Bank of America Investment Banking Pitch Book

Executive Summary

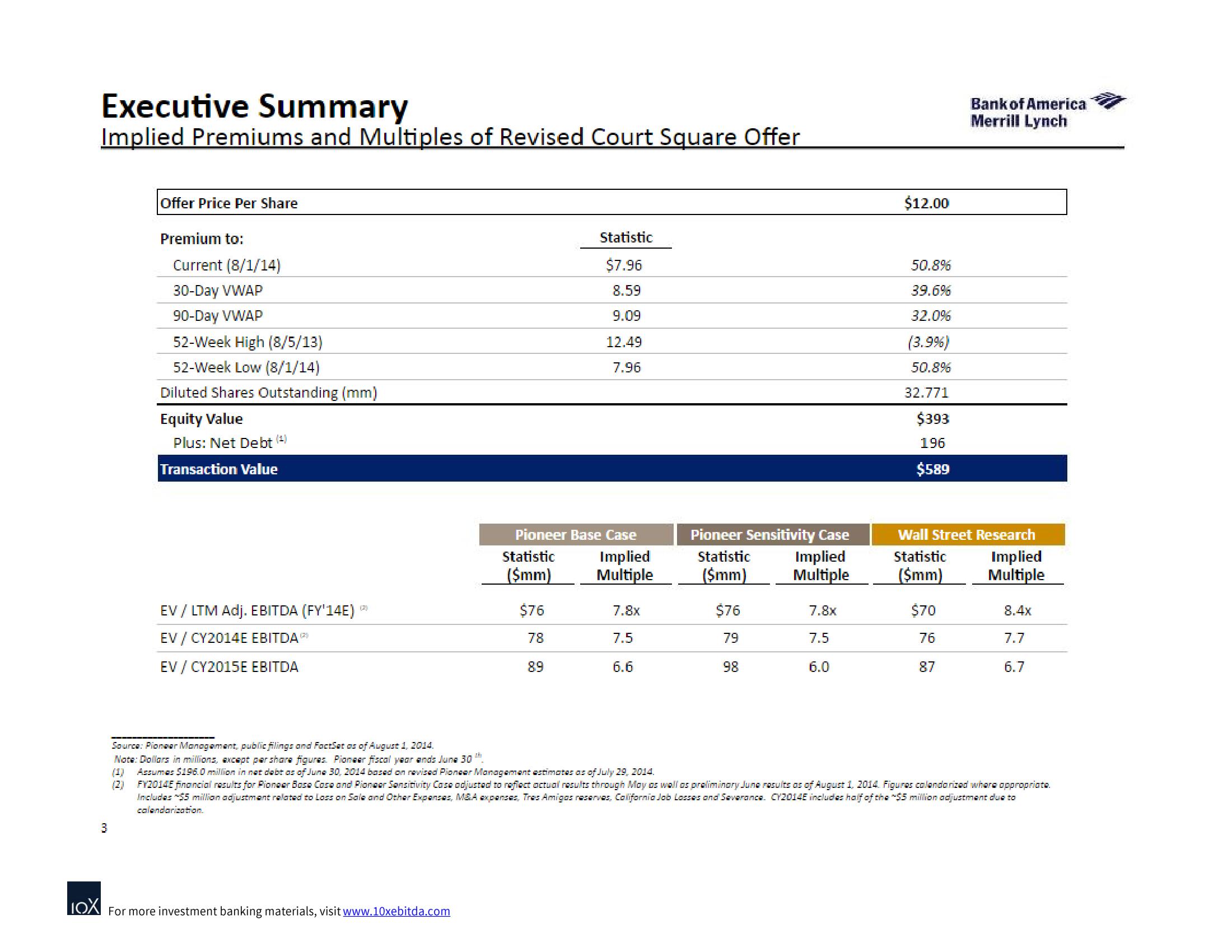

Implied Premiums and Multiples of Revised Court Square Offer

3

Offer Price Per Share

Premium to:

Current (8/1/14)

30-Day VWAP

90-Day VWAP

52-Week High (8/5/13)

52-Week Low (8/1/14)

Diluted Shares Outstanding (mm)

Equity Value

Plus: Net Debt (¹)

Transaction Value

EV / LTM Adj. EBITDA (FY'14E)

EV / CY2014E EBITDA**

EV / CY2015E EBITDA

IOX For more investment banking materials, visit www.10xebitda.com

Pioneer Base Case

Statistic

($mm)

Statistic

$7.96

8.59

9.09

12.49

7.96

$76

78

89

Implied

Multiple

7.8x

7.5

6.6

Pioneer Sensitivity Case

Statistic Implied

($mm)

Multiple

$76

79

98

7.8x

7.5

6.0

$12.00

50.8%

39.6%

32.0%

(3.9%)

50.8%

32.771

$393

196

$589

Bank of America

Merrill Lynch

Wall Street Research

Statistic

($mm)

$70

76

87

Implied

Multiple

8.4x

7.7

6.7

Source: Pioneer Management, public filings and FactSet as of August 1, 2014.

Note: Dollars in millions, except pershare figures. Pioneer fiscal year ands June 30

(2)

(1) Assumes $196.0 million in net debt as of June 30, 2014 based on revised Pioneer Management estimates as of July 29, 2014.

FY2014E financial results for Pioneer Bose Cose and Pioneer Sensitivity Case adjusted to reflect actual results through May as well as preliminary June results as of August 1, 2014. Figures colandorized where appropriate.

Includes $5 million adjustment related to Loss on Sale and Other Expenses, M&A expenses, Tres Amigos reserves, California Job Losses and Severance. CY2014E includes half of the "$5 million adjustment due to

calendarization.View entire presentation