Inovalon Results Presentation Deck

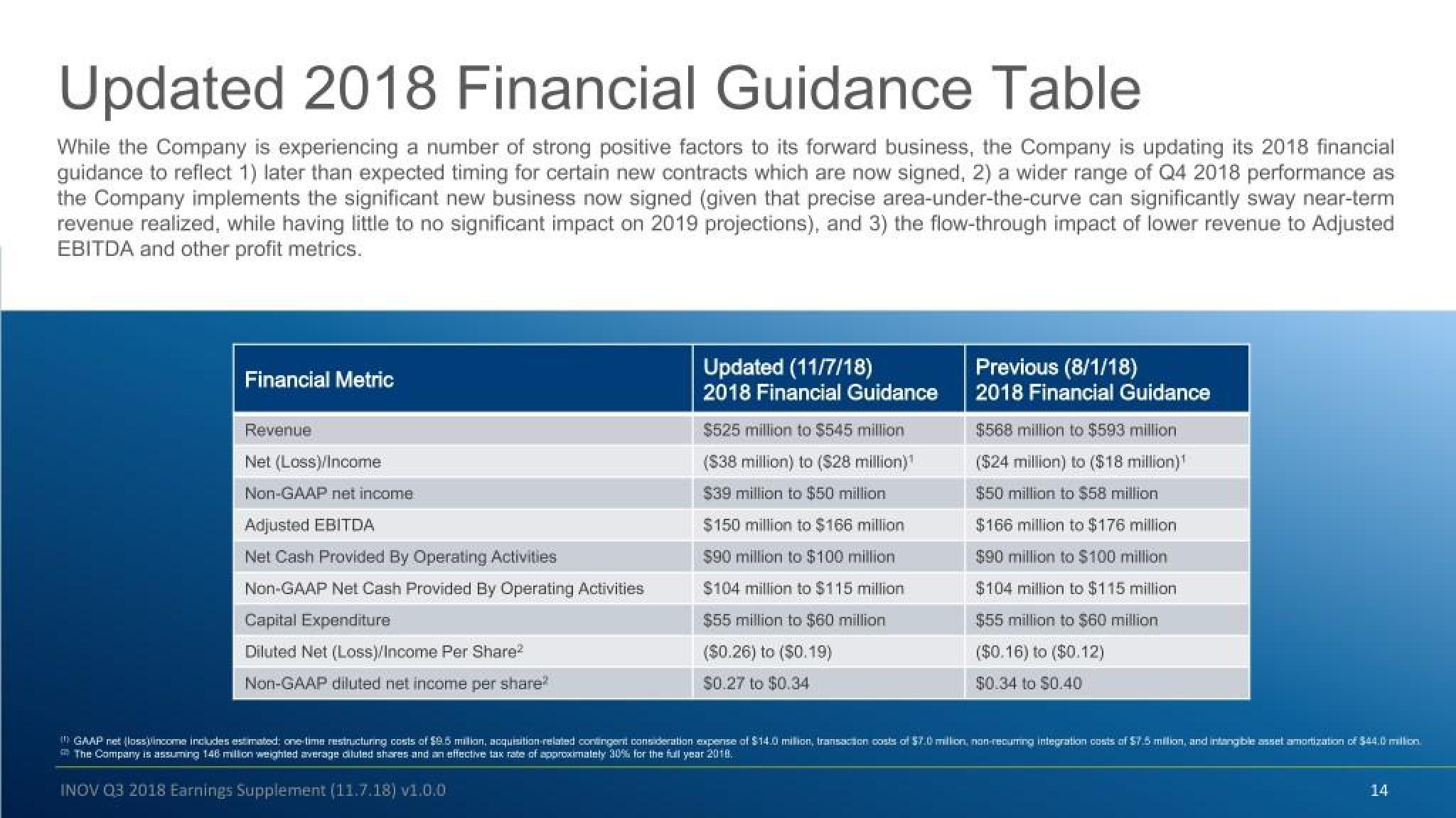

Updated 2018 Financial Guidance Table

While the Company is experiencing a number of strong positive factors to its forward business, the Company is updating its 2018 financial

guidance to reflect 1) later than expected timing for certain new contracts which are now signed, 2) a wider range of Q4 2018 performance as

the Company implements the significant new business now signed (given that precise area-under-the-curve can significantly sway near-term

revenue realized, while having little to no significant impact on 2019 projections), and 3) the flow-through impact of lower revenue to Adjusted

EBITDA and other profit metrics.

Financial Metric

Revenue

Net (Loss)/Income

Non-GAAP net income

Adjusted EBITDA

Net Cash Provided By Operating Activities

Non-GAAP Net Cash Provided By Operating Activities

Capital Expenditure

Diluted Net (Loss)/Income Per Share²

Non-GAAP diluted net income per share?

Updated (11/7/18)

2018 Financial Guidance

$525 million to $545 million

($38 million) to ($28 million)¹

$39 million to $50 million

$150 million to $166 million

$90 million to $100 million

$104 million to $115 million

$55 million to $60 million

($0.26) to ($0.19)

$0.27 to $0.34

Previous (8/1/18)

2018 Financial Guidance

$568 million to $593 million

($24 million) to ($18 million)¹

$50 million to $58 million

$166 million to $176 million

$90 million to $100 million

$104 million to $115 million

$55 million to $60 million

($0.16) to ($0.12)

$0.34 to $0.40

!!! GAAP net (lossincome includes estimated; one-time restructuring costs of $9.5 million, acquisition-related contingent consideration expense of $14.0 million, transaction costs of $7.0 million, non-recurring integration costs of $7.5 million, and intangible asset amortization of $44.0 million.

The Company is assuming 146 million weighted average diluted shares and an effective tax rate of approximately 30% for the full year 2018.

INOV Q3 2018 Earnings Supplement (11.7.18) v1.0.0

14View entire presentation