Tesla Results Presentation Deck

9

OTHER HIGHLIGHTS

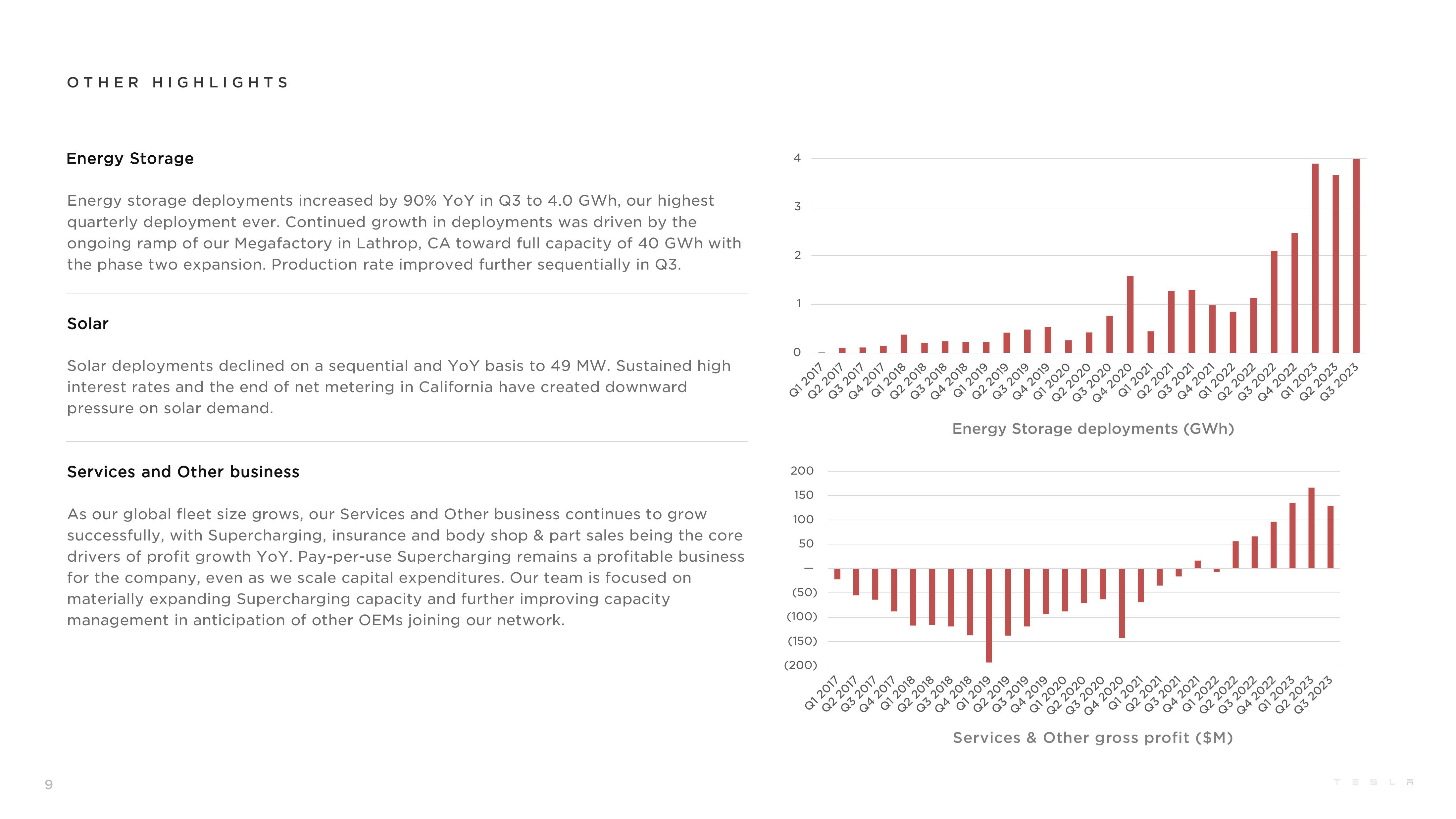

Energy Storage

Energy storage deployments increased by 90% YoY in Q3 to 4.0 GWh, our highest

quarterly deployment ever. Continued growth in deployments was driven by the

ongoing ramp of our Megafactory in Lathrop, CA toward full capacity of 40 GWh with

the phase two expansion. Production rate improved further sequentially in Q3.

Solar

Solar deployments declined on a sequential and YoY basis to 49 MW. Sustained high

interest rates and the end of net metering in California have created downward

pressure on solar demand.

Services and Other business

As our global fleet size grows, our Services and Other business continues to grow

successfully, with Supercharging, insurance and body shop & part sales being the core

drivers of profit growth YoY. Pay-per-use Supercharging remains a profitable business

for the company, even as we scale capital expenditures. Our team is focused on

materially expanding Supercharging capacity and further improving capacity

management in anticipation of other OEMs joining our network.

4

3

2

1

O

200

150

100

50

Q1 2017

(50)

(100)

(150)

(200)

Q2 2017

Q1 2017

Q3 2017

Q2 2017

Q4 2017

Q1 2018

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q2 2018

Q3 2018

Q1 2019

Q4 2018

Q2 2019

Q1 2019

Q3 2019

Q2 2019

Q4 2019

Q3 2019

Q1 2020

Q4 2019

Q2 2020

Q1 2020

Energy Storage deployments (GWh)

Q3 2020

Q2 2020

Q4 2020

Q3 2020

Q4 2020

Q1 2021

Q1 2021

Q2 2021

Q3 2021

Q2 2021

Q3 2021

Q4 2021

Q4 2021

Q1 2022

Q1 2022

Q2 2022

Q2 2022

Services & Other gross profit ($M)

/////

Q3 2022

Q4 2022

Q3 2022

Q4 2022

Q1 2023

Q1 2023

Q2 2023

Q3 2023

Q2 2023

Q3 2023

TESLAView entire presentation