Q2 2019 Financial Results

Q2 2019 Highlights

■

■

■

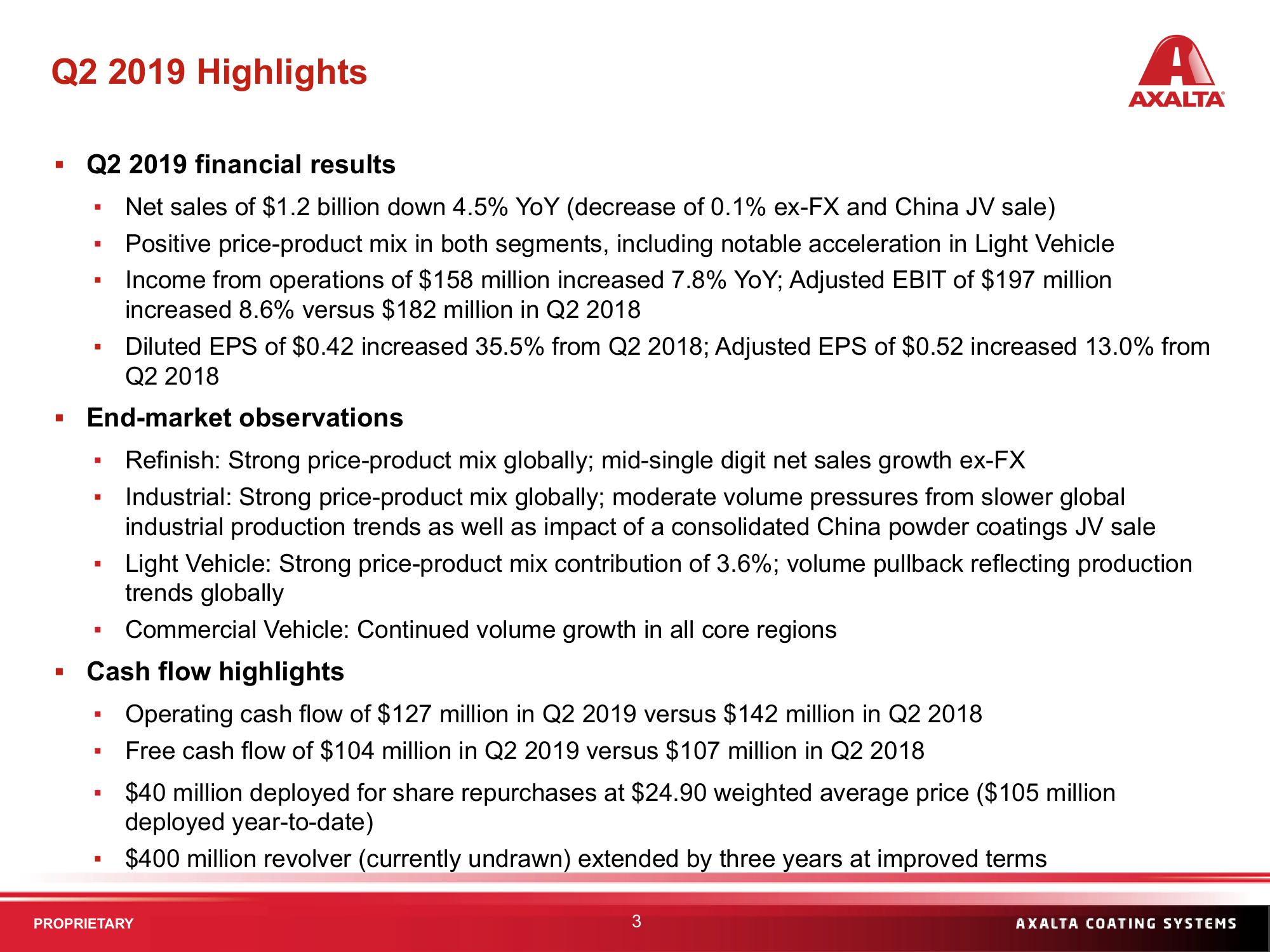

Q2 2019 financial results

Net sales of $1.2 billion down 4.5% YoY (decrease of 0.1% ex-FX and China JV sale)

Positive price-product mix in both segments, including notable acceleration in Light Vehicle

Income from operations of $158 million increased 7.8% YoY; Adjusted EBIT of $197 million

increased 8.6% versus $182 million in Q2 2018

■

■

■

I

Diluted EPS of $0.42 increased 35.5% from Q2 2018; Adjusted EPS of $0.52 increased 13.0% from

Q2 2018

End-market observations

Refinish: Strong price-product mix globally; mid-single digit net sales growth ex-FX

Industrial: Strong price-product mix globally; moderate volume pressures from slower global

industrial production trends as well as impact of a consolidated China powder coatings JV sale

■

■

■

I

Commercial Vehicle: Continued volume growth in all core regions

Cash flow highlights

Operating cash flow of $127 million in Q2 2019 versus $142 million in Q2 2018

Free cash flow of $104 million in Q2 2019 versus $107 million in Q2 2018

■

■

■

Light Vehicle: Strong price-product mix contribution of 3.6%; volume pullback reflecting production

trends globally

$40 million deployed for share repurchases at $24.90 weighted average price ($105 million

deployed year-to-date)

$400 million revolver (currently undrawn) extended by three years at improved terms

A

AXALTAⓇ

PROPRIETARY

3

AXALTA COATING SYSTEMSView entire presentation