2011 and Fourth Quarter Results

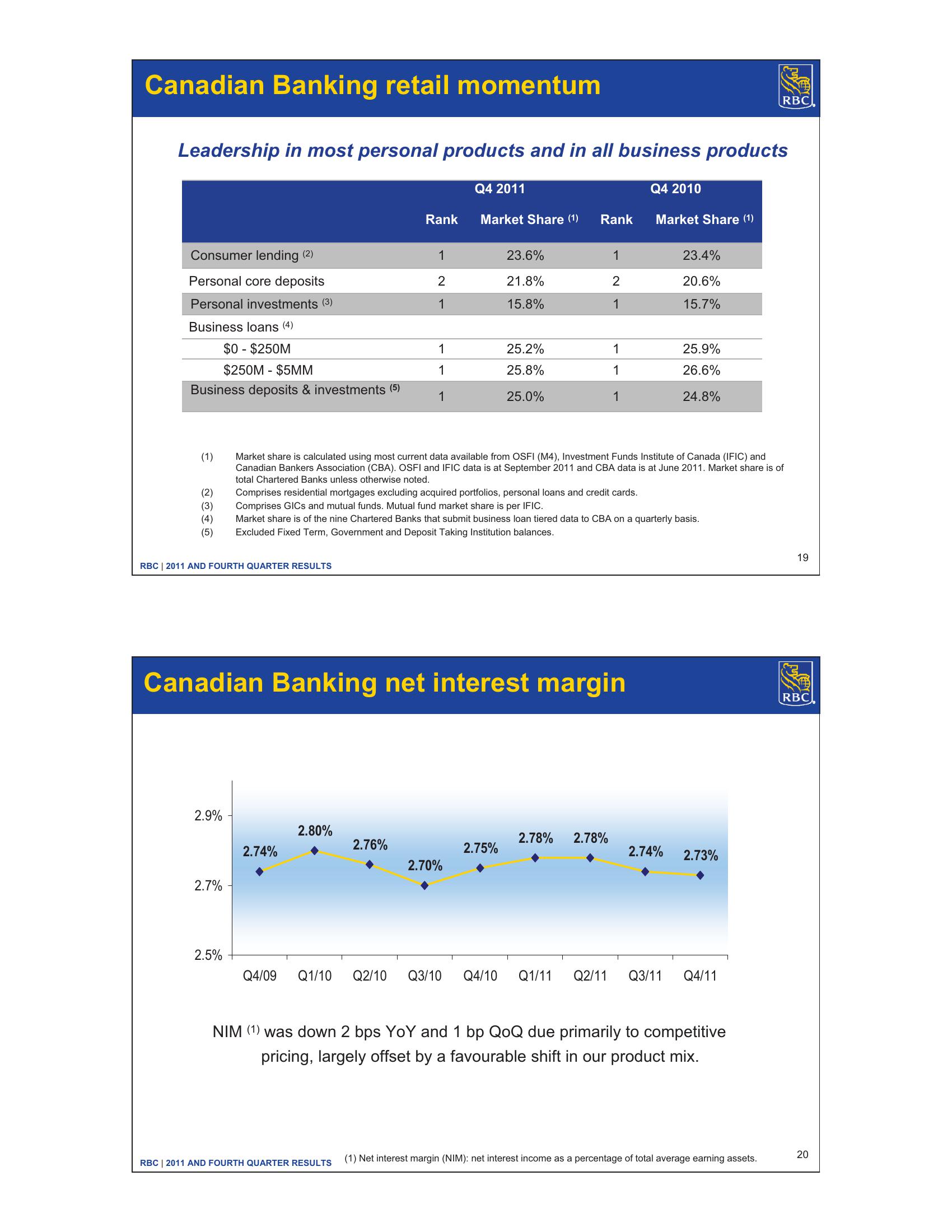

Canadian Banking retail momentum

Leadership in most personal products and in all business products

RBC

Q4 2011

Q4 2010

Rank

Market Share (1)

Rank

Market Share (1)

Consumer lending (2)

1

23.6%

1

23.4%

Personal core deposits

2

21.8%

2

20.6%

Personal investments (3)

1

15.8%

1

15.7%

Business loans (4)

$0 - $250M

1

25.2%

1

25.9%

$250M $5MM

1

25.8%

1

26.6%

Business deposits & investments (5)

1

25.0%

1

24.8%

(1)

Market share is calculated using most current data available from OSFI (M4), Investment Funds Institute of Canada (IFIC) and

Canadian Bankers Association (CBA). OSFI and IFIC data is at September 2011 and CBA data is at June 2011. Market share is of

total Chartered Banks unless otherwise noted.

GETN

(2)

Comprises residential mortgages excluding acquired portfolios, personal loans and credit cards.

(3)

Comprises GICs and mutual funds. Mutual fund market share is per IFIC.

(4)

(5)

Market share is of the nine Chartered Banks that submit business loan tiered data to CBA on a quarterly basis.

Excluded Fixed Term, Government and Deposit Taking Institution balances.

RBC 2011 AND FOURTH QUARTER RESULTS

Canadian Banking net interest margin

2.9%

2.80%

2.78% 2.78%

2.76%

2.74%

2.75%

2.74% 2.73%

2.70%

2.7%

2.5%

Q4/09 Q1/10 Q2/10 Q3/10 Q4/10 Q1/11 Q2/11 Q3/11 Q4/11

NIM (1) was down 2 bps YoY and 1 bp QoQ due primarily to competitive

pricing, largely offset by a favourable shift in our product mix.

19

RBC

20

(1) Net interest margin (NIM): net interest income as a percentage of total average earning assets.

RBC 2011 AND FOURTH QUARTER RESULTSView entire presentation