Lyft Results Presentation Deck

Adjusted EBITDA

($ in millions)

(1)

Note:

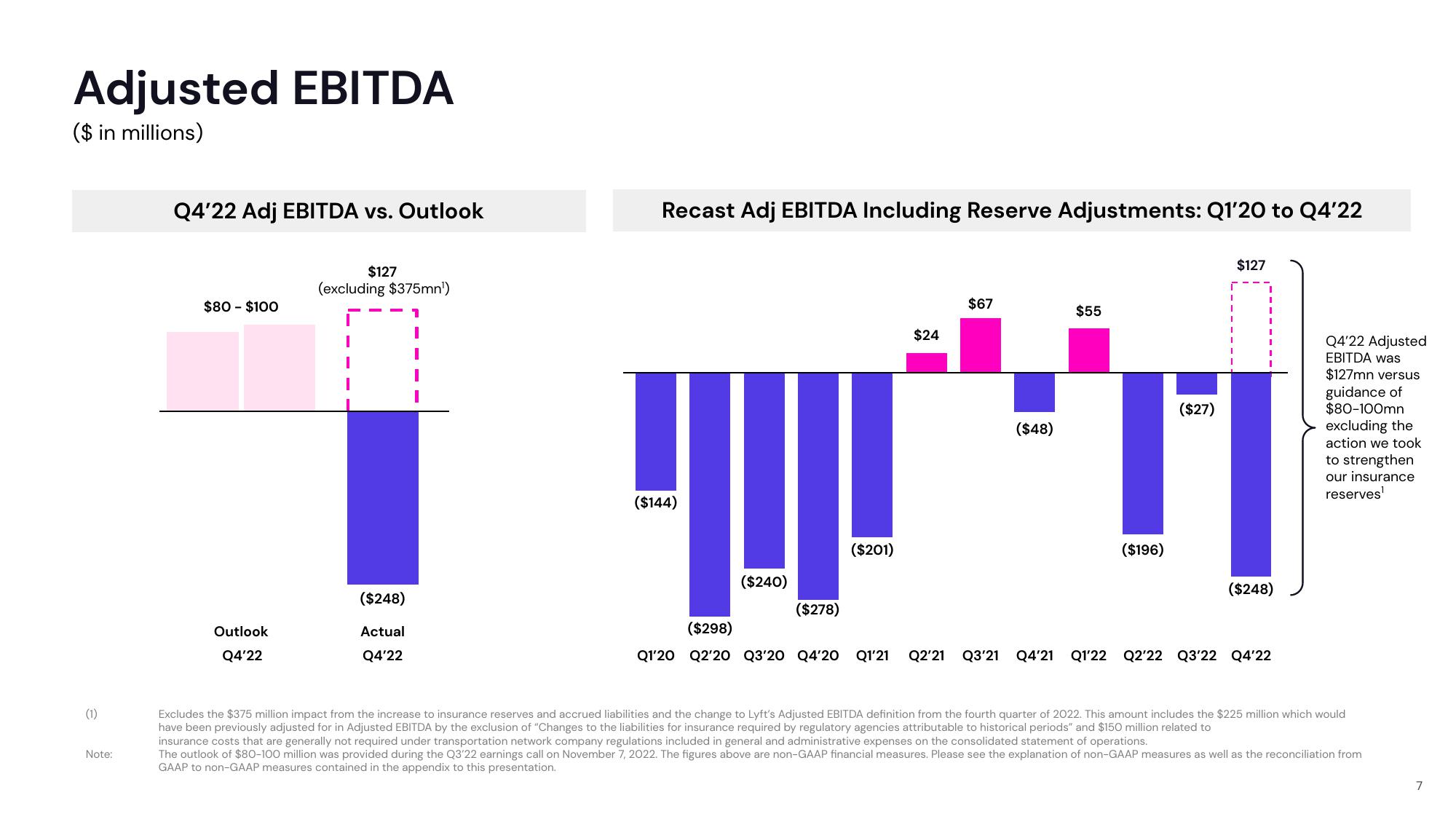

Q4'22 Adj EBITDA vs. Outlook

$80 - $100

Outlook

Q4'22

$127

(excluding $375mn¹)

($248)

Actual

Q4'22

Recast Adj EBITDA Including Reserve Adjustments: Q1'20 to Q4'22

($144)

($240)

($278)

($201)

$24

$67

($48)

$55

($196)

($27)

$127

($248)

($298)

Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22

Q4'22 Adjusted

EBITDA was

$127mn versus

guidance of

$80-100mn

excluding the

action we took

to strengthen

our insurance

reserves¹

Excludes the $375 million impact from the increase to insurance reserves and accrued liabilities and the change to Lyft's Adjusted EBITDA definition from the fourth quarter of 2022. This amount includes the $225 million which would

have been previously adjusted for in Adjusted EBITDA by the exclusion of "Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods" and $150 million related to

insurance costs that are generally not required under transportation network company regulations included in general and administrative expenses on the consolidated statement of operations.

The outlook of $80-100 million was provided during the Q3'22 earnings call on November 7, 2022. The figures above are non-GAAP financial measures. Please see the explanation of non-GAAP measures as well as the reconciliation from

GAAP to non-GAAP measures contained in the appendix to this presentation.

7View entire presentation