Mondee SPAC

Transaction Summary

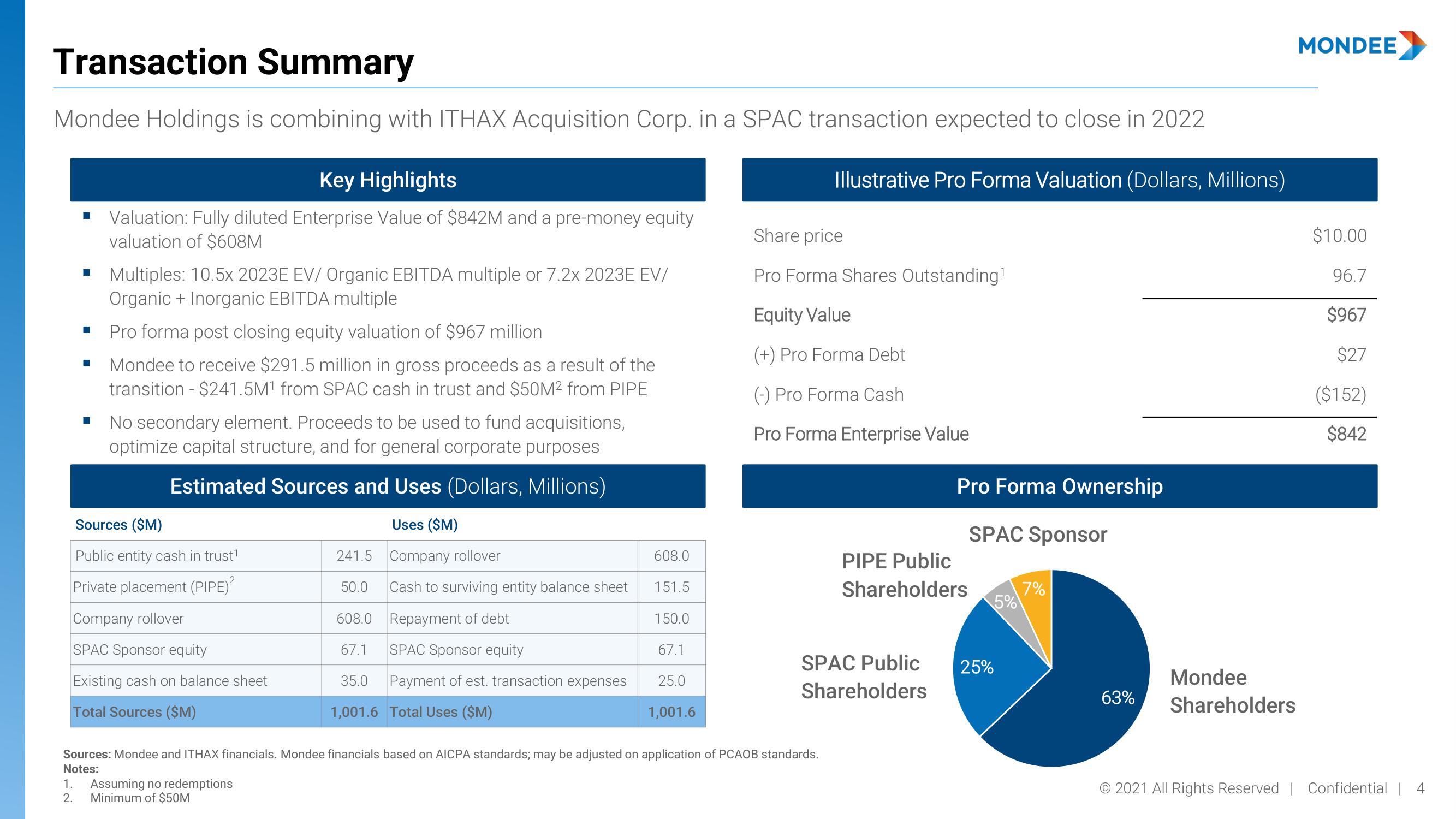

Mondee Holdings is combining with ITHAX Acquisition Corp. in a SPAC transaction expected to close in 2022

■

■

■

■

Key Highlights

Valuation: Fully diluted Enterprise Value of $842M and a pre-money equity

valuation of $608M

Multiples: 10.5x 2023E EV/ Organic EBITDA multiple or 7.2x 2023E EV/

Organic + Inorganic EBITDA multiple

Pro forma post closing equity valuation of $967 million

Mondee to receive $291.5 million in gross proceeds as a result of the

transition - $241.5M¹ from SPAC cash in trust and $50M² from PIPE

No secondary element. Proceeds to be used to fund acquisitions,

optimize capital structure, and for general corporate purposes

Estimated Sources and Uses (Dollars, Millions)

Sources ($M)

Public entity cash in trust¹

Private placement (PIPE)²

Company rollover

SPAC Sponsor equity

Existing cash on balance sheet

Total Sources ($M)

Uses ($M)

Company rollover

Cash to surviving entity balance sheet

608.0 Repayment of debt

67.1

35.0

1,001.6

1. Assuming no redemptions

2.

Minimum of $50M

241.5

50.0

SPAC Sponsor equity

Payment of est. transaction expenses

Total Uses ($M)

608.0

151.5

150.0

67.1

25.0

1,001.6

Illustrative Pro Forma Valuation (Dollars, Millions)

Share price

Pro Forma Shares Outstanding¹

Equity Value

(+) Pro Forma Debt

(-) Pro Forma Cash

Pro Forma Enterprise Value

Sources: Mondee and ITHAX financials. Mondee financials based on AICPA standards; may be adjusted on application of PCAOB standards.

Notes:

SPAC Public

Shareholders

Pro Forma Ownership

SPAC Sponsor

PIPE Public

Shareholders

5%

25%

7%

63%

Mondee

Shareholders

MONDEE

$10.00

96.7

$967

$27

($152)

$842

2021 All Rights Reserved | Confidential | 4View entire presentation