MoneyLion SPAC Presentation Deck

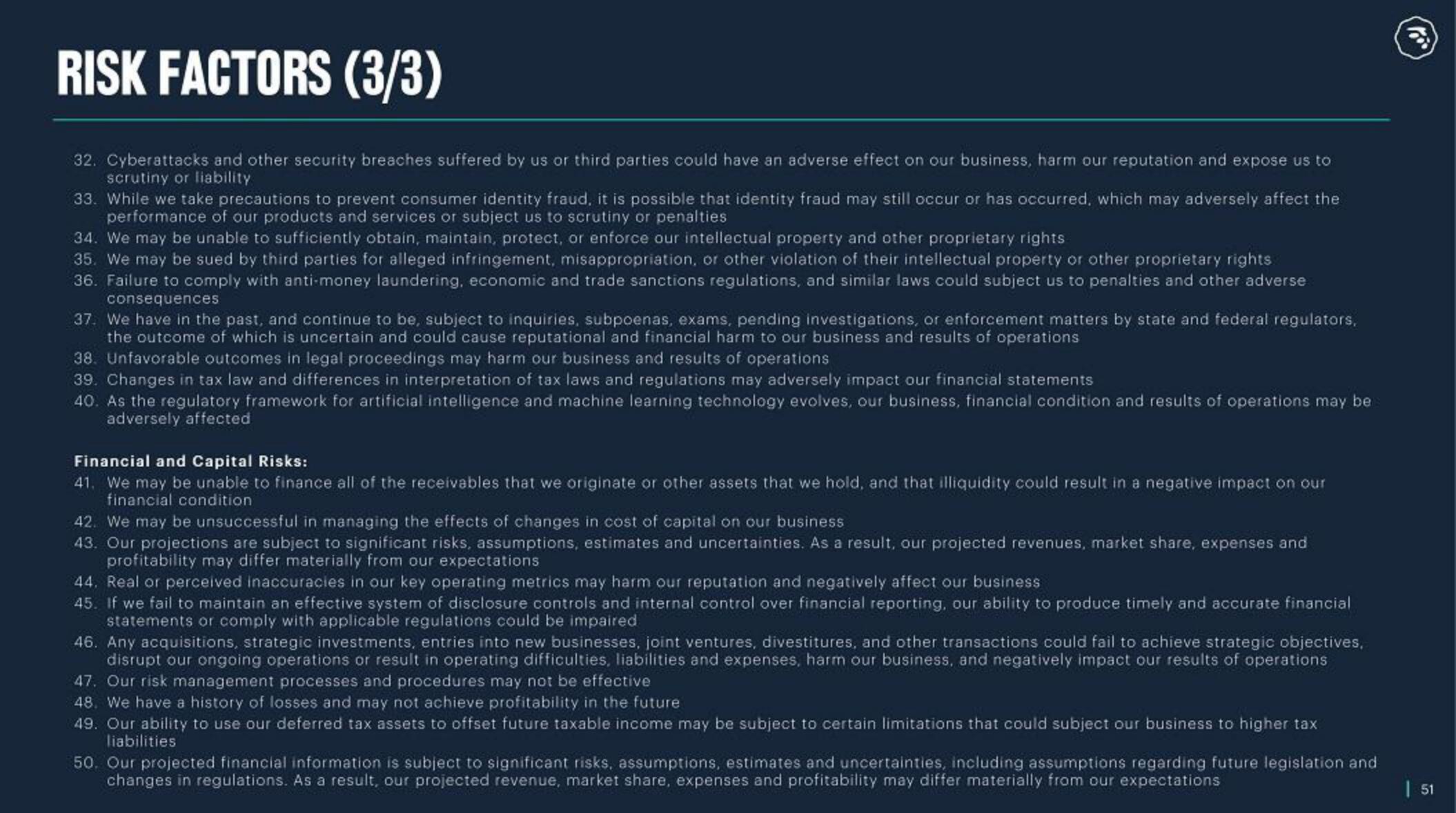

RISK FACTORS (3/3)

32. Cyberattacks and other security breaches suffered by us or third parties could have an adverse effect on our business, harm our reputation and expose us to

scrutiny or liability

33. While we take precautions to prevent consumer identity fraud, it is possible that identity fraud may still occur or has occurred, which may adversely affect the

performance of our products and services or subject us to scrutiny or penalties

34. We may be unable to sufficiently obtain, maintain, protect, or enforce our intellectual property and other proprietary rights

35. We may be sued by third parties for alleged infringement, misappropriation, or other violation of their intellectual property or other proprietary rights

36. Failure to comply with anti-money laundering, economic and trade sanctions regulations, and similar laws could subject us to penalties and other adverse

consequences

We have in the past, and continue to be, subject to inquiries, subpoenas, exams, pending investigations, or nforcement matters by state and federal regulators,

the outcome of which is uncertain and could cause reputational and financial harm to our business and results of operations

38. Unfavorable outcomes in legal proceedings may harm our business and results of operations

39. Changes in tax law and differences in interpretation of tax laws and regulations may adversely impact our financial statements

40. As the regulatory framework for artificial intelligence and machine learning technology evolves, our business, financial condition and results of operations may be

adversely affected

Financial and Capital Risks:

41. We may be unable to finance all of the receivables that we originate or other assets that we hold, and that illiquidity could result in a negative impact on our

financial condition

42. We may be unsuccessful in managing the effects of changes in cost of capital on our business

43. Our projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, our projected revenues, market share, expenses and

profitability may differ materially from our expectations

44. Real or perceived inaccuracies in our key operating metrics may harm our reputation and negatively affect our business

If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and

statements or comply with applicable regulations could be impaired

ccurate financial

46. Any acquisitions, strategic investments, entries into new businesses, joint ventures, divestitures, and other transactions could fail to achieve strategic objectives,

disrupt our ongoing operations or result in operating difficulties, liabilities and expenses, harm our business, and negatively impact our results of operations

47. Our risk management processes and procedures may not be effective

48. We have a history of losses and may not achieve profitability in the future

49. Our ability to use our deferred tax assets to offset future taxable income may be subject to certain limitations that could subject our business to higher tax

liabilities

50. Our projected financial information is subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and

changes in regulations. As a result, our projected revenue, market share, expenses and profitability may differ materially from our expectations

| 51View entire presentation