KKR Real Estate Finance Trust Investor Presentation Deck

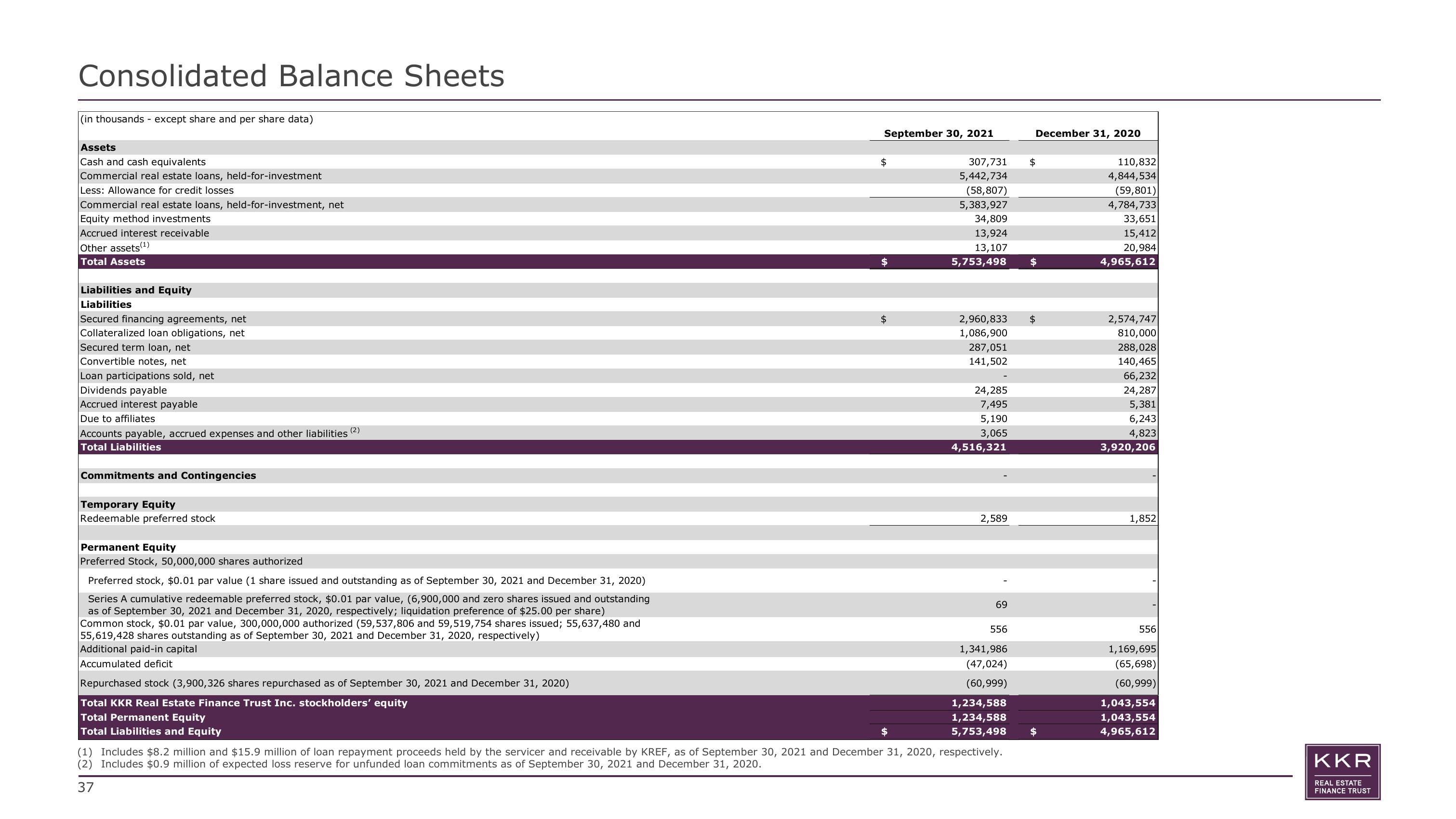

Consolidated Balance Sheets

(in thousands - except share and per share data)

Assets

Cash and cash equivalents

Commercial real estate loans, held-for-investment

Less: Allowance for credit losses

Commercial real estate loans, held-for-investment, net

Equity method investments

Accrued interest receivable

Other assets (1)

Total Assets

Liabilities and Equity

Liabilities

Secured financing agreements, net

Collateralized loan obligations, net

Secured term loan, net

Convertible notes, net

Loan participations sold, net

Dividends payable

Accrued interest payable

Due to affiliates

Accounts payable, accrued expenses and other liabilities (2)

Total Liabilities

Commitments and Contingencies

Temporary Equity

Redeemable preferred stock

Permanent Equity

Preferred Stock, 50,000,000 shares authorized

Preferred stock, $0.01 par value (1 share issued and outstanding as of September 30, 2021 and December 31, 2020)

Series A cumulative redeemable preferred stock, $0.01 par value, (6,900,000 and zero shares issued and outstanding

as of September 30, 2021 and December 31, 2020, respectively; liquidation preference of $25.00 per share)

Common stock, $0.01 par value, 300,000,000 authorized (59,537,806 and 59,519,754 shares issued; 55,637,480 and

55,619,428 shares outstanding as of September 30, 2021 and December 31, 2020, respectively)

Additional paid-in capital

Accumulated deficit

Repurchased stock (3,900,326 shares repurchased as of September 30, 2021 and December 31, 2020)

Total KKR Real Estate Finance Trust Inc. stockholders' equity

Total Permanent Equity

Total Liabilities and Equity

September 30, 2021

$

$

$

307,731

5,442,734

(58,807)

5,383,927

34,809

13,924

13,107

5,753,498

2,960,833

1,086,900

287,051

141,502

24,285

7,495

5,190

3,065

4,516,321

2,589

69

556

1,341,986

(47,024)

(60,999)

1,234,588

1,234,588

5,753,498

$

(1) Includes $8.2 million and $15.9 million of loan repayment proceeds held by the servicer and receivable by KREF, as of September 30, 2021 and December 31, 2020, respectively.

(2) Includes $0.9 million of expected loss reserve for unfunded loan commitments as of September 30, 2021 and December 31, 2020.

37

December 31, 2020

$

$

$

$

110,832

4,844,534

(59,801)

4,784,733

33,651

15,412

20,984

4,965,612

2,574,747

810,000

288,028

140,465

66,232

24,287

5,381

6,243

4,823

3,920,206

1,852

556

1,169,695

(65,698)

(60,999)

1,043,554

1,043,554

4,965,612

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation