Credit Suisse Investment Banking Pitch Book

Preliminary illustrative Maine NAV analysis assumptions

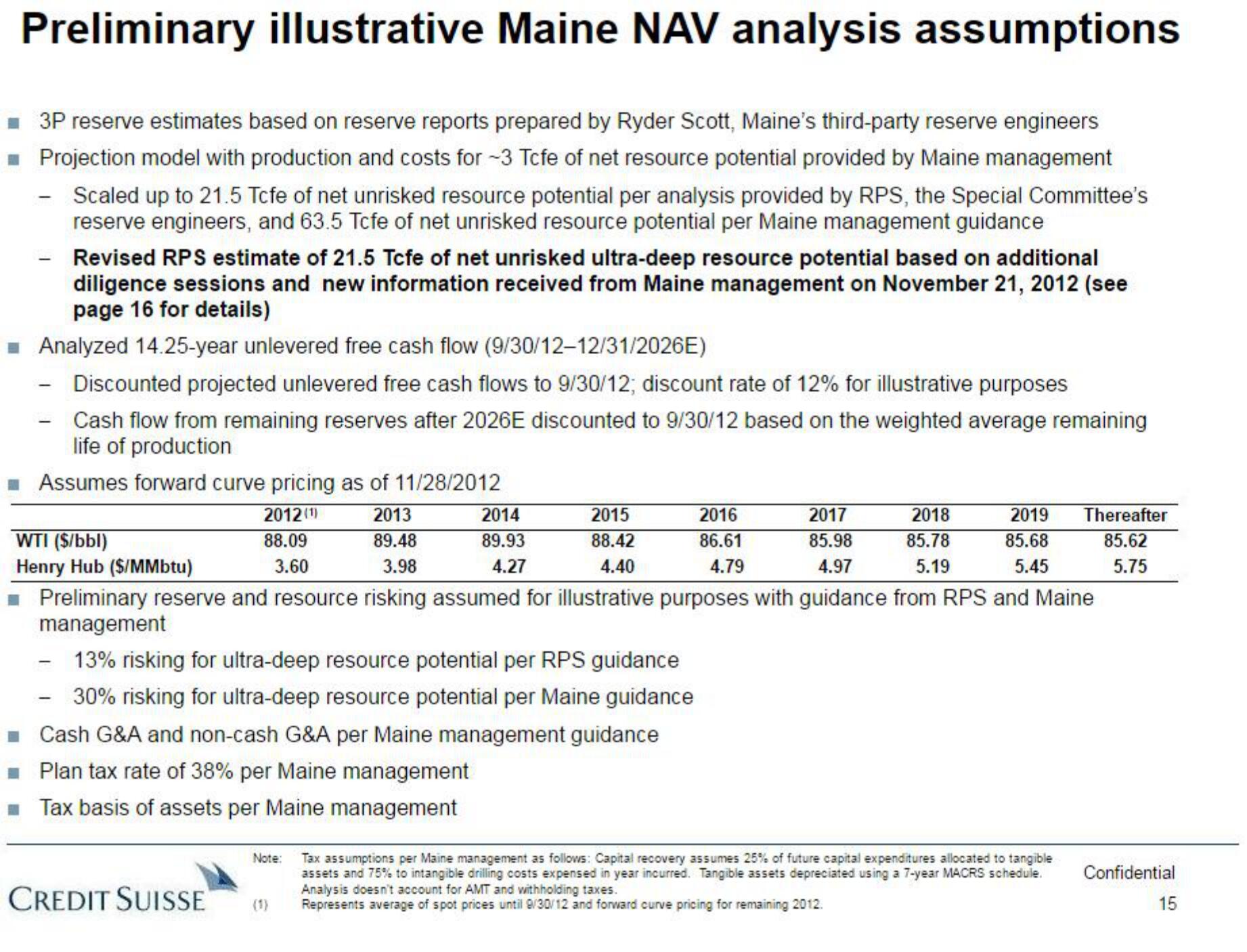

■ 3P reserve estimates based on reserve reports prepared by Ryder Scott, Maine's third-party reserve engineers

■ Projection model with production and costs for -3 Tcfe of net resource potential provided by Maine management

- Scaled up to 21.5 Tcfe of net unrisked resource potential per analysis provided by RPS, the Special Committee's

reserve engineers, and 63.5 Tcfe of net unrisked resource potential per Maine management guidance

Revised RPS estimate of 21.5 Tcfe of net unrisked ultra-deep resource potential based on additional

diligence sessions and new information received from Maine management on November 21, 2012 (see

page 16 for details)

■ Analyzed 14.25-year unlevered free cash flow (9/30/12-12/31/2026E)

Discounted projected unlevered free cash flows to 9/30/12; discount rate of 12% for illustrative purposes

- Cash flow from remaining reserves after 2026E discounted to 9/30/12 based on the weighted average remaining

life of production

-

■ Assumes forward curve pricing as of 11/28/2012

2012 (¹)

88.09

3.60

2013

89.48

3.98

2014

89.93

4.27

CREDIT SUISSE

2015

88.42

4.40

- 13% risking for ultra-deep resource potential per RPS guidance

30% risking for ultra-deep resource potential per Maine guidance

Cash G&A and non-cash G&A per Maine management guidance

■ Plan tax rate of 38% per Maine management

■ Tax basis of assets per Maine management

2016

86.61

4.79

2017

85.98

4.97

2018

85.78

5.19

2019

85.68

5.45

WTI ($/bbl)

Henry Hub ($/MMbtu)

Preliminary reserve and resource risking assumed for illustrative purposes with guidance from RPS and Maine

management

Thereafter

85.62

5.75

Note: Tax assumptions per Maine management as follows: Capital recovery assumes 25% of future capital expenditures allocated to tangible

assets and 75% to intangible drilling costs expensed in year incurred. Tangible assets depreciated using a 7-year MACRS schedule.

Analysis doesn't account for AMT and withholding taxes.

Represents average of spot prices until 9/30/12 and forward curve pricing for remaining 2012.

Confidential

15View entire presentation