Maersk Investor Presentation Deck

Guidance

Guidance for 2020

A.P. Moller-Maersk suspended the full-year guidance for 2020 (EBITDA before

restructuring and integration costs of around USD 5.5bn) on 20 March 2020 due to

the COVID-19 pandemic, given material uncertainties and lack of visibility related to

the global demand for container transport and logistics.

Despite the uncertainties related to COVID-19, A.P. Moller-Maersk reinstates its full-

year guidance for 2020 and expects earnings before interest, tax, depreciation and

amortisation (EBITDA) to be between USD 6.0bn-7.0bn before restructuring and

integration costs.

The global demand growth for containers is still expected to contract in 2020 due to

COVID-19 and for Q3 2020 volumes are expected to progressively recover with a

current expectation of a mid-single digit contraction. Organic volume growth in

Ocean is expected to be in line with or slightly lower than the average market growth.

The outlook and guidance for 2020 is subject to significant uncertainties related to

the COVID-19 pandemic and does not take into consideration a material second

lockdown phase. The guidance is also subject to uncertainties related to freight rates,

bunker prices and other external factors.

The accumulated guidance on gross capital expenditures excl. acquisitions (CAPEX)

for 2020-2021 is still expected to be USD 3.0-4.0bn, with steps being taken to

reduce CAPEX in 2020. High cash conversion (cash flow from operations compared

to EBITDA) is still expected for both years.

22

Q2 2020 interim report

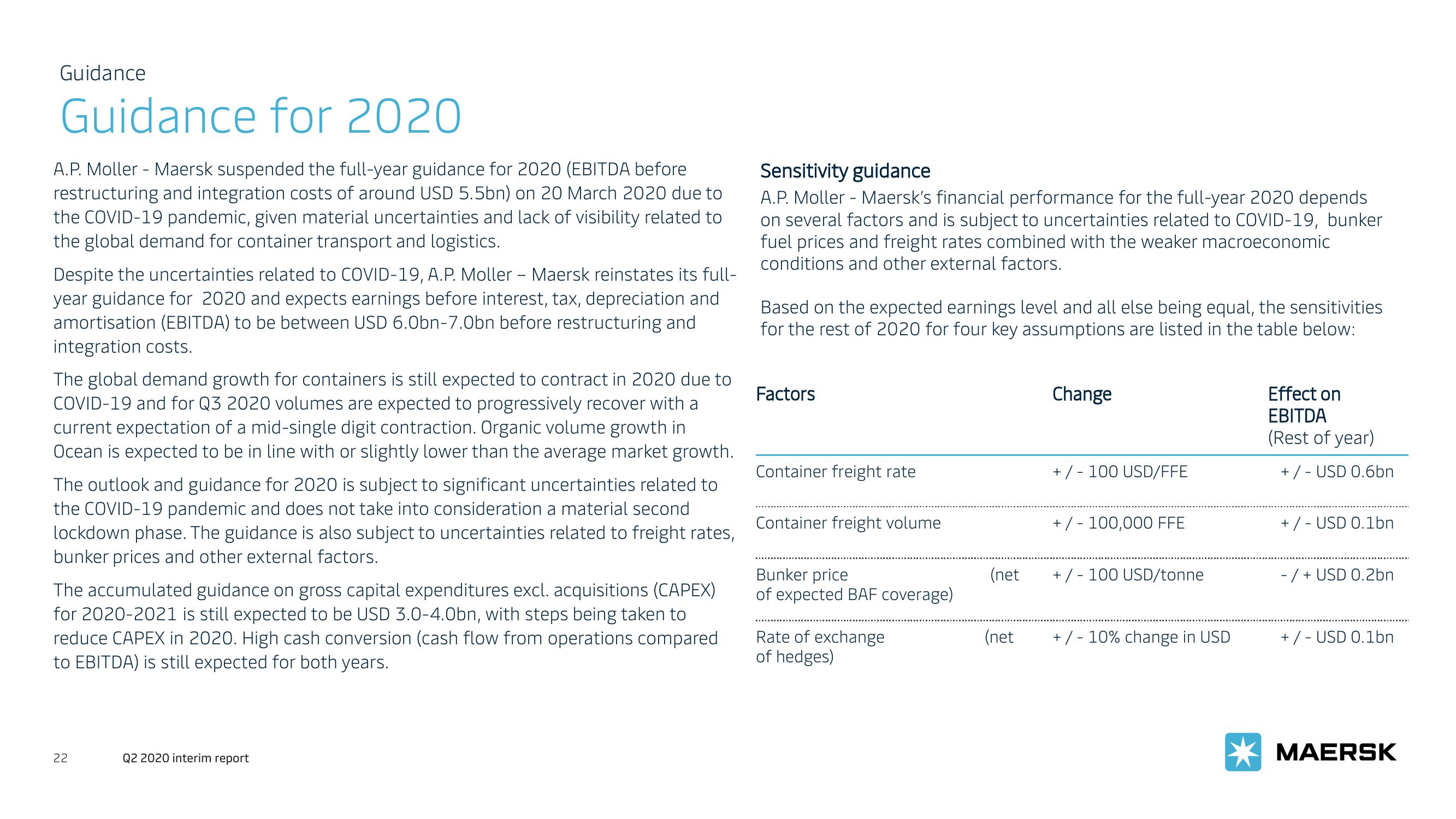

Sensitivity guidance

A.P. Moller - Maersk's financial performance for the full-year 2020 depends

on several factors and is subject to uncertainties related to COVID-19, bunker

fuel prices and freight rates combined with the weaker macroeconomic

conditions and other external factors.

Based on the expected earnings level and all else being equal, the sensitivities

for the rest of 2020 for four key assumptions are listed in the table below:

Factors

Container freight rate

Container freight volume

Bunker price

of expected BAF coverage)

Rate of exchange

of hedges)

(net

(net

Change

+/- 100 USD/FFE

+/- 100,000 FFE

+/- 100 USD/tonne

+/- 10% change in USD

Effect on

EBITDA

(Rest of year)

+/- USD 0.6bn

+/- USD 0.1bn

-/+ USD 0.2bn

+/- USD 0.1bn

MAERSKView entire presentation