Imperial Brands Results Presentation Deck

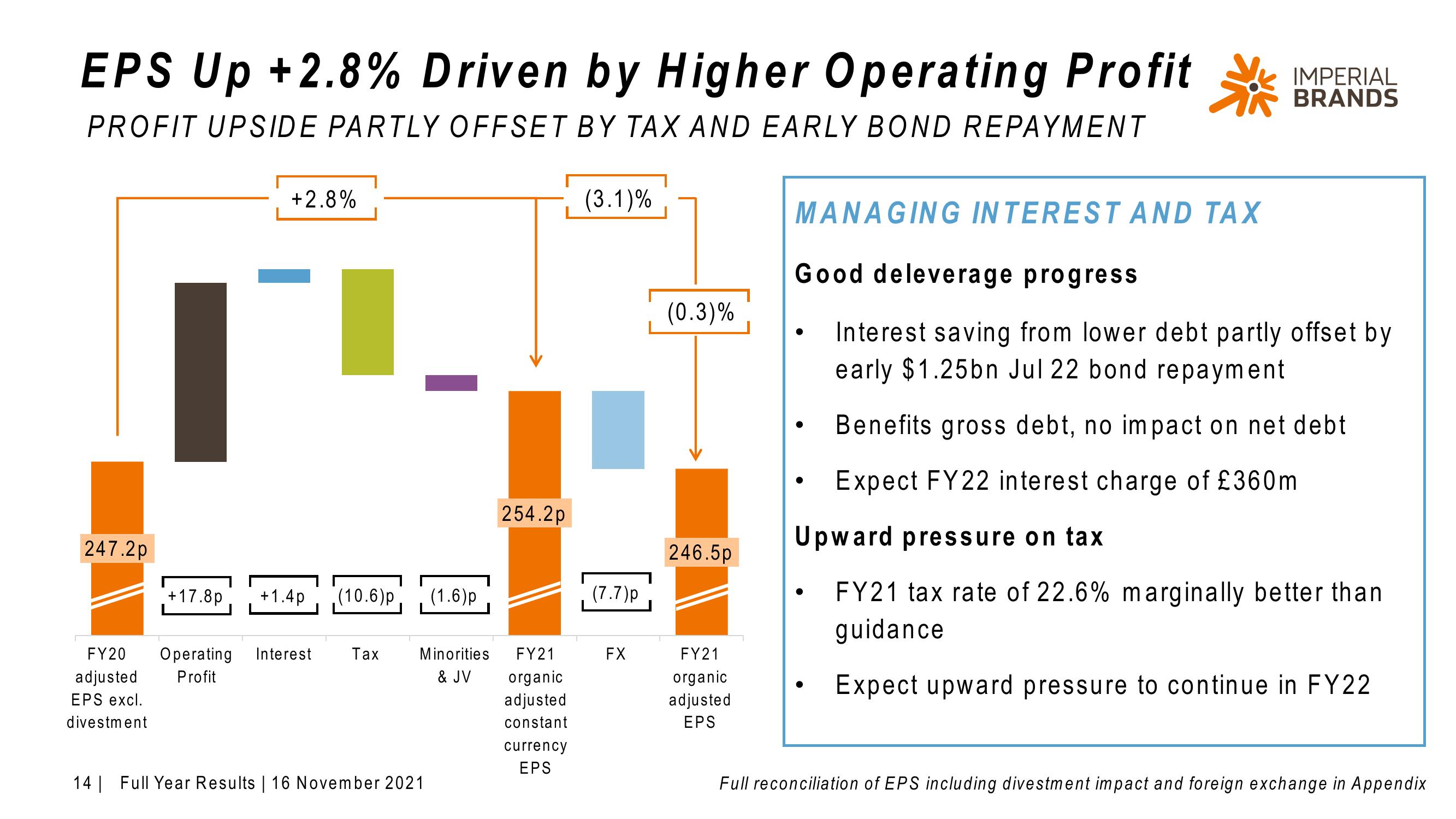

EPS Up +2.8% Driven by Higher Operating Profit **

PROFIT UPSIDE PARTLY OFFSET BY TAX AND EARLY BOND REPAYMENT

247.2p

+2.8%

+17.8p +1.4p (10.6)p (1.6)p

Minorities

& JV

FY20 Operating Interest

adjusted

Profit

EPS excl.

divestment

Tax

14 Full Year Results | 16 November 2021

254.2p

FY21

organic

adjusted

constant

currency

EPS

(3.1)%

(7.7)p

FX

(0.3)%

246.5p

FY21

organic

adjusted

EPS

MANAGING INTEREST AND TAX

IMPERIAL

BRANDS

Good deleverage progress

Interest saving from lower debt partly offset by

early $1.25bn Jul 22 bond repayment

Benefits gross debt, no impact on net debt

Expect FY22 interest charge of £360m

Upward pressure on tax

FY21 tax rate of 22.6% marginally better than

guidance

Expect upward pressure to continue in FY22

Full reconciliation of EPS including divestment impact and foreign exchange in AppendixView entire presentation