

provides that investors admitted at closings after the initial closing of a fund do not participate in the returns of investments realized prior to their admission. Due to the material impact of realizations that took place during

the SLF V fund family's marketing period, with the exception of SLEF V-UL which held one closing in April 2021 and one closing in June 2021, returns calculated based on the actual timing of capital contributions by, and

distributions to, a model full fee paying, first close investor in an SLF V fund are higher than the methodology used above. Gross and net returns for SLIF V-UL, SLF V-UL, SLEF V-UL, SLF V-L and SLIF V-L calculated based on

the actual timing of capital contributions by, and distributions to, a model full fee paying, first close investor in such fund (rounded to the nearest whole number) are 10%/6%, 14%/10%, 8%/5%, 24%/16% and 16%/9%,

respectively. As is expected with SLF VI, SLF V utilized a capital call facility collateralized by its capital commitments. Average based on total face value committed across direct lending platform. *Please refer to Appendix

I for additional information and definitions of the capitalized terms used above.

2.3%

NC1.6, 103, 101, 101

100% / 0%

10% gross / 7% net7

16% gross / 10% net7

HPS

88%

SLF 2016

2%

5%

93%

SLF V

Participant

14View entire presentation