Weber Results Presentation Deck

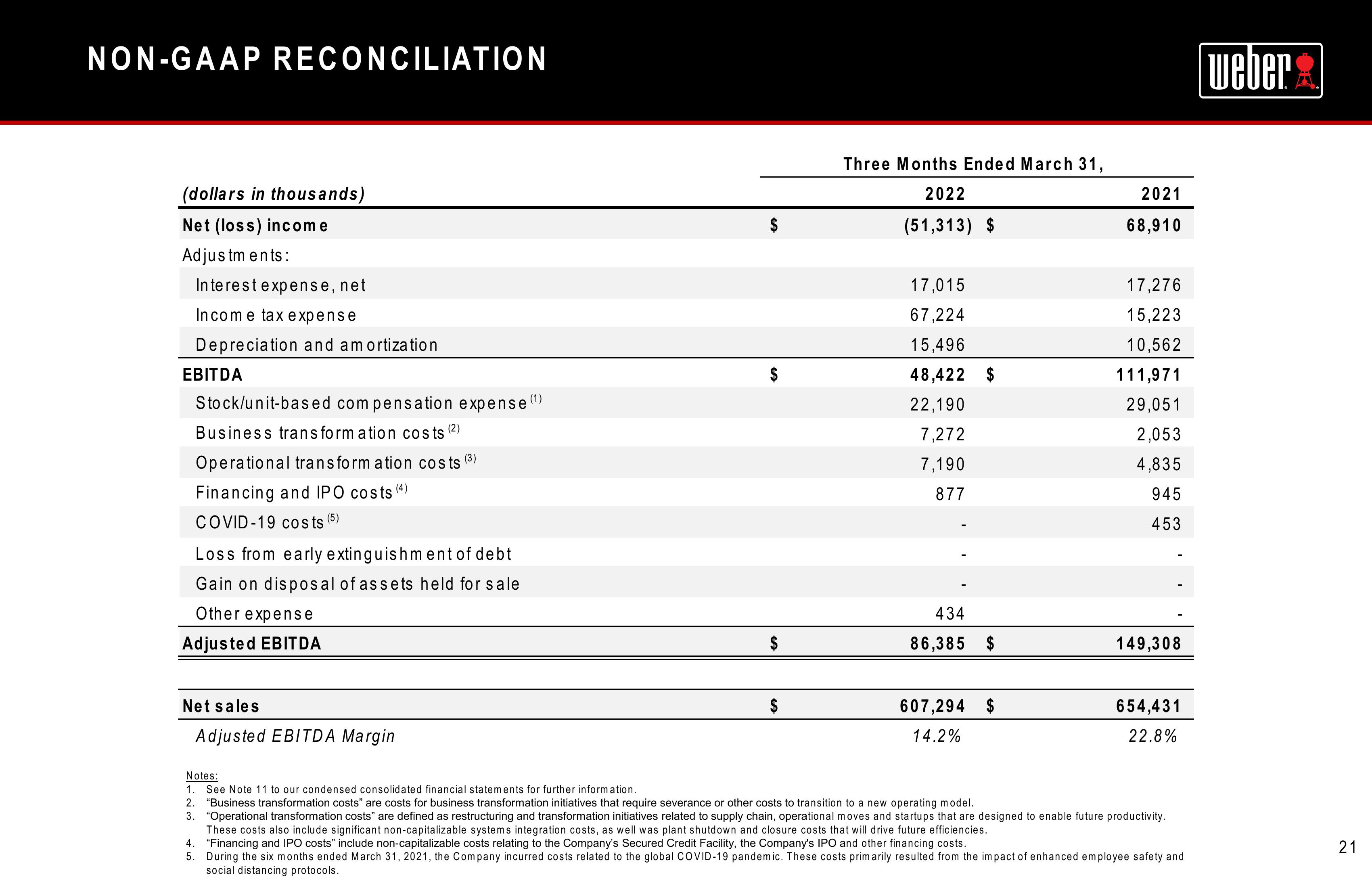

NON-GAAP RECONCILIATION

(dollars in thousands)

Net (loss) income

Adjustments:

Interest expense, net

Income tax expense

Depreciation and amortization

EBITDA

Stock/unit-based compensation expense (¹)

Business transformation costs (²)

Operational transformation costs (3)

Financing and IPO costs (4)

COVID-19 costs (5)

Loss from early extinguishment of debt

Gain on disposal of assets held for sale

Other expense

Adjusted EBITDA

Net sales

Adjusted EBITDA Margin

Three Months Ended March 31,

2022

(51,313) $

17,015

67,224

15,496

48,422 $

22,190

7,272

7,190

877

434

86,385 $

607,294 $

14.2%

Notes:

1. See Note 11 to our condensed consolidated financial statements for further information.

2. "Business transformation costs" are costs for business transformation initiatives that require severance or other costs to transition to a new operating model.

2021

68,910

17,276

15,223

10,562

111,971

29,051

2,053

4,835

945

453

149,308

654,431

22.8%

3. "Operational transformation costs" are defined as restructuring and transformation initiatives related to supply chain, operational moves and startups that are designed to enable future productivity.

These costs also include significant non-capitalizable systems integration costs, as well was plant shutdown and closure costs that will drive future efficiencies.

4. "Financing and IPO costs" include non-capitalizable costs relating to the Company's Secured Credit Facility, the Company's IPO and other financing costs.

5. During the six months ended March 31, 2021, the Company incurred costs related to the global COVID-19 pandemic. These costs primarily resulted from the impact of enhanced employee safety and

social distancing protocols.

weber

21View entire presentation