Investor Insights: Q1 MCR Corp

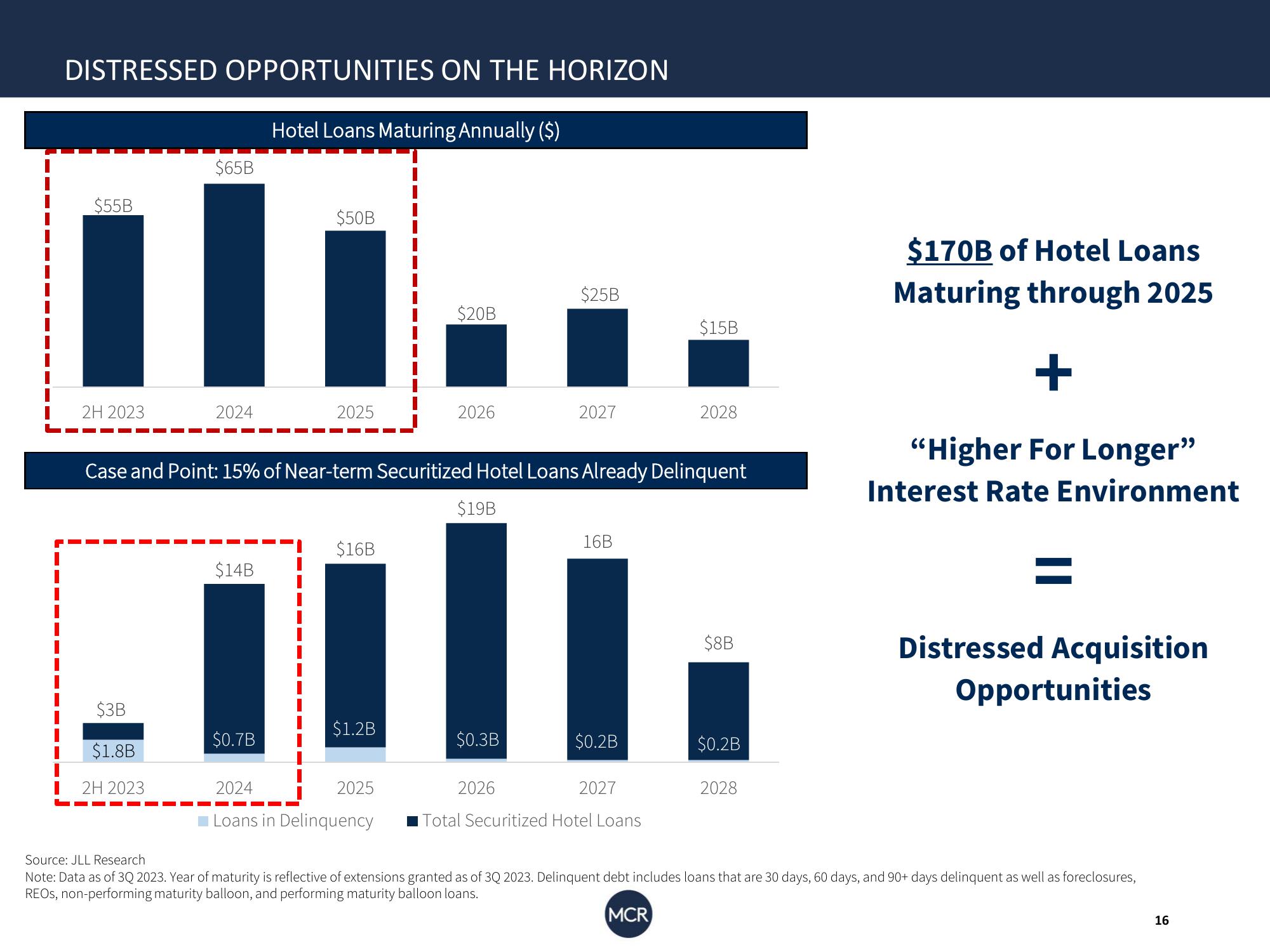

DISTRESSED OPPORTUNITIES ON THE HORIZON

$55B

2H 2023

$3B

$1.8B

2H 2023

$65B

I

2024

Hotel Loans Maturing Annually ($)

$14B

$0.7B

$50B

2025

$16B

Case and Point: 15% of Near-term Securitized Hotel Loans Already Delinquent

$19B

$1.2B

2024

Loans in Delinquency

2025

$20B

2026

$0.3B

$25B

2026

2027

16B

$0.2B

2027

$15B

Total Securitized Hotel Loans

2028

$8B

$0.2B

2028

$170B of Hotel Loans

Maturing through 2025

+

"Higher For Longer"

Interest Rate Environment

Distressed Acquisition

Opportunities

Source: JLL Research

Note: Data as of 3Q 2023. Year of maturity is reflective of extensions granted as of 3Q 2023. Delinquent debt includes loans that are 30 days, 60 days, and 90+ days delinquent as well as foreclosures,

REOs, non-performing maturity balloon, and performing maturity balloon loans.

MCR

16View entire presentation