Whitebread Annual Update

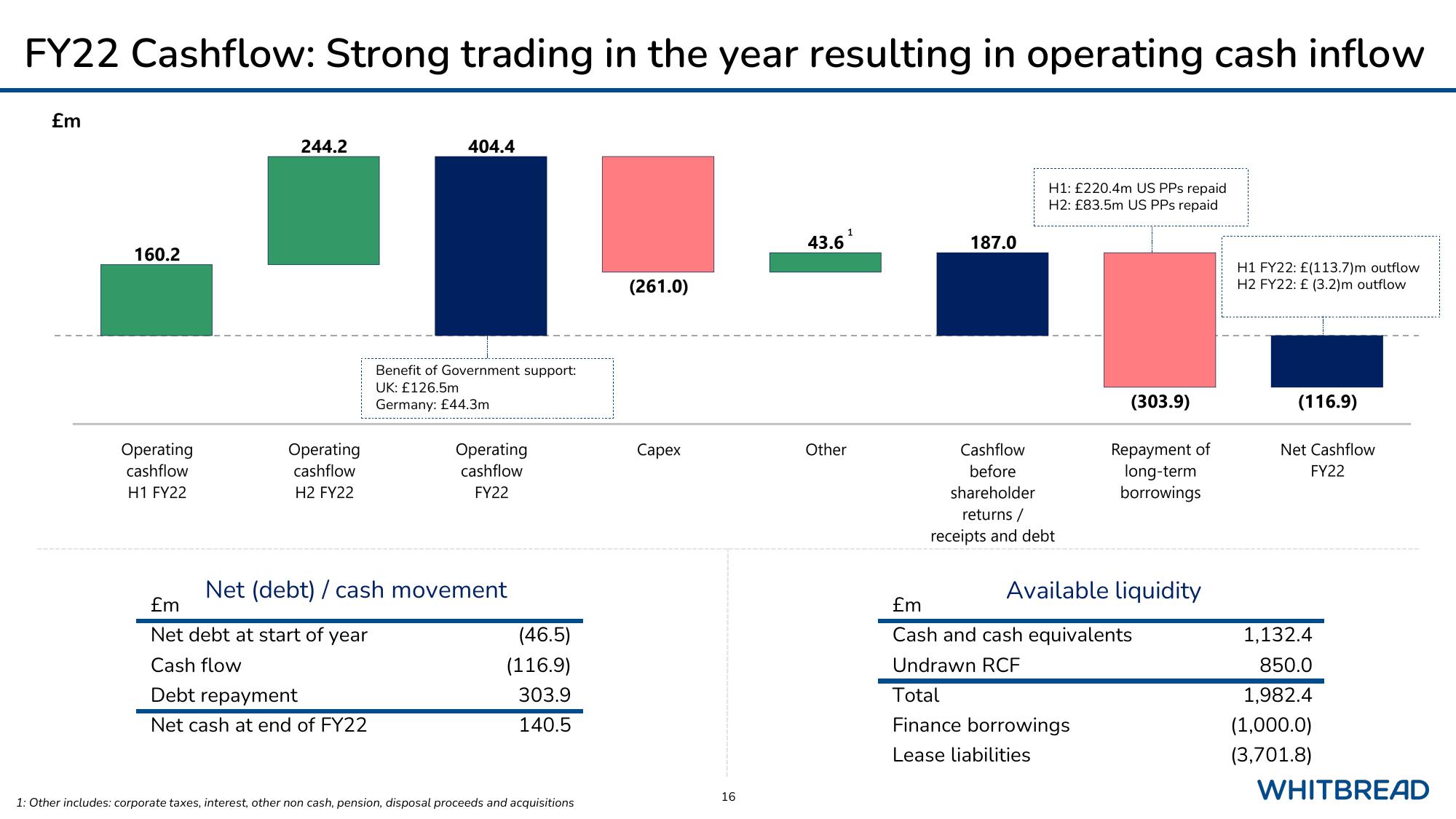

FY22 Cashflow: Strong trading in the year resulting in operating cash inflow

£m

160.2

Operating

cashflow

H1 FY22

244.2

Operating

cashflow

H2 FY22

£m

Net debt at start of year

404.4

Cash flow

Debt repayment

Net cash at end of FY22

Benefit of Government support:

UK: £126.5m

Germany: £44.3m

Net (debt) / cash movement

Operating

cashflow

FY22

(46.5)

(116.9)

303.9

140.5

1: Other includes: corporate taxes, interest, other non cash, pension, disposal proceeds and acquisitions

(261.0)

Capex

16

43.6

1

Other

187.0

H1: £220.4m US PPS repaid

H2: £83.5m US PPS repaid

Cashflow

before

shareholder

returns/

receipts and debt

(303.9)

Repayment of

long-term

borrowings

Available liquidity

£m

Cash and cash equivalents

Undrawn RCF

Total

Finance borrowings

Lease liabilities

H1 FY22: £(113.7)m outflow

H2 FY22: £ (3.2)m outflow

(116.9)

Net Cashflow

FY22

1,132.4

850.0

1,982.4

(1,000.0)

(3,701.8)

WHITBREADView entire presentation