Credit Suisse Investment Banking Pitch Book

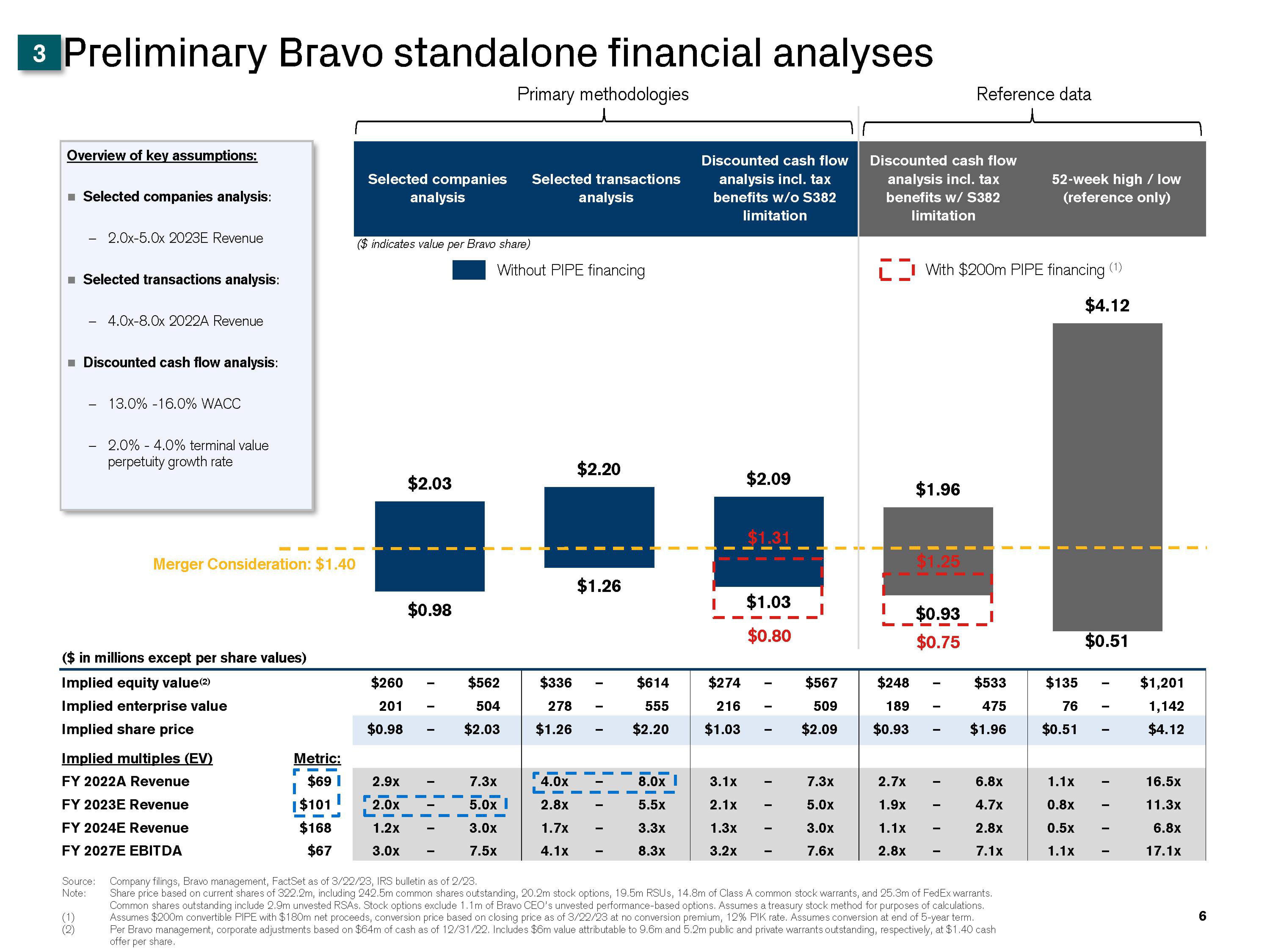

3 Preliminary Bravo standalone financial analyses

Overview of key assumptions:

■ Selected companies analysis:

-

■ Selected transactions analysis:

2.0x-5.0x 2023E Revenue

■ Discounted cash flow analysis:

Source:

Note:

(1)

(2)

4.0x-8.0x 2022A Revenue

13.0% -16.0% WACC

2.0% - 4.0% terminal value

perpetuity growth rate

($ in millions except per share values)

Implied equity value (2)

Implied enterprise value

Implied share price

Implied multiples (EV)

FY 2022A Revenue

FY 2023E Revenue

FY 2024E Revenue

FY 2027E EBITDA

Merger Consideration: $1.40

Metric:

$69 I

r-

|$101

$168

$67

Selected companies Selected transactions

analysis

analysis

($ indicates value per Bravo share)

$260

201

$0.98

$2.03

-

$0.98

2.9x

2.0x

———

1.2x

3.0x

Primary methodologies

Without PIPE financing

$562

504

$2.03

7.3x

5.0x I

3.0x

7.5x

$336

278

$1.26

L

4.0x

2.8x

1.7x

4.1x

$2.20

$1.26

-

-

$614

555

$2.20

8.0x I

5.5x

3.3x

8.3x

Discounted cash flow

analysis incl. tax

benefits w/o S382

limitation

I

$274

216

$1.03

3.1x

2.1x

1.3x

3.2x

$2.09

$1.31

$1.03

$0.80

-

$567

509

$2.09

7.3x

5.0x

3.0x

7.6x

Discounted cash flow

analysis incl. tax

benefits w/ S382

limitation

-

$248

189

$0.93

2.7x

1.9x

1.1x

2.8x

$1.96

With $200m PIPE financing (¹)

$4.12

$1.25

$0.93

$0.75

Reference data

-

-

$533

475

$1.96

6.8x

4.7x

2.8x

7.1x

52-week high / low

(reference only)

Company filings, Bravo management, FactSet as of 3/22/23, IRS bulletin as of 2/23.

Share price based on current shares of 322.2m, including 242.5m common shares outstanding, 20.2m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx warrants.

Common shares outstanding include 2.9m unvested RSAs. Stock options exclude 1.1m of Bravo CEO's unvested performance-based options. Assumes a treasury stock method for purposes of calculations.

Assumes $200m convertible PIPE with $180m net proceeds, conversion price based on closing price as of 3/22/23 at no conversion premium, 12% PIK rate. Assumes conversion at end of 5-year term.

Per Bravo management, corporate adjustments based on $64m of cash as of 12/31/22. Includes $6m value attributable to 9.6m and 5.2m public and private warrants outstanding, respectively, at $1.40 cash

offer per share.

$135

76

$0.51

1.1x

0.8x

0.5x

1.1x

$0.51

$1,201

1,142

$4.12

16.5x

11.3x

6.8x

17.1x

6View entire presentation