Investor Presentation

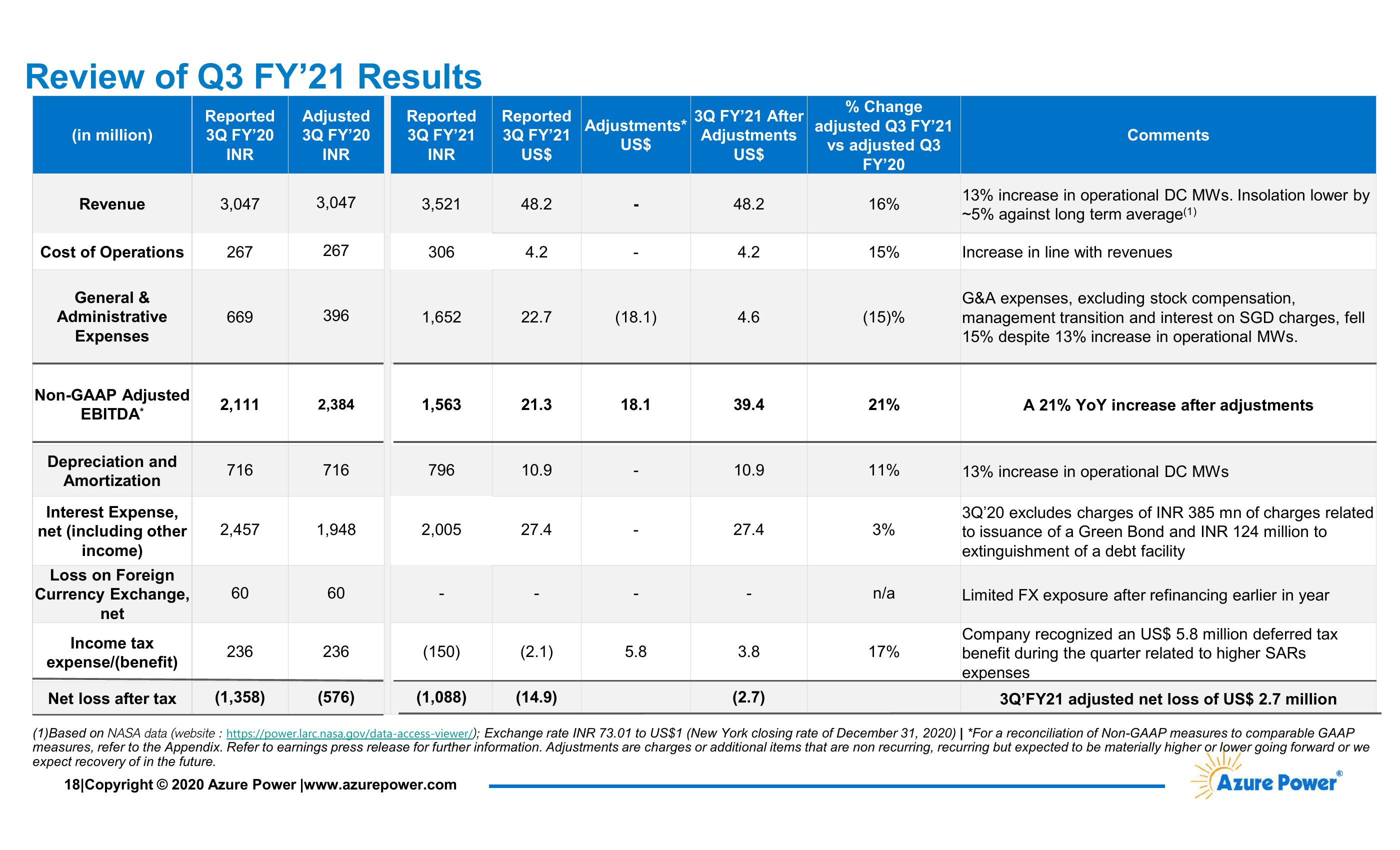

Review of Q3 FY'21 Results

(in million)

Reported

3Q FY'20

Adjusted

Reported

INR

3Q FY'20

INR

3Q FY'21

INR

Reported

3Q FY'21

US$

3Q FY'21 After

Adjustments*

US$

Adjustments

US$

Revenue

3,047

3,047

3,521

48.2

Cost of Operations

267

267

306

4.2

% Change

adjusted Q3 FY'21

vs adjusted Q3

FY'20

Comments

48.2

16%

13% increase in operational DC MWs. Insolation lower by

~5% against long term average(1)

4.2

15%

Increase in line with revenues

General &

Administrative

669

396

1,652

22.7

(18.1)

4.6

(15)%

Expenses

G&A expenses, excluding stock compensation,

management transition and interest on SGD charges, fell

15% despite 13% increase in operational MWs.

Non-GAAP Adjusted

2,111

2,384

1,563

21.3

18.1

39.4

21%

A 21% YoY increase after adjustments

EBITDA*

Depreciation and

716

716

796

10.9

10.9

11%

Amortization

Interest Expense,

net (including other

2,457

1,948

2,005

27.4

27.4

3%

income)

13% increase in operational DC MWS

3Q'20 excludes charges of INR 385 mn of charges related

to issuance of a Green Bond and INR 124 million to

extinguishment of a debt facility

Loss on Foreign

Currency Exchange,

60

60

n/a

Limited FX exposure after refinancing earlier in year

net

Income tax

expense/(benefit)

236

236

(150)

(2.1)

5.8

3.8

17%

Company recognized an US$ 5.8 million deferred tax

benefit during the quarter related to higher SARS

expenses

Net loss after tax

(1,358)

(576)

(1,088)

(14.9)

(2.7)

3Q'FY21 adjusted net loss of US$ 2.7 million

(1) Based on NASA data (website: https://power.larc.nasa.gov/data-access-viewer/); Exchange rate INR 73.01 to US$1 (New York closing rate of December 31, 2020) | *For a reconciliation of Non-GAAP measures to comparable GAAP

measures, refer to the Appendix. Refer to earnings press release for further information. Adjustments are charges or additional items that are non recurring, recurring but expected to be materially higher or lower going forward or we

expect recovery of in the future.

18|Copyright © 2020 Azure Power |www.azurepower.com

Azure PowerⓇView entire presentation