Investor Presentation

Accelerated and sustainable growth

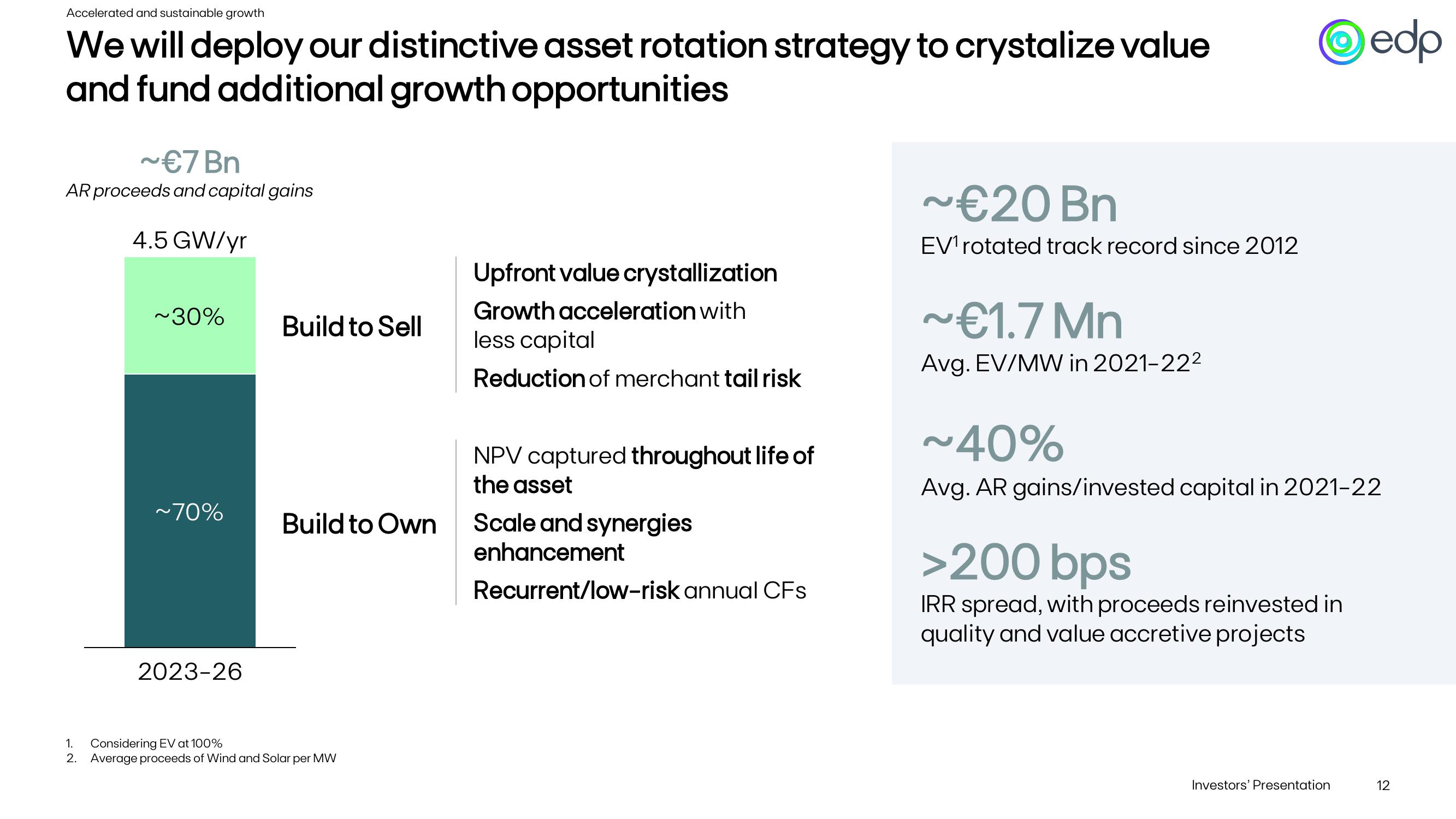

We will deploy our distinctive asset rotation strategy to crystalize value

and fund additional growth opportunities

~€7 Bn

AR proceeds and capital gains

4.5 GW/yr

~30%

Build to Sell

~70%

Build to Own

2023-26

1.

Considering EV at 100%

2. Average proceeds of Wind and Solar per MW

edp

Upfront value crystallization

Growth acceleration with

less capital

Reduction of merchant tail risk

NPV captured throughout life of

the asset

Scale and synergies

enhancement

Recurrent/low-risk annual CFs

~€20 Bn

EV1 rotated track record since 2012

~€1.7 Mn

Avg. EV/MW in 2021-222

~40%

Avg. AR gains/invested capital in 2021-22

>200 bps

IRR spread, with proceeds reinvested in

quality and value accretive projects

Investors' Presentation

12View entire presentation