Bank of America Results Presentation Deck

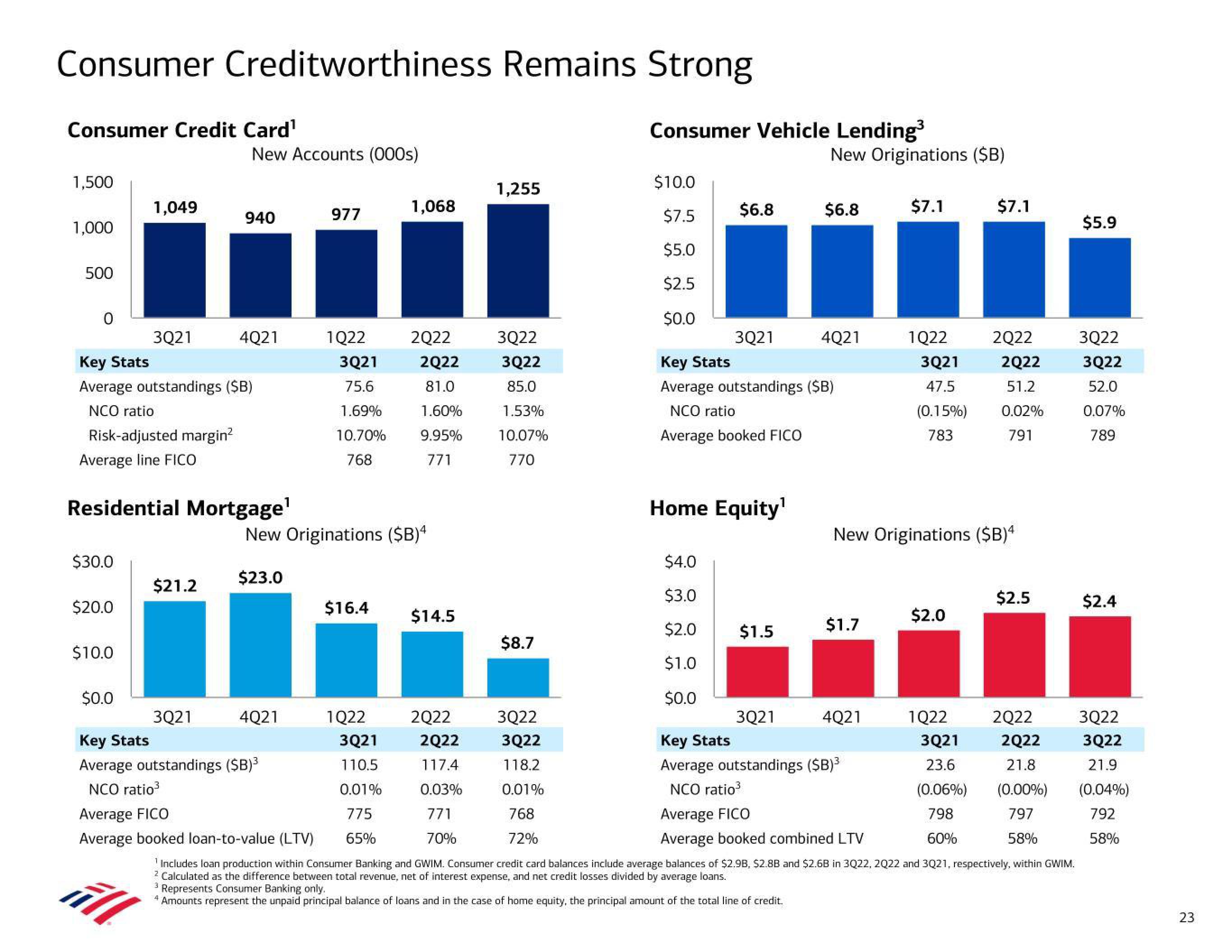

Consumer Creditworthiness Remains Strong

Consumer Credit Card¹

1,500

1,000

500

0

$30.0

$20.0

1,049

$10.0

3Q21

Key Stats

Average outstandings ($B)

NCO ratio

Risk-adjusted margin²

Average line FICO

$0.0

Residential Mortgage¹

New Accounts (000s)

$21.2

940

3Q21

4Q21

4Q21

Key Stats

Average outstandings ($B)³

NCO ratio³

977

1Q22

Average FICO

Average booked loan-to-value (LTV)

3Q21

75.6

1.69%

10.70%

768

New Originations ($B)4

$23.0

$16.4

1Q22

1,068

3Q21

110.5

0.01%

775

65%

2Q22

2Q22

81.0

1.60%

9.95%

771

$14.5

2Q22

2Q22

117.4

0.03%

771

70%

1,255

3Q22

3Q22

85.0

1.53%

10.07%

770

$8.7

3Q22

3Q22

118.2

0.01%

768

72%

Consumer Vehicle Lending³

$10.0

$7.5

$5.0

$2.5

$0.0

$6.8

3Q21

$4.0

$3.0

$2.0

$1.0

$0.0

Home Equity¹

Key Stats

Average outstandings ($B)

NCO ratio

Average booked FICO

$1.5

3Q21

New Originations ($B)

$6.8

4Q21

Represents Consumer Banking only.

4 Amounts represent the unpaid principal balance of loans and in the case of home equity, the principal amount of the total line of credit.

$1.7

4Q21

Key Stats

Average outstandings ($B)³

NCO ratio³

$7.1

Average FICO

Average booked combined LTV

1Q22

3Q21

47.5

(0.15%)

783

New Originations ($B)4

$2.0

1Q22

3Q21

23.6

$7.1

(0.06%)

798

60%

2Q22

2Q22

51.2

0.02%

791

$2.5

(0.00%)

797

58%

Includes loan production within Consumer Banking and GWIM. Consumer credit card balances include average balances of $2.9B, $2.8B and $2.6B in 3Q22, 2022 and 3Q21, respectively, within GWIM.

2 Calculated as the difference between total revenue, net of interest expense, and net credit losses divided by average loans.

2Q22

2Q22

21.8

$5.9

3Q22

3Q22

52.0

0.07%

789

$2.4

3Q22

3Q22

21.9

(0.04%)

792

58%

23View entire presentation