Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

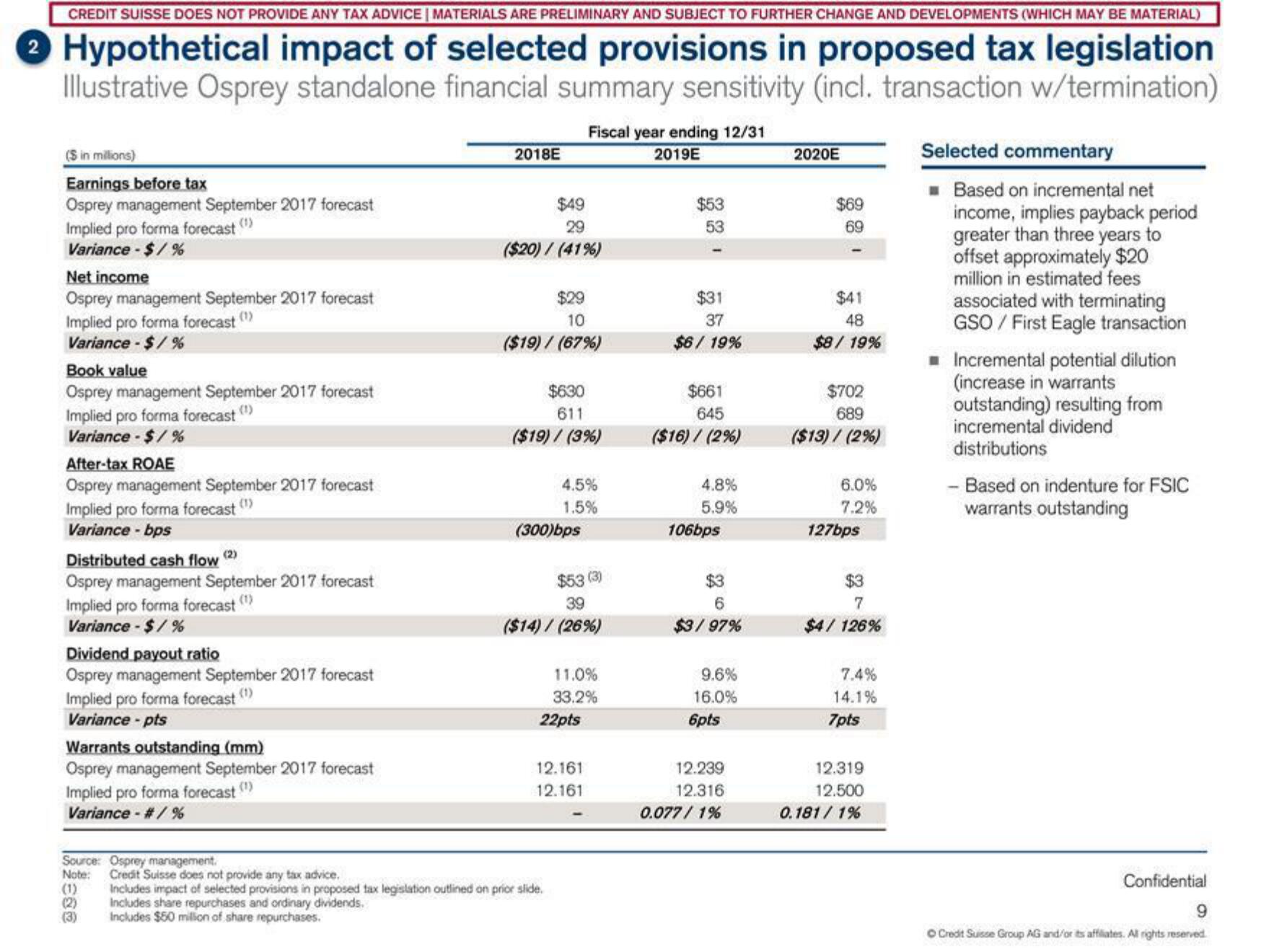

Hypothetical impact of selected provisions in proposed tax legislation

Illustrative Osprey standalone financial summary sensitivity (incl. transaction w/termination)

($ in millions)

Earnings before tax

Osprey management September 2017 forecast

Implied pro forma forecast

Variance-$/%

Net income

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance - $ / %

Book value

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance - $/%

After-tax ROAE

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance-bps

Distributed cash flow (2)

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance - $ / %

Dividend payout ratio

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance- pts

Warrants outstanding (mm)

Osprey management September 2017 forecast

Implied pro forma forecast (¹)

Variance - #/%

Source: Osprey management.

Note: Credit Suisse does not provide any tax advice.

(2)

(3)

2018E

$49

29

($20) / (41%)

$29

10

($19) / (67%)

$630

611

($19) / (3%)

Fiscal year ending 12/31

2019E

(300)bps

4.5%

1.5%

$53 (3)

39

($14) / (26%)

22pts

Includes impact of selected provisions in proposed tax legislation outlined on prior slide.

Includes share repurchases and ordinary dividends.

Includes $50 million of share repurchases.

11.0%

33.2%

12.161

12.161

$53

53

$31

37

$6/19%

$661

645

($16) / (2%)

4.8%

5.9%

106bps

$3

6

$3/97%

9.6%

16.0%

6pts

12.239

12.316

0.077/1%

2020E

$69

69

$41

48

$8/19%

$702

689

($13) / (2%)

6.0%

7.2%

127bps

$3

7

$4/ 126%

7.4%

14.1%

7pts

12.319

12.500

0.181/ 1%

Selected commentary

Based on incremental net

income, implies payback period

greater than three years to

offset approximately $20

million in estimated fees

associated with terminating

GSO/ First Eagle transaction

■ Incremental potential dilution

(increase in warrants

outstanding) resulting from

incremental dividend

distributions

- Based on indenture for FSIC

warrants outstanding

Confidential

9

● Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation