LSE Investor Presentation Deck

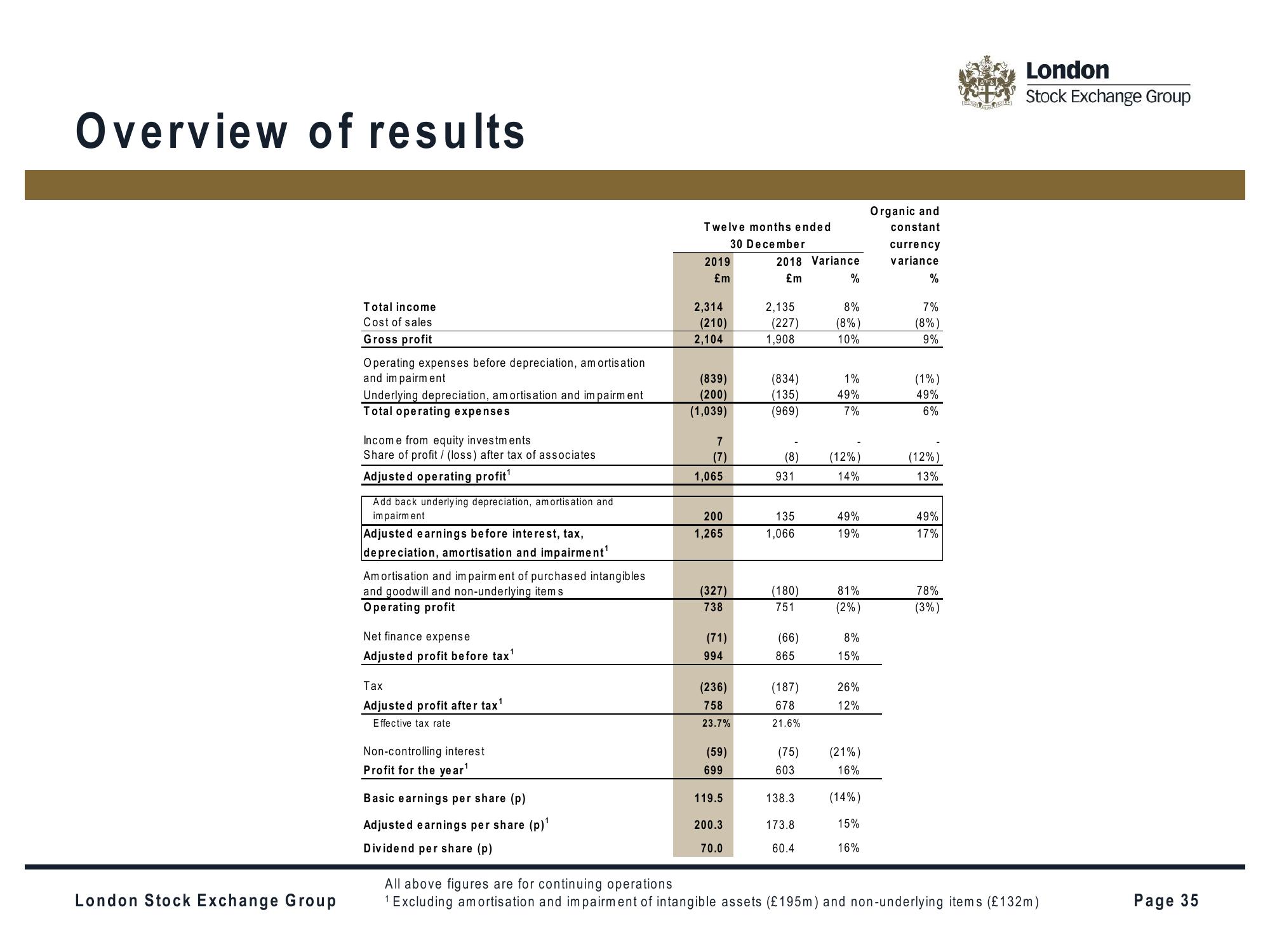

Overview of results

London Stock Exchange Group

Total income

Cost of sales

Gross profit

Operating expenses before depreciation, amortisation

and impairment

Underlying depreciation, amortisation and impairment

Total operating expenses

Income from equity investments

Share of profit/ (loss) after tax of associates

Adjusted operating profit¹

Add back underlying depreciation, amortisation and

impairment

Adjusted earnings before interest, tax,

depreciation, amortisation and impairment¹

Amortisation and impairment of purchased intangibles

and goodwill and non-underlying items

Operating profit

Net finance expense

Adjusted profit before tax¹

Tax

Adjusted profit after tax¹

Effective tax rate

Non-controlling interest

Profit for the year¹

Basic earnings per share (p)

Adjusted earnings per share (p)¹

Dividend per share (p)

Twelve months ended

30 December

2019

£m

2,314

(210)

2,104

(839)

(200)

(1,039)

7

(7)

1,065

200

1,265

(327)

738

(71)

994

(236)

758

23.7%

(59)

699

119.5

200.3

70.0

2018 Variance

£m

2,135

(227)

1,908

(834)

(135)

(969)

(8)

931

135

1,066

(180)

751

(66)

865

(187)

678

21.6%

(75)

603

138.3

173.8

60.4

%

8%

(8%)

10%

1%

49%

7%

(12%)

14%

49%

19%

81%

(2%)

8%

15%

26%

12%

(21%)

16%

(14%)

15%

16%

Organic and

constant

currency

variance

%

7%

(8%)

9%

(1%)

49%

6%

(12%)

13%

49%

17%

78%

(3%)

London

Stock Exchange Group

All above figures are for continuing operations

¹ Excluding amortisation and impairment of intangible assets (£195m) and non-underlying items (£132m)

Page 35View entire presentation