Evercore Investment Banking Pitch Book

Preliminary Discussion Materials

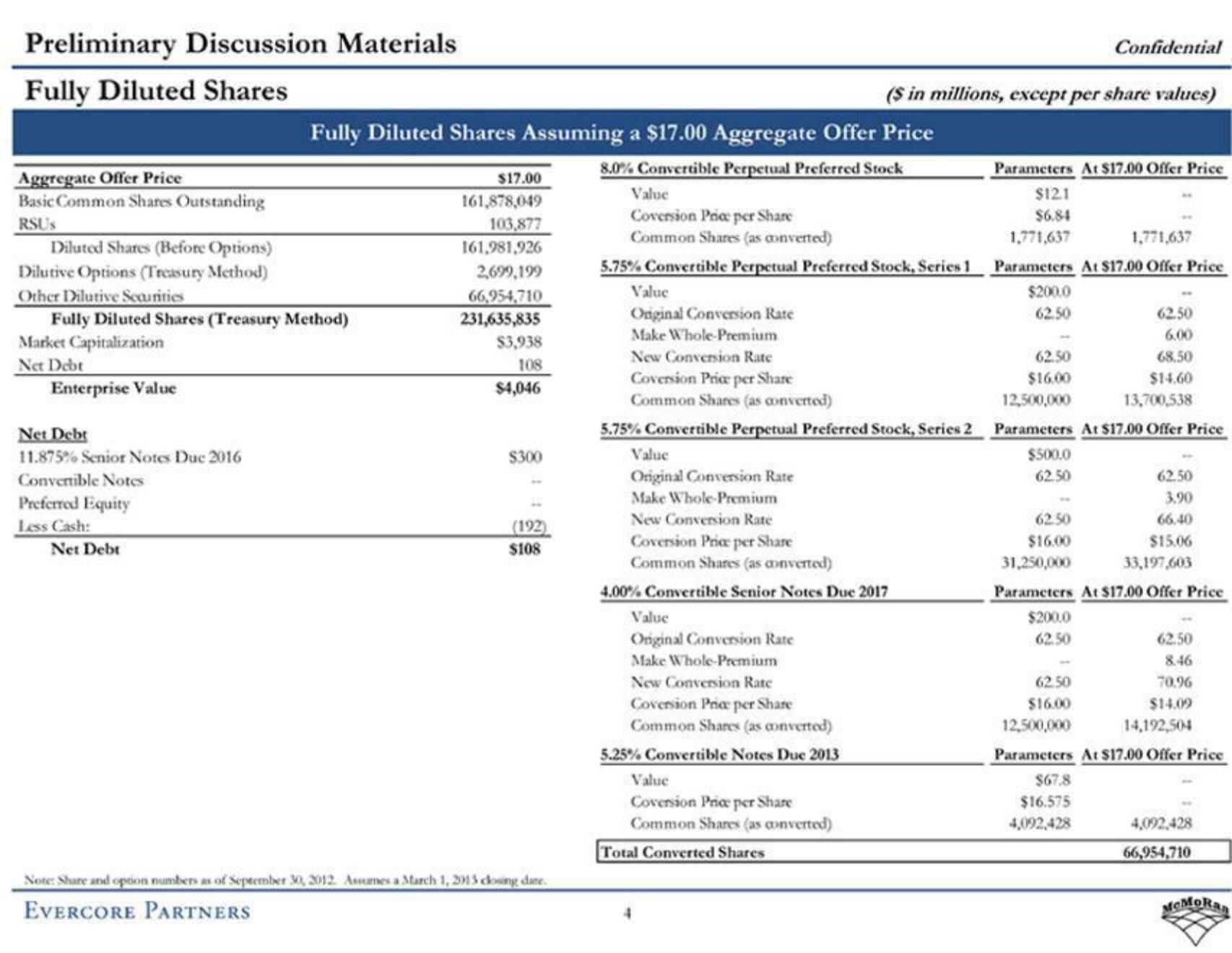

Fully Diluted Shares

Aggregate Offer Price

Basic Common Shares Outstanding

RSUS

Diluted Shares (Before Options)

Dilutive Options (Treasury Method)

Other Dilutive Securities

Fully Diluted Shares (Treasury Method)

Market Capitalization

Net Debt

Enterprise Value

Net Debt

11.875% Senior Notes Due 2016

Convertible Notes

Preferred Equity

Less Cash:

Net Debt

Fully Diluted Shares Assuming a $17.00 Aggregate Offer Price

8.0% Convertible Perpetual Preferred Stock

$17.00

161,878,049

103,877

161,981,926

2,699,199

66,954,710

231,635,835

$3,938

108

$4,046

$300

(192)

$108

Note: Share and option numbers as of September 30, 2012. Assumes a March 1, 2013 closing date.

EVERCORE PARTNERS

Value

Original Conversion Rate

Make Whole-Premium

New Conversion Rate

Parameters At $17.00 Offer Price

Value

$121

Coversion Price per Share

$6.84

Common Shares (as converted)

1,771,637

1,771,637

5.75% Convertible Perpetual Preferred Stock, Series 1 Parameters At $17.00 Offer Price

Value

Original Conversion Rate

Make Whole-Premium

New Conversion Rate

(S in millions, except per share values)

62.50

6.00

62.50

68.50

Coversion Price per Share

$16.00

$14.60

Common Shares (as converted)

12,500,000

13,700,538

5.75% Convertible Perpetual Preferred Stock, Series 2 Parameters At $17.00 Offer Price

$500.0

62.50

Coversion Price per Share

Common Shares (as converted)

4.00%Convertible Senior Notes Due 2017

Value

Original Conversion Rate

Make Whole-Premium

New Conversion Rate

Coversion Price per Share

Common Shares (as converted)

5.25% Convertible Notes Due 2013

Value

Coversion Price per Share

Common Shares (as converted)

Total Converted Shares

$200.0

62.50

Confidential

62.50

3.90

62.50

66.40

$16.00

$15.06

31,250,000

33,197,603

Parameters At $17.00 Offer Price

$200.0

62.50

62.50

8.46

62.50

70.96

$16.00

$14.09

12,500,000

14,192,504

Parameters At $17.00 Offer Price

$67.8

$16.575

4,092,428

4,092,428

66,954,710

MCMoRanView entire presentation