Polestar SPAC Presentation Deck

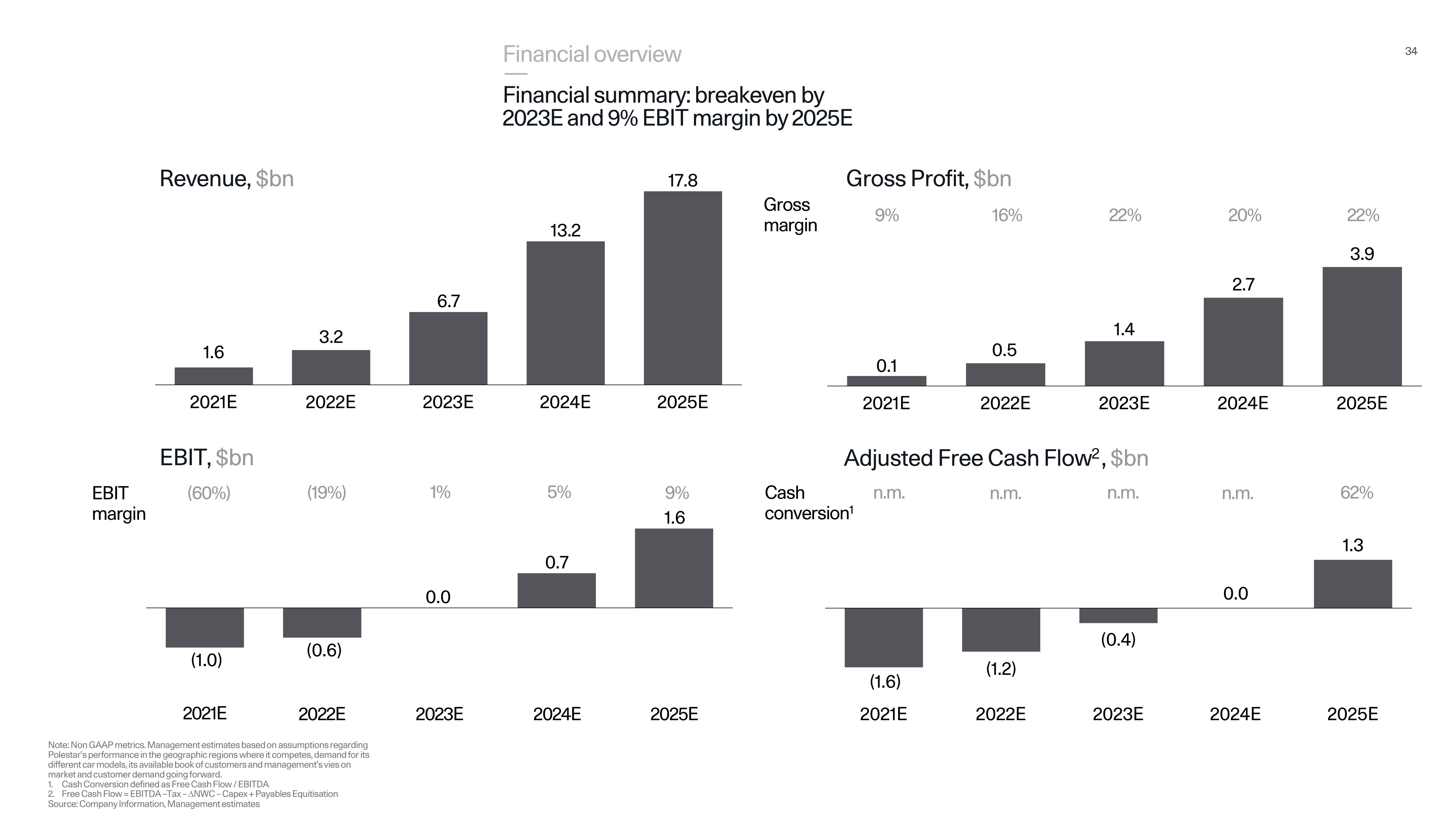

EBIT

margin

Revenue, $bn

1.6

2021E

EBIT, $bn

(60%)

(1.0)

3.2

2022E

(19%)

(0.6)

2021E

2022E

Note: Non GAAP metrics. Management estimates based on assumptions regarding

Polestar's performance in the geographic regions where it competes, demand for its

different car models, its available book of customers and management's vies on

market and customer demand going forward.

1. Cash Conversion defined as Free Cash Flow/ EBITDA

2. Free Cash Flow=EBITDA-Tax-ANWC-Capex + Payables Equitisation

Source: Company Information, Management estimates

6.7

2023E

1%

0.0

2023E

Financial overview

Financial summary: breakeven by

2023E and 9% EBIT margin by 2025E

13.2

2024E

5%

0.7

2024E

17.8

2025E

9%

1.6

2025E

Gross

margin

Gross Profit, $bn

9%

0.1

Cash

conversion¹

2021E

n.m.

16%

(1.6)

2021E

0.5

2022E

Adjusted Free Cash Flow², $bn

n.m.

(1.2)

22%

2022E

1.4

2023E

n.m.

(0.4)

2023E

20%

2.7

2024E

n.m.

0.0

2024E

22%

3.9

2025E

62%

1.3

2025E

34View entire presentation