Markforged SPAC Presentation Deck

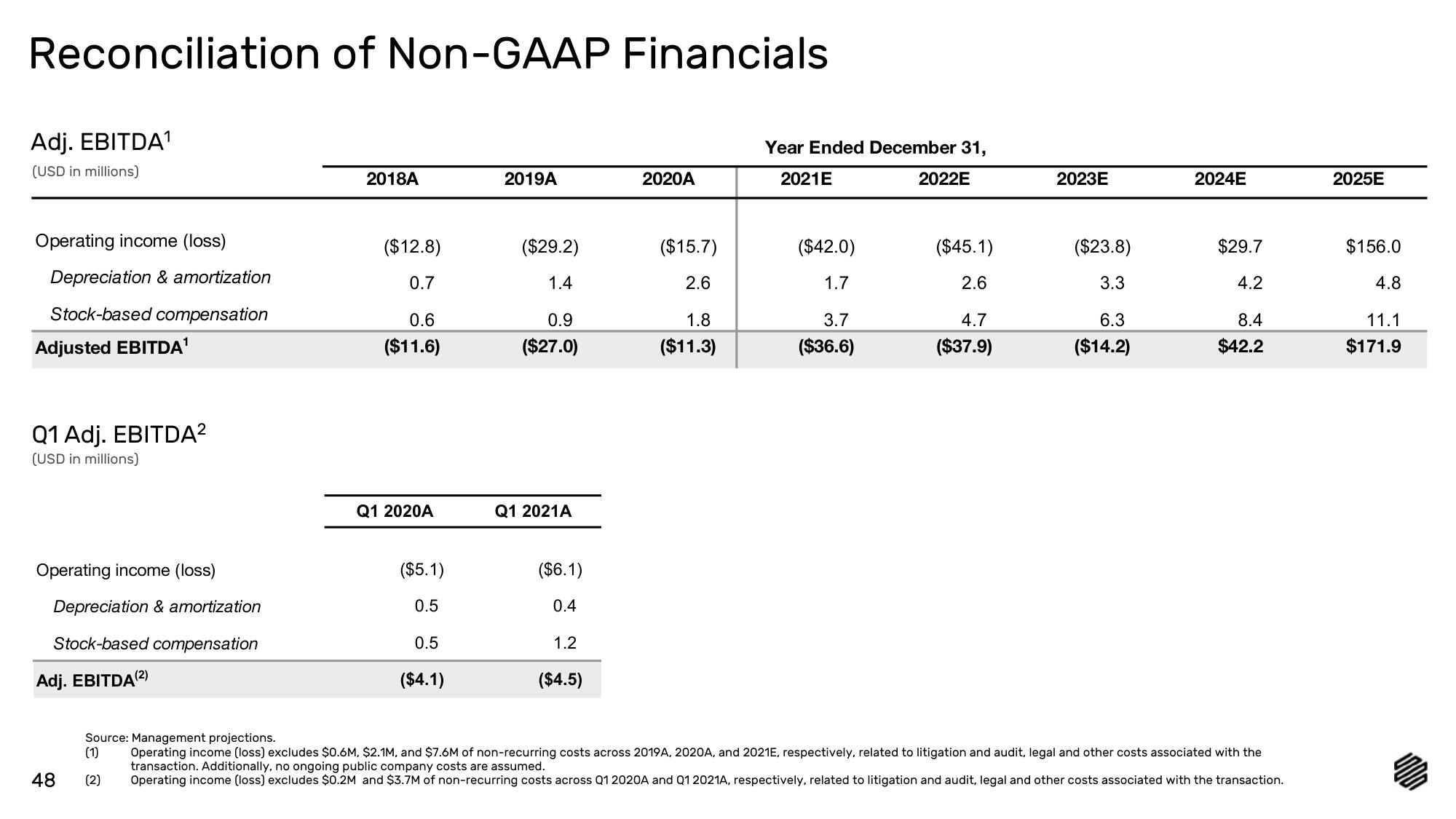

Reconciliation of Non-GAAP Financials

Adj. EBITDA¹

(USD in millions)

Operating income (loss)

Depreciation & amortization

Stock-based compensation

Adjusted EBITDA¹

Q1 Adj. EBITDA²

(USD in millions)

Operating income (loss)

Depreciation & amortization

Stock-based compensation

Adj. EBITDA (2)

48

2018A

($12.8)

0.7

0.6

($11.6)

Q1 2020A

($5.1)

0.5

0.5

($4.1)

2019A

($29.2)

1.4

0.9

($27.0)

Q1 2021A

($6.1)

0.4

1.2

($4.5)

2020A

($15.7)

2.6

1.8

($11.3)

Year Ended December 31,

2021E

($42.0)

1.7

3.7

($36.6)

2022E

($45.1)

2.6

4.7

($37.9)

2023E

($23.8)

3.3

6.3

($14.2)

2024E

$29.7

4.2

8.4

$42.2

Source: Management projections.

(1)

Operating income (loss) excludes $0.6M, $2.1M, and $7.6M of non-recurring costs across 2019A, 2020A, and 2021E, respectively, related to litigation and audit, legal and other costs associated with the

transaction. Additionally, no ongoing public company costs are assumed.

(2) Operating income (loss) excludes $0.2M and $3.7M of non-recurring costs across Q1 2020A and Q1 2021A, respectively, related to litigation and audit, legal and other costs associated with the transaction.

2025E

$156.0

4.8

11.1

$171.9View entire presentation